Bitcoin (BTC) has been experiencing a part of consolidation after dealing with a notable correction from its latest highs. At the moment buying and selling round $83,371, BTC is struggling to regain bullish momentum however has managed to carry above the important thing $80,000 assist stage. Market members are carefully watching whether or not Bitcoin is forming a base for a possible rally or whether it is prone to additional draw back.

The broader crypto market has additionally been exhibiting indicators of uncertainty, with Bitcoin’s value motion largely influenced by macroeconomic elements, institutional exercise, and technical indicators. This evaluation explores BTC’s present state, key assist and resistance ranges, and whether or not a breakout or additional decline is on the horizon.

Bitcoin Value Prediction: Is Bitcoin’s Consolidation a Signal of Power or Weak point?

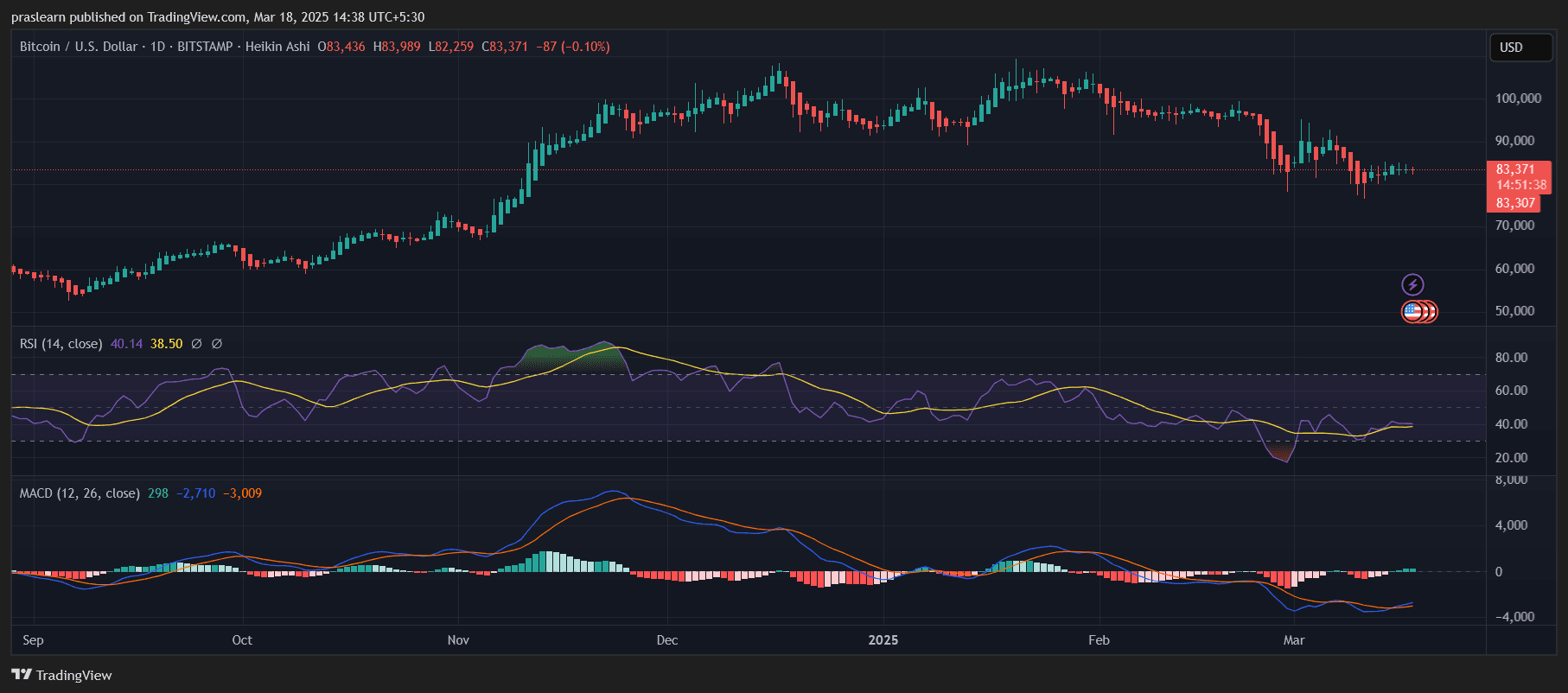

BTC/USD Day by day Chart- TradingView

After a powerful bull run in early 2025, Bitcoin has slowed down, consolidating between $80,000 and $85,000. This sideways motion means that each bulls and bears are ready for affirmation earlier than making their subsequent transfer.

The Relative Power Index (RSI) stands at 40.14, indicating that Bitcoin is approaching oversold territory however hasn’t but signaled a transparent reversal. Usually, an RSI under 30 is taken into account oversold, that means that BTC might nonetheless see additional declines earlier than discovering strong shopping for assist.

From a quantity perspective, buying and selling exercise has been comparatively low in latest periods, suggesting that neither bulls nor bears have full management at this level. If Bitcoin is to mount a powerful restoration, we have to see a rise in quantity alongside a decisive breakout.

Can Bitcoin Maintain Help Above $80,000?

The $80,000 stage has confirmed to be a vital psychological and technical assist zone. Traditionally, BTC has bounced again from such key assist ranges when backed by sturdy shopping for curiosity. If Bitcoin continues to commerce above this stage, we might see a reduction rally pushing it towards $85,000 or greater.

Nonetheless, a breakdown under $80,000 would point out weak spot, probably resulting in a retest of $77,000 and even $75,000. This situation would sign that bears stay in management and will set off further sell-offs.

Merchants ought to look ahead to shopping for quantity at present ranges. If demand stays weak, BTC might battle to maintain itself above assist, growing the chance of a deeper pullback.

What Does the MACD Indicator Counsel?

The Shifting Common Convergence Divergence (MACD) is at the moment in bearish territory, with the MACD line under the sign line. This implies that downward momentum nonetheless dominates the market. Nonetheless, the histogram bars are shrinking, which signifies that the bearish momentum could also be fading.

A bullish crossover (the place the MACD line crosses above the sign line) can be an early signal of a possible restoration. If this occurs whereas BTC stays above $80,000, it might set off renewed shopping for stress, pushing Bitcoin again towards key resistance ranges.

Bitcoin Value Prediction: Will Bitcoin Retest $90,000 Quickly?

For BTC value to shift again right into a bullish development, it should break above $85,000, which is appearing as quick resistance. If Bitcoin value efficiently clears this stage with sturdy shopping for quantity, the following goal can be $90,000, a significant psychological resistance zone.

Past $90,000, the following bullish goal can be $95,000 and finally $100,000, which might mark a brand new all-time excessive. Nonetheless, for this to occur, BTC value wants sturdy institutional inflows, optimistic macroeconomic sentiment, and a rise in on-chain exercise.

Key bullish catalysts to look at embody:

- Bitcoin ETF inflows: If institutional buyers enhance their BTC holdings, we might see renewed upward momentum.

- Federal Reserve financial coverage: Any signal of price cuts or dovish insurance policies might strengthen Bitcoin’s enchantment as a hedge towards inflation.

What’s Subsequent for BTC Value?

Bitcoin value motion stays at a essential juncture, with $80,000 serving because the make-or-break stage for short-term route. If bulls defend this stage, we might see a restoration towards $85,000 and past. Nonetheless, if BTC fails to carry this assist, a deeper correction towards $75,000 might comply with.

Technical indicators present combined indicators, with the RSI nearing oversold situations, the MACD nonetheless bearish however weakening, and low buying and selling quantity suggesting market indecision.