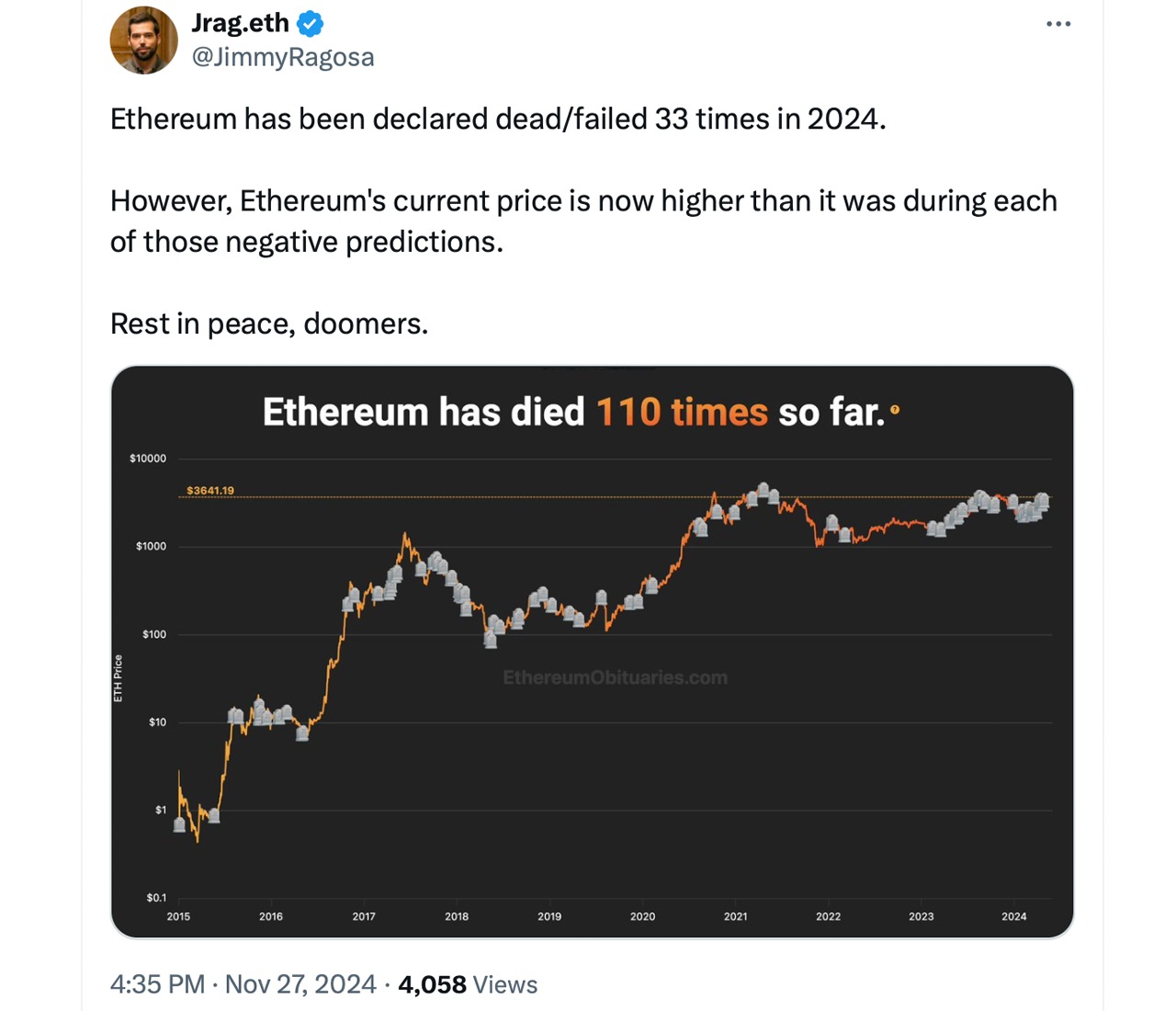

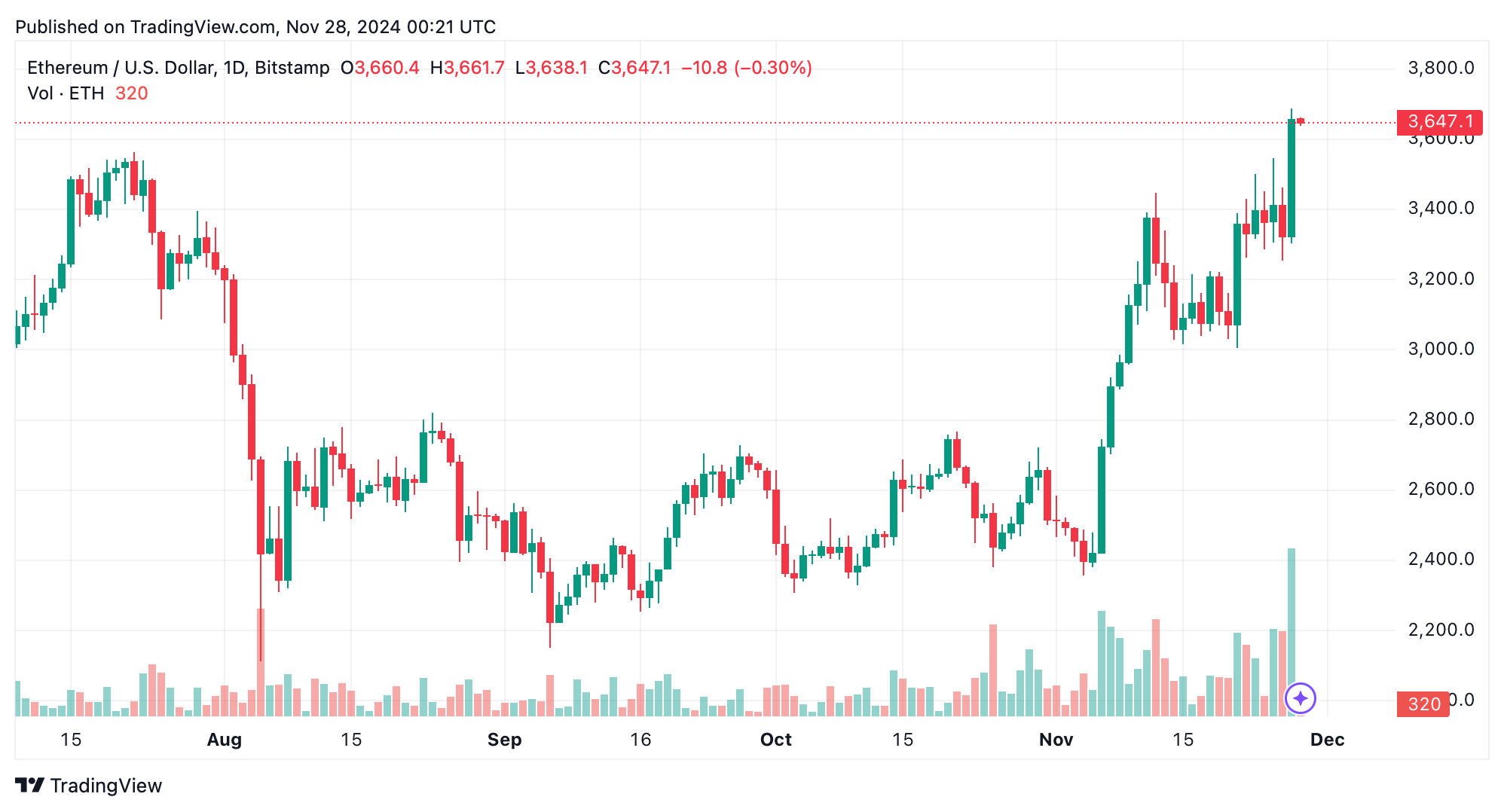

As bitcoin loved a little bit of a carry on Wednesday, ether (ETH) stole the highlight by leaping greater than 10% in simply 24 hours. The second-largest cryptocurrency now claims over 13% of the $3.33 trillion whole market cap.

Ether’s $47B Quantity Surge Sparks Wild Hypothesis—$7,500 Subsequent?

Bitcoin (BTC) gained 4.4% in opposition to the U.S. greenback in the identical timeframe, however ether raced forward with a ten.66% climb. Up to now in 2024, BTC has left ethereum (ETH) within the mud, outperforming it almost threefold—a spot that showcases a transparent distinction of their market momentum this yr.

Nonetheless, ethereum tends to shine when bitcoin slows its roll, and Wednesday, Nov. 27, was no exception. Ether boasted $47.87 billion in commerce quantity, with high exchanges like Binance, Digifinex, and Bybit main the motion.

Tether (USDT) emerged as ETH’s hottest buying and selling pair, trailed by the U.S. greenback, FDUSD, USDC, BTC, the Korean received, and the euro. In the meantime, on the derivatives aspect, ether noticed $56.5 million in liquidations over the previous day—$47.73 million of which got here from ETH quick positions. Buying and selling at $3,647, ether nonetheless has a climb of 24.8% forward to reclaim its all-time excessive of $4.8K set in 2021.

This upward momentum has sparked optimism amongst lovers. “Ethereum weekly SuperTrend triggers purchase sign,” Tony “The Bull” Severino stated on X. “Ether did a 120% rally after 2023’s purchase sign.” Severino added:

One other 120% from right this moment’s sign could be $7,500 per [ethereum].

Ethereum’s latest climb hints at a potential shake-up within the crypto scene, as merchants set their sights on altcoins. Blockchaincenter.web’s Altcoin Season Index (ASI) presently scores a 65 out of 100, edging nearer to the 75 wanted to declare it “altcoin season.” Although ether nonetheless has floor to cowl to succeed in its peak, this momentum may revive enthusiasm for altcoins.