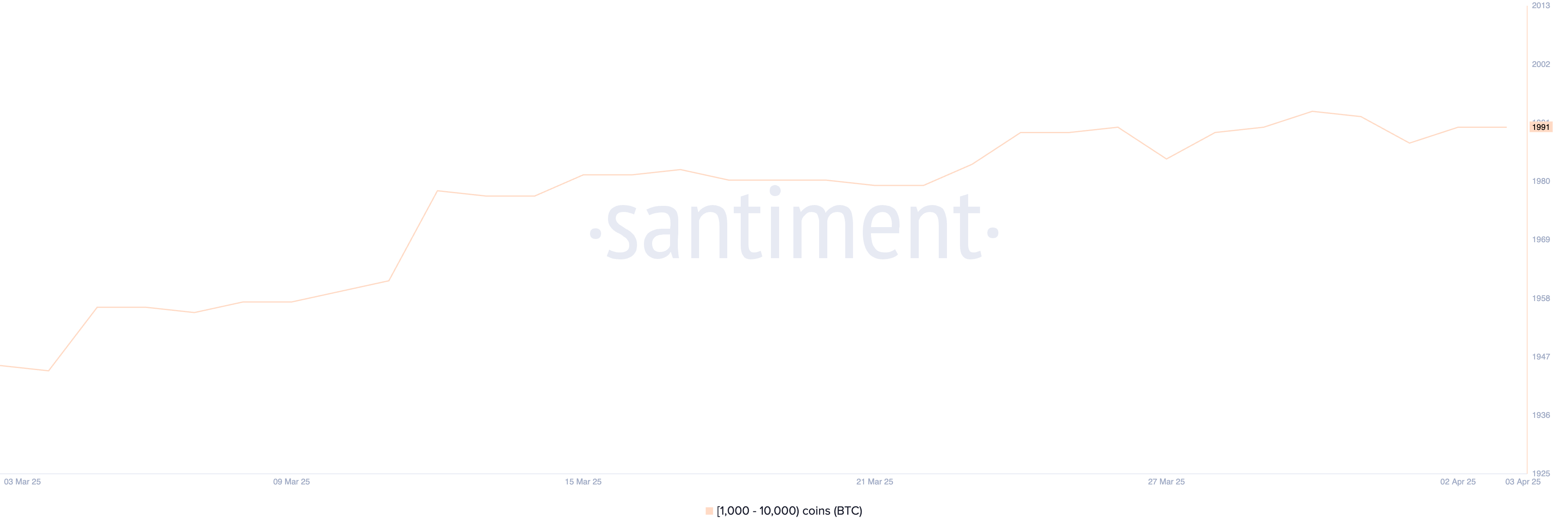

Bitcoin (BTC) continues to hover in a state of uncertainty as each whale exercise and technical indicators level to a market missing robust conviction. Massive holders have remained inactive for over every week, with the variety of whale wallets holding between 1,000 and 10,000 BTC regular at 1,991 since March 24.

In the meantime, technical charts just like the Ichimoku Cloud and EMA traces provide a combined outlook, reflecting hesitation in each bullish and bearish instructions. As BTC trades close to key assist and resistance ranges, the approaching days may decide whether or not April brings a breakout or deeper correction.

Bitcoin Whales Aren’t Accumulating

The variety of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—at present stands at 1,991, a determine that has remained remarkably regular since March 24.

This degree of consistency in giant holder exercise means that main gamers are neither aggressively accumulating nor offloading their positions.

Given the scale of those holdings, even minor shifts in whale habits can considerably impression the market. This stability is especially noteworthy given current volatility throughout the broader crypto market.

Bitcoin Whales. Supply: Santiment

Monitoring Bitcoin whales is essential as a result of these giant holders usually have the ability to affect value motion by their shopping for or promoting choices.

When whales accumulate BTC, it could possibly sign confidence in future value appreciation, whereas large-scale promoting can point out upcoming downward stress. The truth that the variety of whales has remained steady for the final 11 days might recommend a interval of consolidation, the place huge traders are ready for a clearer macro or market sign earlier than making their subsequent transfer.

