BTC traded as excessive as $99,497.97 earlier than retreating, however the dominant digital asset has been progressively edging in the direction of the $100,000 barrier, with bears getting squeezed on shorts to the tune of $128.35 million.

Bitcoin Nears $100K However Meets Resistance

Bitcoin (BTC) is edging nearer to the extremely anticipated $100,000 milestone, buying and selling at $99,207.54 on the time of reporting. The world’s main cryptocurrency has gained 1.51% over the previous 24 hours and is up 2.39% over the previous week. With a 24-hour buying and selling vary of $96,874.82 to $99,497.97, BTC is displaying indicators of robust bullish momentum as traders proceed to push the worth increased.

(BTC value / Buying and selling View)

Buying and selling Quantity and Market Capitalization on the Rise

Bitcoin’s 24-hour buying and selling quantity has surged 27.08% to $34.42 billion, reflecting elevated market participation and heightened investor exercise. Alongside this uptick in quantity, Bitcoin’s whole market capitalization has risen to $1.96 trillion, marking a 1.47% improve since yesterday. These metrics counsel rising confidence in BTC, with merchants positioning themselves for potential additional beneficial properties.

BTC Dominance Sees Slight Dip Amid ETH Rally

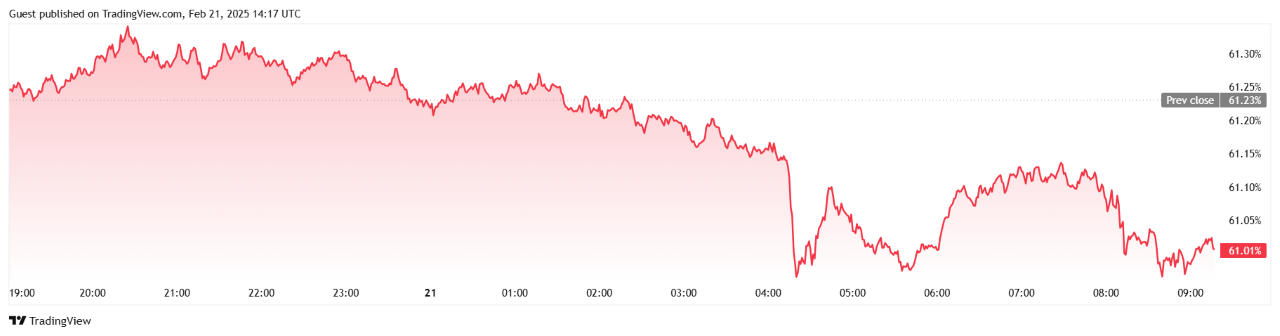

Regardless of bitcoin’s power, its dominance within the crypto market has dipped barely by 0.34% over the previous 24 hours, presently standing at 61.02%, in keeping with Buying and selling View. This decline may be partially attributed to ether’s (ETH) current efficiency. ETH is buying and selling at $2,824.63, having rallied 2.31% over the previous 24 hours and expanded its market capitalization by 2.32%. Consequently, BTC’s general market share has seen a minor discount as traders allocate capital to ether and doubtlessly different altcoins.

(BTC dominance / Buying and selling View)

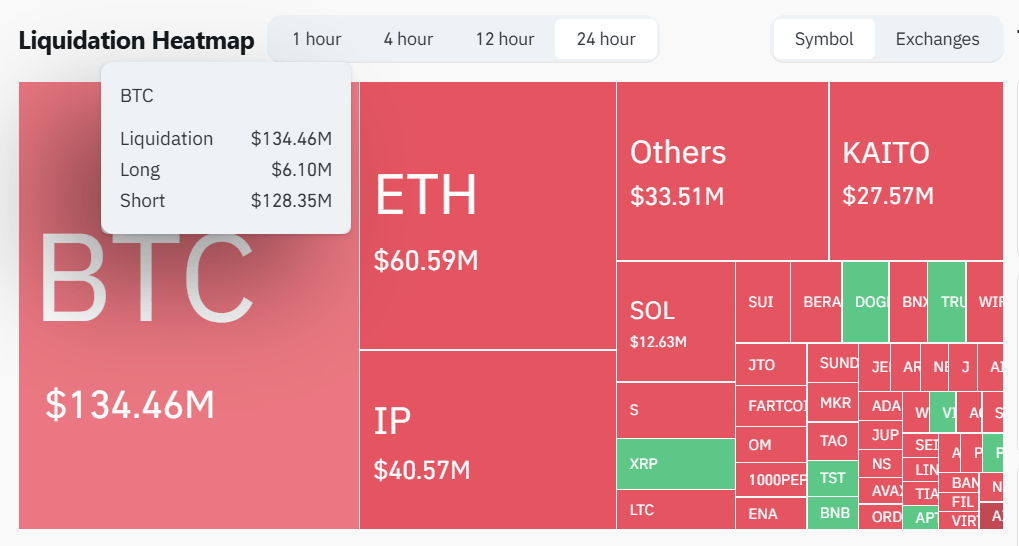

Futures Market Sees Elevated Hypothesis, Shorts Squeezed

Within the derivatives market, bitcoin futures open curiosity has jumped 3.33% over the previous 24 hours to $65.83 billion, in keeping with Coinglass. This improve signifies a rising variety of leveraged positions betting on BTC’s subsequent transfer.

Liquidation information highlights an aggressive quick squeeze, with whole liquidations reaching $134.46 million over the previous 24 hours. Brief merchants bore the brunt of the losses, accounting for $128.35 million of the entire, whereas lengthy liquidations remained comparatively modest at $6.10 million. The imbalance means that merchants betting in opposition to BTC’s value improve have been pressured to cowl their positions, contributing to the current upward momentum.

(Crypto liquidations / Coinglass)

Bitcoin Market Outlook

With bitcoin hovering just under $100,000, market sentiment stays bullish. The rise in buying and selling quantity and futures open curiosity, mixed with a big quick squeeze, suggests continued upward stress on BTC’s value. Nevertheless, the slight dip in BTC dominance signifies that capital can also be flowing into altcoins, notably Ethereum, which might have an effect on Bitcoin’s rapid trajectory.

Trying forward, BTC wants to interrupt previous the psychological resistance of $100,000 to solidify its subsequent leg up. If shopping for stress sustains, a decisive transfer past this degree might open the door for brand new all-time highs. On the draw back, assist stays round $97,000, the place patrons might look to step in if the worth faces a brief pullback.