BlackRock continues to double down on its Bitcoin technique, actively shopping for the dip regardless of broader market turbulence.

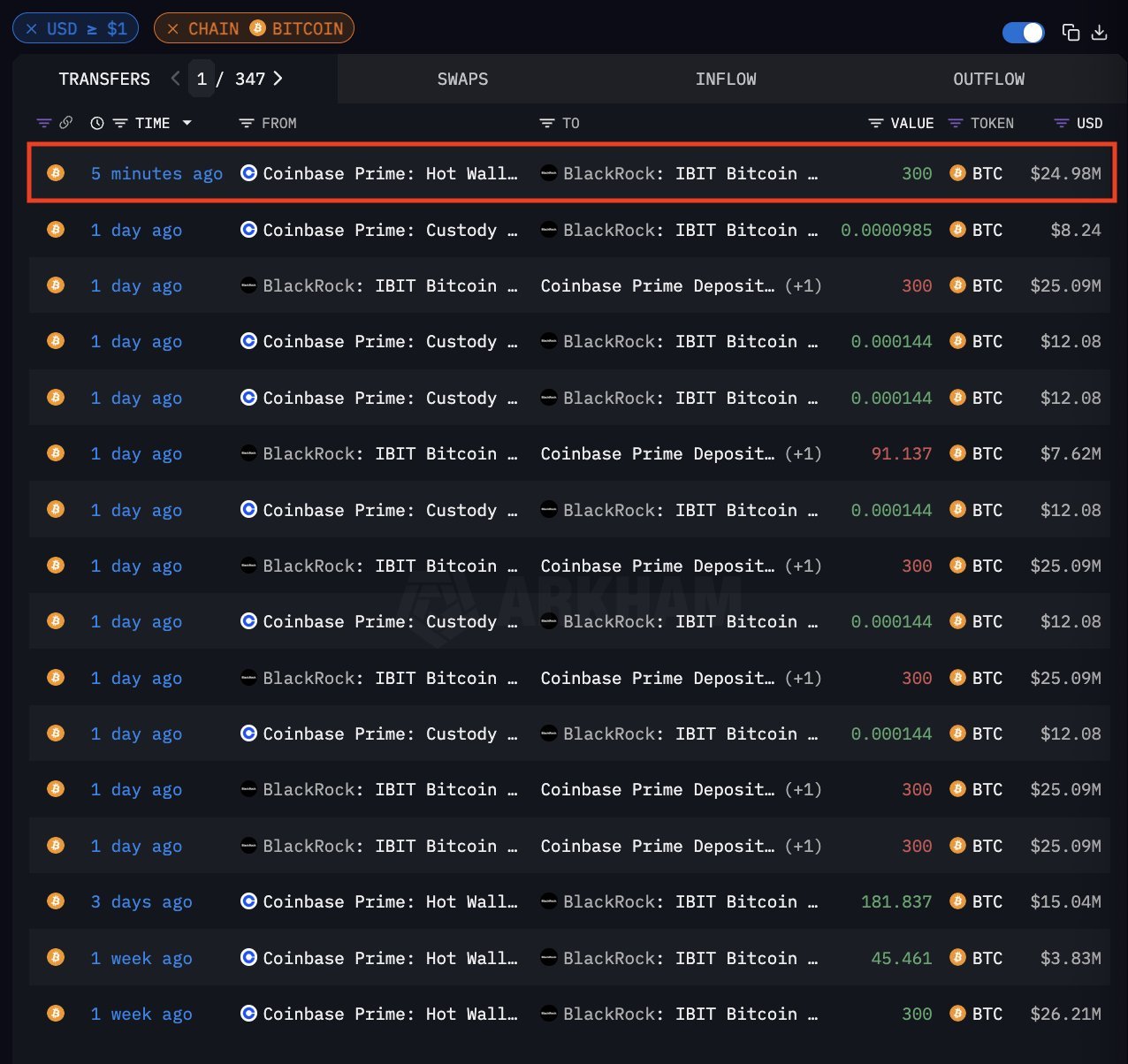

In response to knowledge from Arkham, BlackRock’s spot ETF, IBIT, added one other $25 million price of Bitcoin to its holdings.

This comes as Bitcoin trades round $83,300, gaining about 1% on Friday even because the Nasdaq 100 skilled a second day of sharp declines following newly introduced commerce tariffs.

The Nasdaq has now fallen over 16% year-to-date, whereas Bitcoin has dipped practically 12% in the identical interval — however has nonetheless considerably outperformed the tech-heavy index over time.

The continued accumulation by BlackRock underscores its long-term conviction in Bitcoin. This stance was echoed earlier within the yr by CEO Larry Fink in his annual shareholder letter, the place he raised considerations in regards to the U.S. greenback’s world dominance.

Citing the ballooning nationwide debt and rising geopolitical dangers, Fink warned that Bitcoin may ultimately turn into a extra enticing retailer of worth than the U.S. greenback. He additionally cautioned that decentralized finance would possibly erode the U.S.’s financial edge.

Is Bitcoin risk-off asset?

Regardless of Bitcoin’s current outperformance of conventional equities, the query of whether or not it capabilities as a risk-off asset stays contested. Traditionally, Bitcoin has traded in keeping with different threat belongings, exhibiting sturdy correlation with shares.

Bloomberg’s ETF analyst Eric Balchunas weighed in, suggesting Bitcoin shouldn’t be bought as a hedge to something however inflation and financial debasement. “It’s 100% sizzling sauce,” Balchunas famous, including that whereas it isn’t a secure haven, IBIT remains to be up 78% since its launch simply over a yr in the past.

Yeah IMO the issuers mustn’t promote it as a hedge to something besides the worldwide cash printer. It’s 100% sizzling sauce, which isn’t unhealthy factor imo, however if you happen to go in figuring out that then no likelihood of shock. And btw $IBIT is STILL up 78% since launch barely over a yr in the past. https://t.co/Rk3p9ys5LO

— Eric Balchunas (@EricBalchunas) April 4, 2025

As establishments like BlackRock proceed to again Bitcoin, investor notion of the asset might evolve — not essentially as digital gold, however as a robust, if risky, software in an more and more unsure macroeconomic panorama.