As February unfolds, the cryptocurrency market continues to witness important developments. Among the many key occasions, Nasdaq’s resolution to evaluate Grayscale’s purposes for Change Traded Funds (ETFs) based mostly on XRP, Litecoin (LTC), and Solana has captured the eye of traders, analysts, and market individuals. Moreover, Cardano, a outstanding participant within the blockchain house, continues to point out power, with rising curiosity from each institutional and retail traders. This information replace gives a complete overview of those developments, their potential influence available on the market, and what to anticipate within the coming weeks.

Nasdaq, one of many world’s main inventory exchanges, has begun the method of reviewing Grayscale’s purposes for the creation of cryptocurrency ETFs based mostly on a number of widespread digital belongings: XRP, Litecoin (LTC), and Solana. This transfer has sparked a renewed sense of optimism inside the cryptocurrency group, notably as institutional curiosity in digital belongings continues to rise.

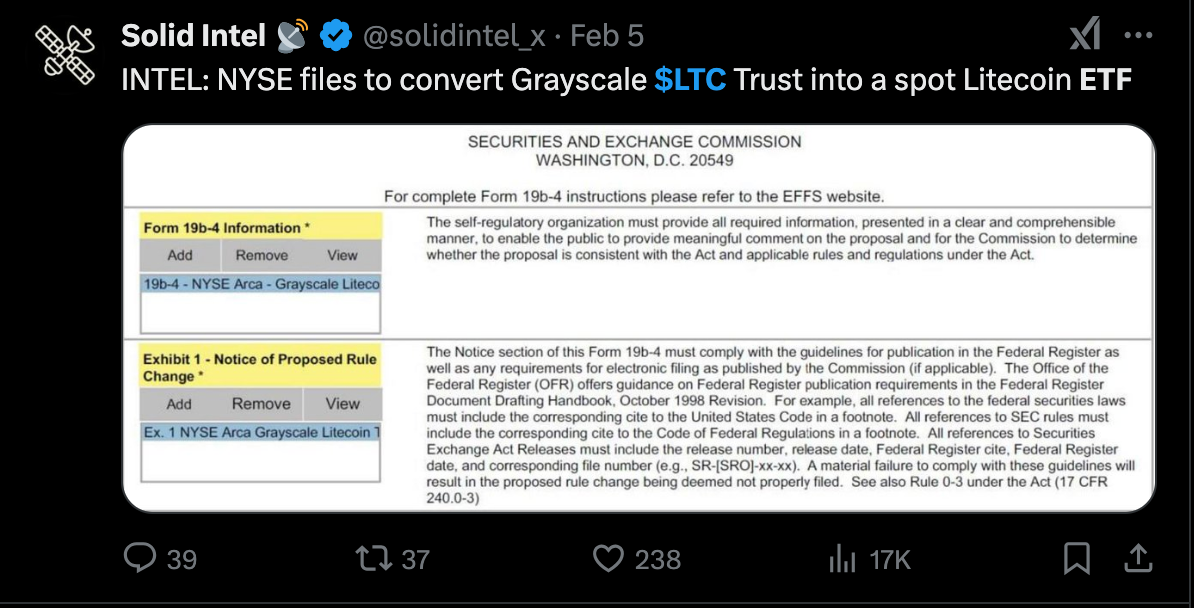

Snap | Supply: Stable Intel on X

Grayscale, a significant participant within the cryptocurrency funding sector, is understood for its profitable Bitcoin and Ethereum Belief merchandise, which have allowed institutional traders to realize publicity to those digital belongings via conventional monetary markets. Nevertheless, the corporate’s newest push to launch ETFs based mostly on various cryptocurrencies equivalent to XRP, LTC, and Solana marks a big growth of its product choices.

Grayscale’s Imaginative and prescient for the Way forward for Crypto ETFs

The proposed ETFs are designed to supply traders with quick access to XRP, Litecoin, and Solana in the identical method they might put money into conventional shares. These merchandise are particularly interesting to those that are hesitant about instantly buying and managing cryptocurrency holdings. By introducing these ETFs, Grayscale goals to supply a safer and extra regulated method for traders to take part out there, with out the complexities related to cryptocurrency exchanges, wallets, and the related dangers.

