Bitcoin (BTC) is hardly shifting from wallets, carrying 1-2 transactions per block and even empty blocks. The community has the bottom exercise since 2022 as homeowners shift to long-term holding.

Bitcoin (BTC) hardly moved precise cash regardless of the speedy value drawdown to $92,000. Throughout that point, the Bitcoin community produced a collection of empty blocks, solely containing the block reward transactions. The empty mempool and blocks with few transactions began prior to now two days, recalling the low transaction ranges that prolonged into the 2022 and 2023 bear markets.

Hours later, Bitcoin carries 1-2 transactions in most blocks, resulting in an nearly empty mempool. The current value strikes haven’t brought about a rush to maneuver and promote cash in panic, as most holders are nonetheless within the cash or don’t have any intention to promote throughout a minor drawdown. Throughout previous bull markets, on-chain exercise and transaction depend had been often seen as an indication of market energy.

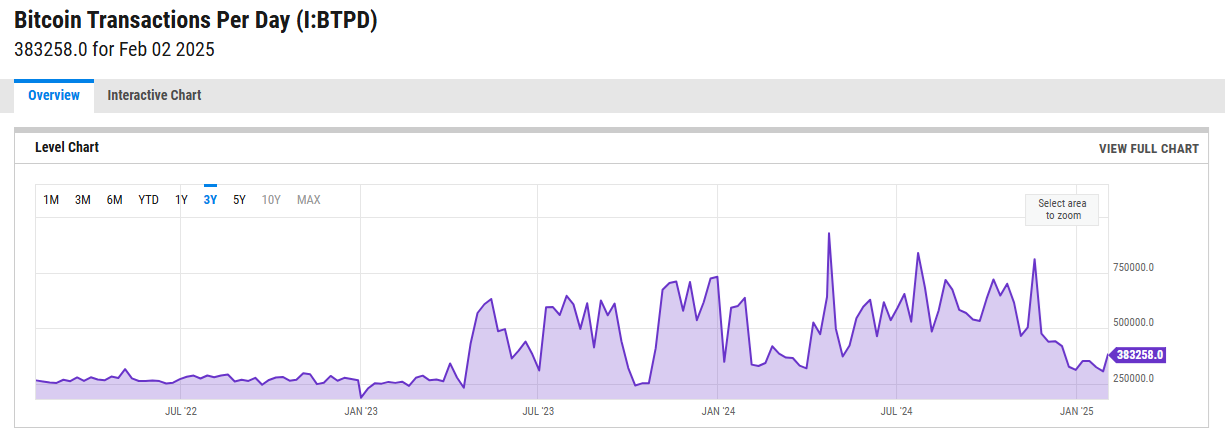

BTC day by day transactions are nonetheless over 380K in 24 hours, although near the decrease vary for the previous 12 months. Over time, BTC day by day switch volumes slid underneath $1B per day regardless of the occasional whale transaction.

Bitcoin transactions per day | Supply: YCharts

Each whales and retail are extra strategic with their promoting, that means fewer waves of transfers throughout market rallies or drawdowns. As compared, stablecoins carry as much as $345B in day by day switch worth, absolutely displacing BTC as a instrument for shifting funds. BTC can be thought of too worthwhile and dangerous to maneuver, particularly for whale-sized transactions.

The comparatively low motion of funds can be seen as an indication that almost all holders should not used to shifting BTC typically, as throughout previous bull markets. Even newer buyers see BTC as a long-term retailer of worth, not utilizing it for funds or peer-to-peer transfers.

In consequence, the Bitcoin common transaction price is right down to $1.18, with no indicators of congestion. Transactions from Ordinals or Runes are additionally negligible, as this sort of asset was largely forgotten. The Bitcoin chain nonetheless carries comparatively small transactions of some hundred {dollars}.

The empty mempool doesn’t imply all blocks are completely empty, although just a few had been mined with no transactions. The low queue within the mempool means all transactions are included instantly within the subsequent block, with minimal ready instances. Presently, Bitcoin’s community is used for easy coin actions, with nearly no exercise tied to Runes, BRC-20 tokens, or extra advanced transactions.

Wrapped BTC (WBTC), alternatively, is actively transacted nearly each second, fulfilling its function inside the Ethereum DeFi ecosystem. BTC can even hypothetically transfer by way of L2 chains, although these chains nonetheless management a really small a part of the coin provide. Babylon Labs continues to be the largest program for non-custodial BTC staking, now holding $5.27B in worth locked.

The gradual transaction depend additionally coincides with an ever-sliding provide of BTC on exchanges. Centralized markets maintain 2.32M BTC, with fixed outflows prior to now months. Miner reserves additionally inched up, remaining at 1.8M BTC.

By way of holders, newer cohorts are retaining the lately purchased cash, whereas whales that held over 5-7 years have divested a few of their holdings.

Will Bitcoin mining be sustainable?

Utilizing Bitcoin’s community just for minimal transactions raises the query of the destiny of miners through the subsequent block reward halvings. Over time, mining could depend on transaction charges to be sustainable, as a result of low block reward.

Even when BTC rallies throughout each halving, transaction charges should not sufficient to help the community. Transaction charges are solely significant when blocks turn into aggressive and require an even bigger cost for together with transactions.

Even with an empty mempool, some mining amenities are sustainable. The Bitcoin hashrate is at an all-time excessive as miners nonetheless compete for the comparatively excessive block reward. Regardless of this, the current gradual transactions present that BTC will not be sustainable as ‘digital gold’ if miners can’t break even on both charges or block rewards.

A few of the site visitors from BTC moved onto the Lightning community, together with different L2 options or wrapped tokens. BTC, as a base layer, may begin receiving charges from its L2 chains or different initiatives, following the mannequin of Ethereum.

Cryptopolitan Academy: Are You Making These Web3 Resume Errors? – Discover Out Right here