Main asset supervisor VanEck plans to spice up its investments into Bitcoin miners amid President Donald Trump’s pro-crypto push.

All through the run-up to the 2024 presidential elections and the times which have adopted, President Donald Trump has made it abundantly clear that he intends to prioritize the U.S.’s aggressive edge in know-how, with a selected give attention to crypto and synthetic intelligence.

Unsurprisingly, funding corporations are taking word.

VanEck Eyes Bitcoin Mining Equities

Amid President Donald Trump’s pro-crypto and AI push, $114 billion world asset supervisor VanEck is seeking to make investments extra in Bitcoin miners.

The agency lately disclosed this, highlighting that Bitcoin mining corporations occupied a singular place as a converging level for crypto and AI amid the vitality calls for of each industries and miners’ capability to repurpose vitality from Bitcoin mining to AI computing.

Because the AI trade grows, they count on miners towing this line to learn considerably.

In preparation for some extra Lively Administration in VanEck’s Bitcoin mining investments and different equities geared to the house, we have begun digging deeper into what makes these shares transfer.

🧵 pic.twitter.com/9yneP0CvEv

— matthew sigel, recovering CFA (@matthew_sigel) January 27, 2025

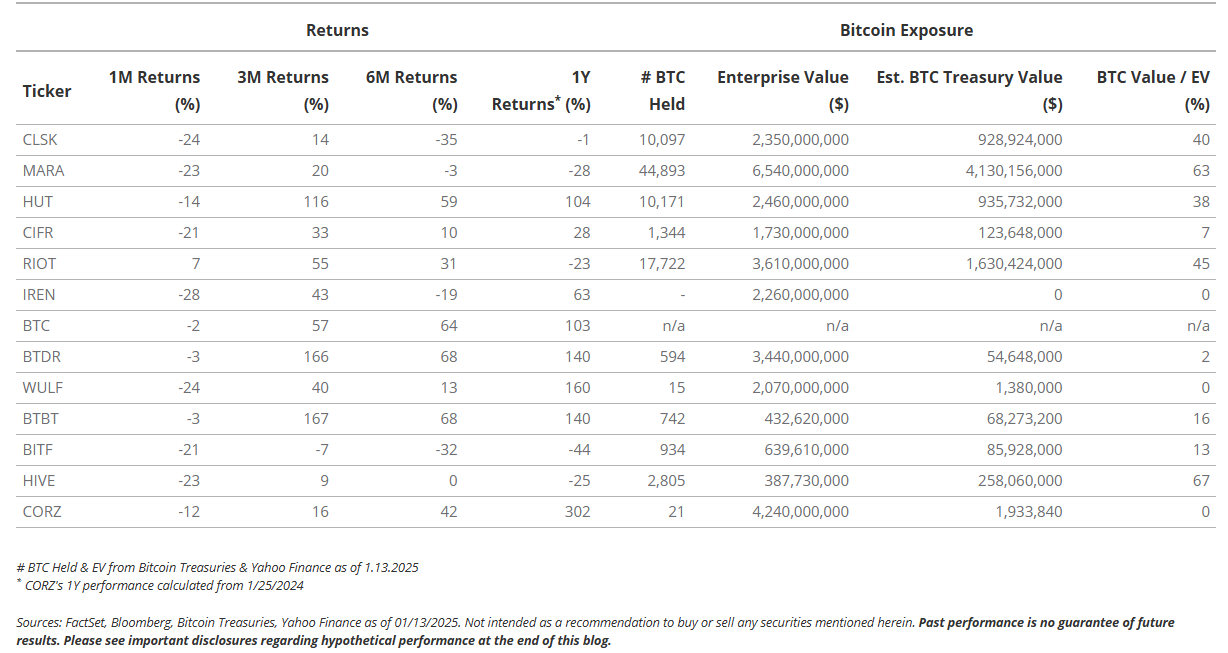

As highlighted by VanEck, the broader market additionally seems to share this notion as gamers like Core Scientific, Terawulf, and Hut 8, which have signaled pivots to supply compute energy for AI, have typically outperformed gamers like Cleanspark and Marathon Digital, who haven’t signaled such pivots over the previous yr.

For instance, Core Scientific inventory posted a staggering 302% acquire previously yr, whereas Marathon Digital’s shares noticed a 28% decline.

Desk exhibiting returns of Bitcoin mining corporations Supply VanEck

Nonetheless, VanEck cautions that this market pattern stays largely speculative, as most of those corporations signaling AI expansions are solely within the early levels of doing so.

VanEck has lately sounded considerably bullish on Bitcoin and crypto, predicting that the main digital asset will one-day rival gold as a world financial commonplace.

Within the close to time period, the agency has tipped the asset to proceed recording value positive factors as adoption grows, setting a value goal of $170,000 for 2025.