XRP, Litecoin, and Solana every have their very own distinctive traits and communities, and their inclusion within the ETF lineup displays Grayscale’s need to diversify its product portfolio. XRP, as an example, is understood for its use in cross-border funds and its sturdy affiliation with Ripple, whereas Litecoin is commonly seen because the ‘silver’ to Bitcoin’s ‘gold.’ Solana, alternatively, has gained reputation as a result of its excessive scalability and low transaction charges, positioning it as a promising platform for decentralized purposes (dApps) and sensible contracts.

The Nasdaq evaluate course of is essential for the approval of those ETFs, because the change should consider the purposes to make sure they meet regulatory requirements and align with market practices. Nasdaq’s involvement lends a layer of credibility to the endeavor, offering assurance to institutional traders that these merchandise will likely be topic to rigorous oversight and compliance measures.

Ought to Nasdaq approve Grayscale’s purposes, these ETFs would mark a historic second within the cryptocurrency market, as they would supply broader market publicity and enhance the liquidity of those digital belongings. Approval might additionally sign a brand new period of mainstream adoption, additional blurring the traces between conventional monetary markets and the decentralized world of cryptocurrencies.

Cardano’s Rising Momentum: A Stable Basis for Future Progress

Whereas the highlight has been on Nasdaq and Grayscale’s ETF developments, Cardano (ADA) continues to construct momentum as one of the crucial outstanding sensible contract platforms within the cryptocurrency house. Based by Ethereum co-founder Charles Hoskinson, Cardano has steadily gained consideration as a result of its distinctive proof-of-stake consensus mechanism, which is taken into account extra energy-efficient and environmentally pleasant than the proof-of-work methods utilized by Bitcoin and Ethereum.

Cardano’s current focus has been on bettering its ecosystem with the launch of a number of key upgrades, together with sensible contract performance and decentralized finance (DeFi) instruments. These developments have allowed Cardano to place itself as a severe contender within the blockchain house, notably for builders in search of a scalable, safe, and sustainable platform for constructing decentralized purposes.

Institutional curiosity in Cardano has been steadily rising, as traders search for various belongings to diversify their portfolios. This rising institutional adoption is mirrored within the rising demand for ADA tokens, which have seen important worth will increase over the previous 12 months. The community’s sturdy concentrate on educational analysis and peer-reviewed improvement processes has earned it a popularity for being one of the crucial methodical and safe blockchain initiatives within the trade.

Cardano’s ecosystem can be gaining traction with builders, due to the community’s enhanced capabilities. The launch of sensible contracts has unlocked new use instances, notably within the DeFi house, the place platforms like SundaeSwap, a decentralized change (DEX), have begun to realize reputation. As Cardano continues to develop its ecosystem, it’s anticipated to play a key function within the ongoing evolution of the blockchain trade.

Trying forward, the long run for Cardano seems promising. The community’s continued improvement of scalability options and its concentrate on interoperability with different blockchains will likely be crucial in driving adoption. Moreover, Cardano’s dedication to increasing its ecosystem of dApps, DeFi initiatives, and NFTs will additional solidify its place out there.

Moreover, Cardano’s partnership with main organizations and governments, notably in creating international locations, highlights its potential to drive real-world influence. These partnerships, together with its emphasis on sustainability, might place Cardano as a number one blockchain platform within the years to return.

