Bybit, in collaboration with Blocks Scholes, launched its newest weekly derivatives analytics report, revealing that Ethereum (ETH) has not too long ago surpassed Bitcoin (BTC) in key buying and selling metrics.

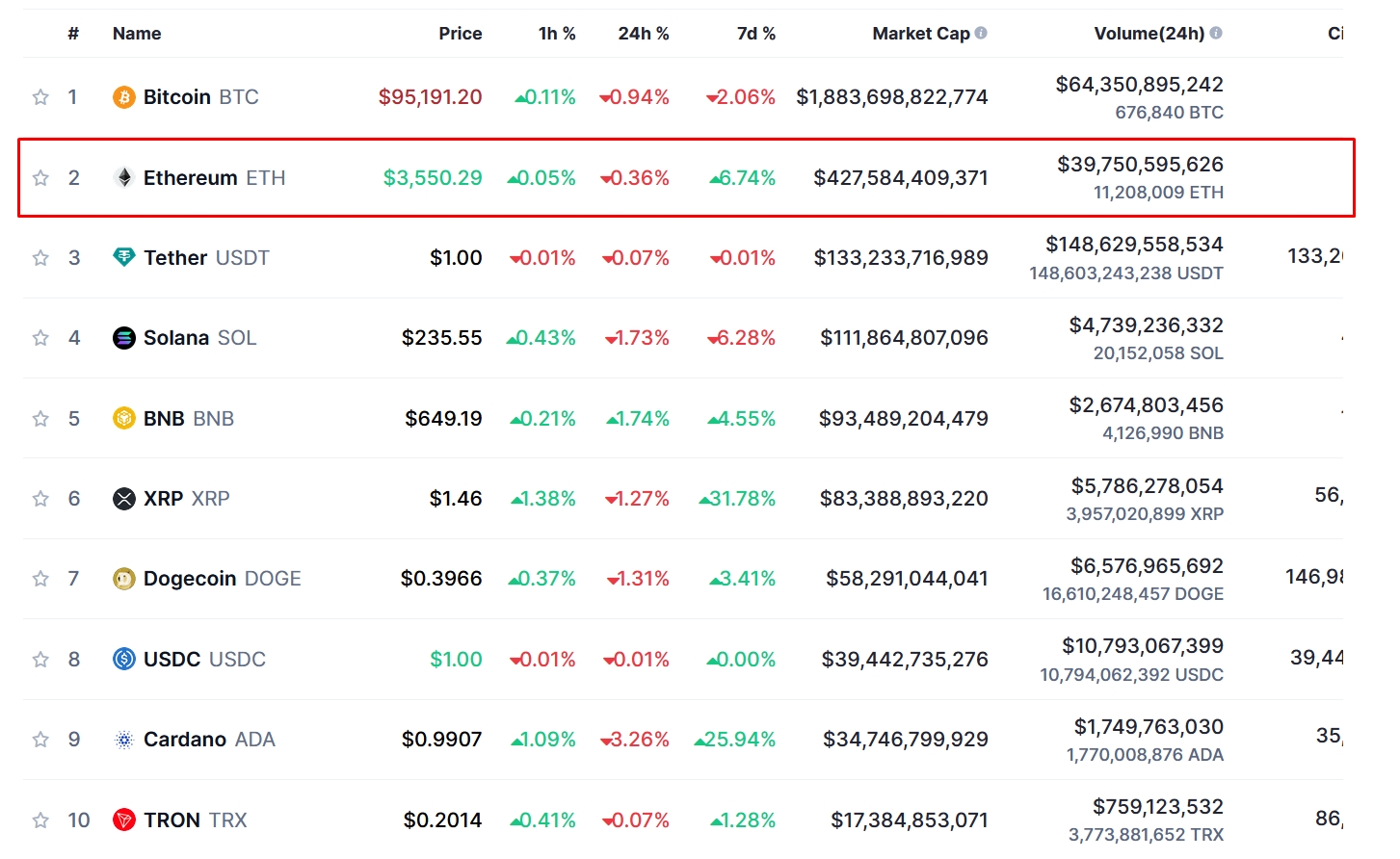

In line with CoinMarketCap, Ethereum is among the many prime gainers within the cryptocurrency market. This surge in ETH’s efficiency is attributed to information concerning US SEC Chair Gary Gensler’s upcoming departure on the finish of the Biden administration’s time period.

Buyers are optimistic a couple of probably extra crypto-friendly SEC Chair after Gensler’s exit on January 20, 2025.

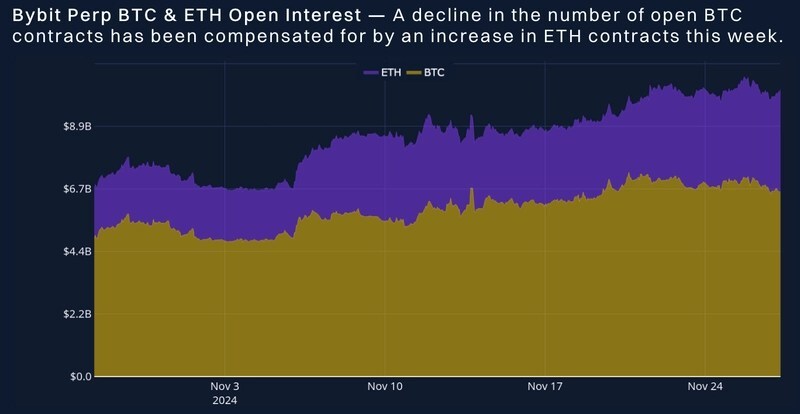

The report highlights that ETH has outperformed BTC in open curiosity. Information exhibits a decline in open curiosity for BTC perpetual contracts, whereas ETH’s open curiosity has been on the rise.

Over the previous six months, ETH has additionally captured a bigger share of every day buying and selling volumes, regardless of a slower market total this week. This shift suggests rising curiosity in Ethereum as traders anticipate much less regulatory scrutiny within the close to future.

Bybit x Block Scholes Derivatives Report: ETH Outperforms BTC, Supply: Bybit

Earlier, The US SEC confirmed Gensler’s departure, as reported by Finance Magnates coinciding with Donald Trump’s inauguration. Gensler, recognized for his strict crypto rules, confronted challenges throughout his tenure, together with the GameStop saga. Regardless of criticism, the SEC credited him with reforms geared toward bettering market effectivity and transparency.

Securities and Alternate Chair Gary Gensler will go away on January 20, giving Trump the flexibility to put in a brand new chief (because the incoming admin talks up crypto) on day 1 pic.twitter.com/GJMetVJvRP

— brian cheung (@bcheungz) November 21, 2024

CoinMarketCap information exhibits that Ethereum’s market cap stands at $428.06 billion, securing the quantity two spot, simply behind Bitcoin.

BTC Worth Decline Results in Flattened Volatility

However, BTC has seen a decline in value from its earlier excessive of $100K. This has led to a flattening of the ATM volatility time period construction, with short-term choices dipping beneath 60%. This drop in BTC’s volatility displays a broader pattern noticed because the US election. Whereas open curiosity in calls and places stays regular, the demand for short-term choices has stagnated.

By way of choices, ETH exhibits barely extra bullish sentiment than BTC. Regardless of market recalibration following the post-election highs, name choices for ETH proceed to steer in each buying and selling volumes and open curiosity.