Ethereum has simply skilled one of the vital chaotic buying and selling days in its historical past, with value motion resembling a rollercoaster. ETH plunged over 30% in lower than 24 hours as fears of a U.S. commerce struggle triggered a large market selloff. Nevertheless, simply as shortly as panic set in, the market rebounded following President Trump’s announcement of negotiations with Canada and Mexico to elevate tariffs. This sharp turnaround injected optimism again into the market, however uncertainty stays excessive.

The sudden drop worn out hundreds of thousands in leveraged positions, creating one of many largest liquidation occasions in Ethereum’s historical past. Knowledge from Glassnode reveals that yesterday, $76.4 million in ETH lengthy liquidations hit the market, with $55.8 million being worn out in a single hour—marking the second-largest liquidation spike in a 12 months, simply behind the $56 million occasion on December 9. This intense value motion highlights the unprecedented volatility in Ethereum and the broader crypto market.

Now, the main target shifts to Ethereum’s means to maintain its restoration and reclaim key resistance ranges. With uncertainty nonetheless looming, the following few days will likely be essential in figuring out whether or not ETH can regain its bullish momentum or if additional draw back is on the horizon.

Ethereum Open Curiosity Drops Considerably

Ethereum has skilled one of the vital risky buying and selling classes in its historical past, dropping over 30% in lower than 24 hours amid U.S. commerce struggle fears, solely to get better quickly following President Trump’s announcement of negotiations with Canada and Mexico. This excessive value motion has shaken investor confidence, however analysts counsel ETH is now stabilizing and getting ready for a push increased.

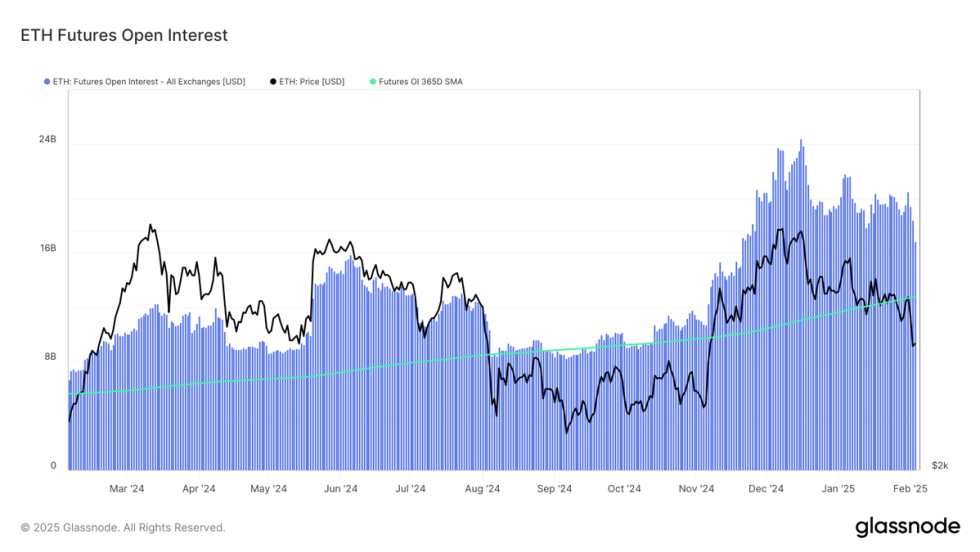

Key information from Glassnode reveals the extent of the liquidation occasion that fueled this historic drop. Yesterday, $76.4 million in ETH lengthy liquidations hit the market, with $55.8 million worn out in a single hour—the second-largest spike in a 12 months, simply behind the $56 million liquidation recorded on December 9. The speedy value decline triggered a big unwinding of futures open curiosity. ETH futures OI fell from $20.5 billion at first of February to $15.9 billion right now, wiping out $4.6 billion in leveraged positions.

Regardless of this sharp decline, Ethereum futures OI stays ~22% above its yearly trendline of $13 billion, suggesting that leverage stays elevated. Ethereum’s value has been closely influenced by leveraged buying and selling, as hypothesis and aggressive lengthy positions fueled speedy swings. Because the market recalibrates, a shift in direction of spot-driven value motion may pave the way in which for more healthy and extra sustainable development.

The approaching weeks will likely be essential in figuring out whether or not Ethereum can get better its bullish momentum. If ETH consolidates above key assist ranges and open curiosity stabilizes, the market might be establishing for an additional leg increased. Nevertheless, if leverage stays excessive and speculative buying and selling continues to dominate value motion, additional volatility and corrections might observe.

ETH Struggles Under Key Stage Amid Market Uncertainty

Ethereum (ETH) is buying and selling at $2,810 after a extremely risky begin to the week. Regardless of a pointy restoration from its latest lows, bulls are nonetheless going through critical challenges as ETH trades under the essential $3,000 mark, a degree that additionally aligns with the 200-day transferring common. This key resistance has traditionally acted as a serious pivot level for Ethereum’s value motion, making it a essential degree to reclaim for bullish momentum to renew.

If bulls need to set up a brand new uptrend, ETH wants to interrupt above the $3,000 mark with power and maintain it as assist. A profitable reclaim of this degree may set the stage for a sustained rally towards $3,200 and past. Nevertheless, failure to take action leaves Ethereum weak to additional draw back danger.

Shedding the $2,800 degree may set off extra promoting strain, doubtlessly main ETH to revisit decrease demand ranges round $2,650–$2,700. With market sentiment nonetheless unsure and leveraged positions unwinding, merchants are carefully watching value motion for affirmation of the following main transfer. Whether or not Ethereum can regain its footing or faces additional declines will rely on its means to reclaim key resistance ranges within the coming days.

Featured picture from Dall-E, chart from TradingView