Nasdaq ETF Approvals and Cardano: Cryptocurrency Turning Level

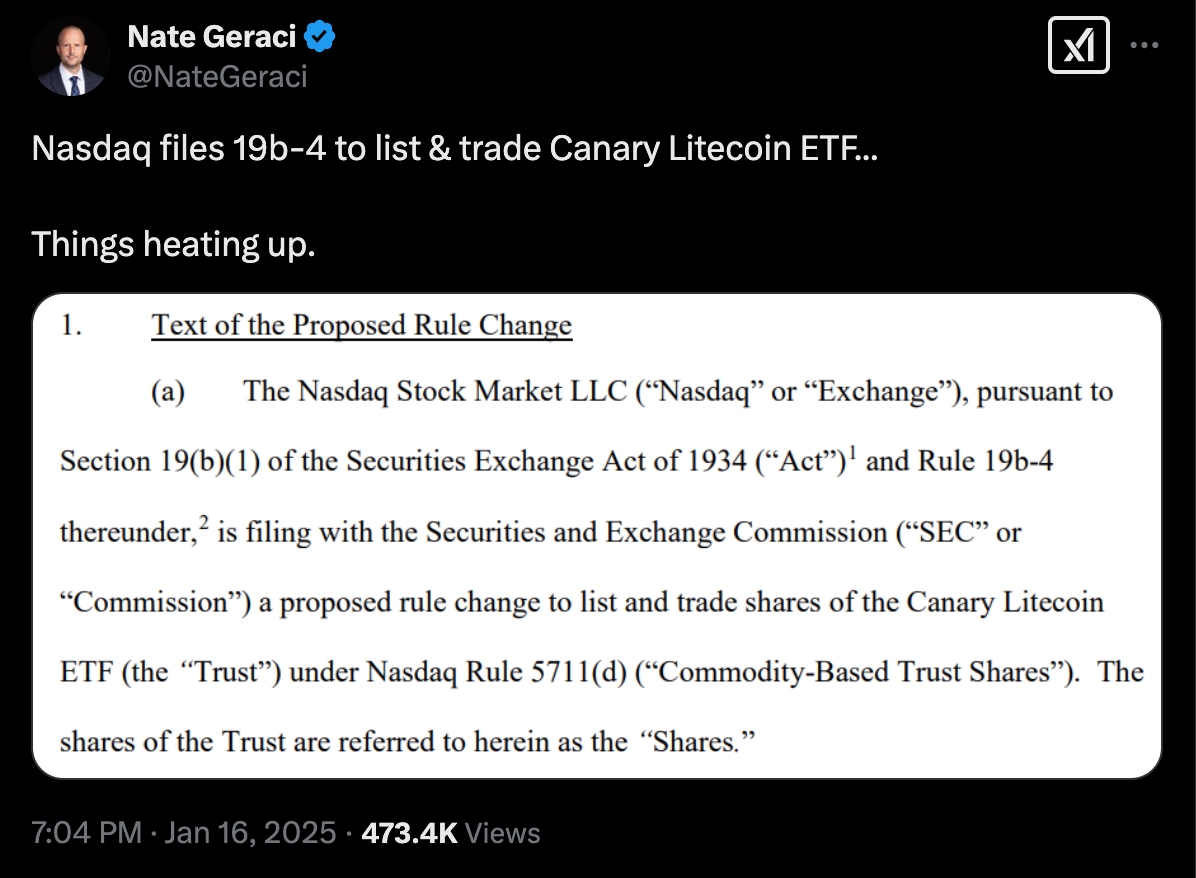

The potential approval of Grayscale’s ETF purposes for XRP, Litecoin, and Solana, mixed with Cardano’s rising affect, might have a profound influence on the cryptocurrency market as an entire. These developments recommend that institutional adoption of digital belongings is accelerating, paving the best way for additional innovation and funding alternatives.

The introduction of ETFs targeted on XRP, Litecoin, and Solana would doubtless drive elevated buying and selling volumes and liquidity, offering better entry to those belongings for traders who could have beforehand been hesitant to enter the market. Moreover, the approval of those ETFs might appeal to extra institutional gamers to the cryptocurrency house, probably resulting in elevated worth stability and broader acceptance of digital belongings in conventional monetary markets.

Snap | Supply: Nate Geraci on X

For Cardano, the continued development of its ecosystem and its institutional adoption might result in better integration of ADA into mainstream finance and enterprise options. If the community can proceed to ship on its guarantees of scalability, safety, and sustainability, Cardano might emerge as a number one platform for decentralized purposes and sensible contracts, additional cementing its place within the international blockchain panorama.

As February progresses, Nasdaq’s evaluate of Grayscale’s ETF purposes for XRP, Litecoin, and Solana, mixed with Cardano’s rising prominence, indicators a pivotal second for the cryptocurrency market. With the potential for mainstream adoption on the horizon, these developments are reshaping the panorama of digital belongings and creating new alternatives for traders, builders, and entrepreneurs alike.

The cryptocurrency market is evolving quickly, and the approaching months will doubtless witness much more groundbreaking developments. Whether or not via the approval of recent ETFs or the continued development of blockchain ecosystems like Cardano, the way forward for digital belongings is more and more intertwined with the broader monetary panorama. For traders and market individuals, staying knowledgeable on these developments will likely be key to navigating the thrilling and ever-changing world of cryptocurrency.