- Analysts spotlight Ethereum’s safe infrastructure and Layer 2 scaling options as important for attracting institutional adoption.

- Regardless of bearish developments and lowered value predictions, on-chain knowledge reveals that institutional traders are steadily accumulating ETH.

The long-term prospects of Ethereum are being likened to the early days of expertise giants Amazon and Microsoft, even because the crypto large has been grappling currently available in the market. Consultants say the blockchain community’s precedence on safety, scalability, and institutional adoption might propel it to develop into a behemoth within the monetary sector.

A Strategic Progress Path For Ethereum

Most analysts imagine that Ethereum is underpriced, with traders maybe failing to know its long-term development prospects. As a substitute of specializing in quick development, Ethereum has put effort into making a safe and scalable infrastructure—an initiative much like Amazon’s early deal with constructing infrastructure previous to changing into a market chief. Such an initiative has established Ethereum as a dependable settlement layer within the blockchain house.

One of many robust fits of Ether is its Layer 2 scaling options, which assist to reinforce the effectivity of transactions and decrease prices. Though these options haven’t but been driving significant income, they exist as a significant distribution community that continues to construct out Ether’s general ecosystem. Business insiders assume these improvements will draw extra institutional cash and conventional monetary gamers as soon as adoption picks up, solidifying Ethereum’s long-term place within the house.

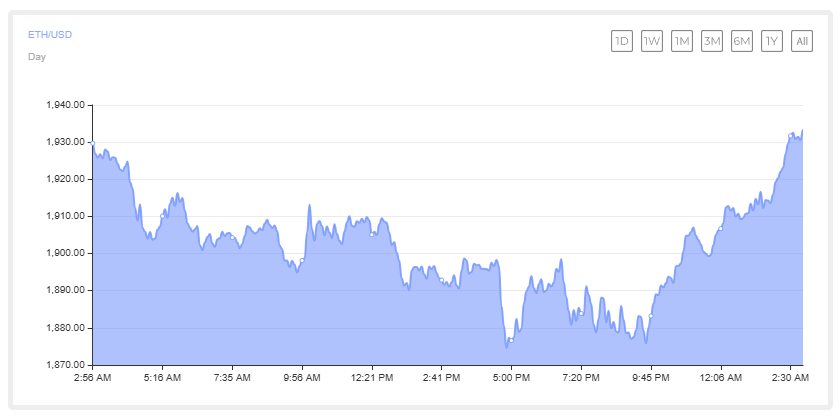

ETH Value Motion Amid Newest Tendencies

Regardless of its stable fundamentals, Ethereum has struggled with constant market headwinds. The digital forex has been in a protracted bearish pattern, with its value recording a big drop in latest months. Market dominance ranges have come again to ranges that have been recorded in 2020, the place there have been worries that Ether value is dropping its grip because the lead participant within the crypto market.

Additionally, massive monetary establishments have lowered their value predictions, indicating bearish sentiment amongst traders. The bearish value motion mixed with the downward expectations has raised questions on whether or not ETH value can get better its momentum within the quick time period, as talked about in our final information story. As of writing, Ether’s value was down by 1.06%, buying and selling at $1,891.24 on Tuesday, March 18. Nevertheless, the ETH open curiosity gained 1.18% to $18.05 billion, in line with Coinglass knowledge.

Regardless of Ethereum’s market efficiency coming below stress, blockchain knowledge signifies that institutional traders are nonetheless optimistic about its future. On-chain metrics point out that high-net-worth wallets are step by step accumulating ETH, which is a sign that institutional individuals imagine there may be long-term worth regardless of current volatility. All eyes will probably be at the moment on the upcoming Pectra improve for Ethereum that can set the tone for its future trajectory.

This fixed buildup suggests the potential of a future bounce, with strategic traders taking positions for eventual revenue. But the trail for Ethereum is unclear, with sentiment available in the market largely deciding if it could possibly take the route of expertise giants that overcame preliminary setbacks to in the end be extraordinarily profitable.