This might indicate that main gamers see the present BTC value as truthful worth, probably resulting in a tightening of value motion within the quick time period earlier than a breakout in both course.

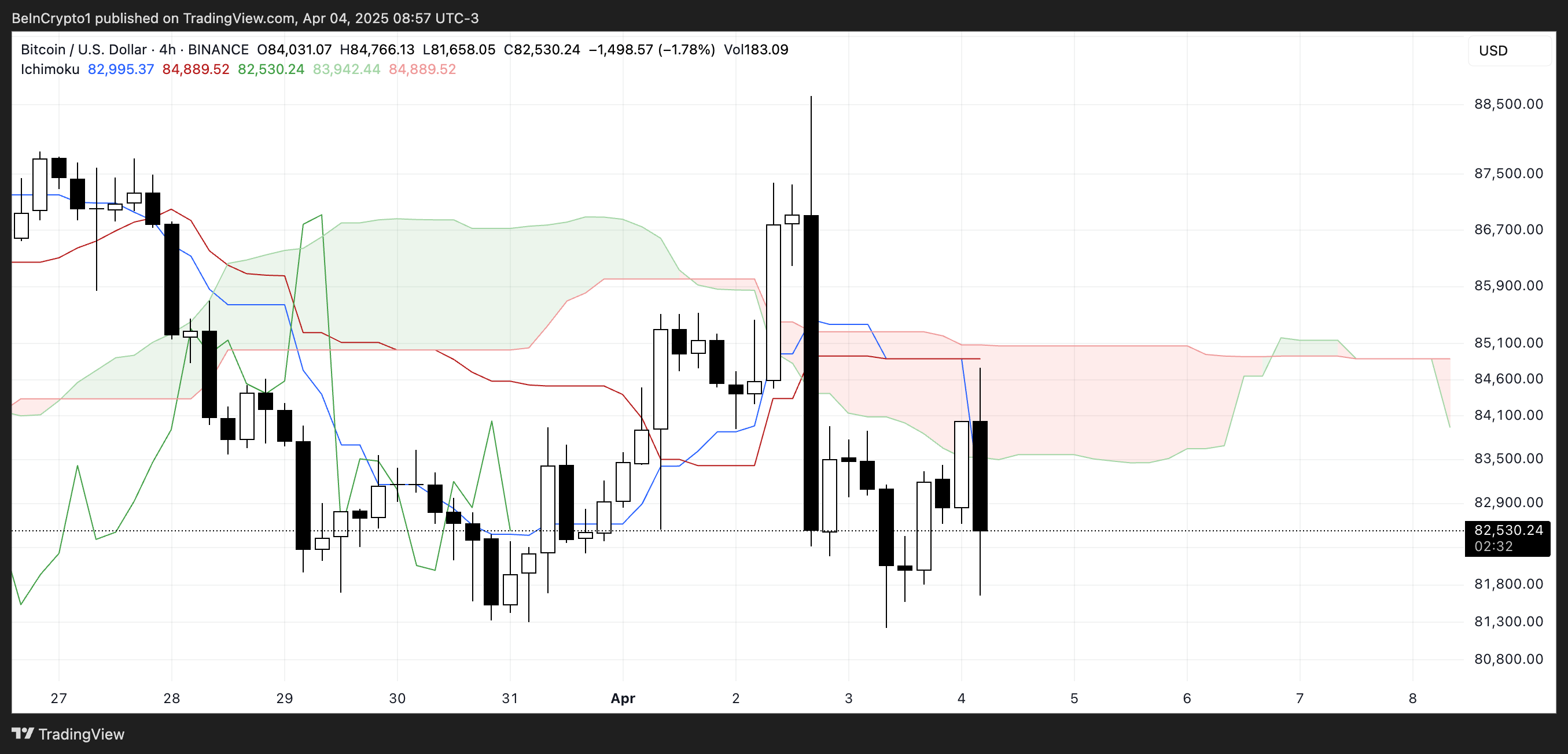

BTC Ichimoku Cloud Exhibits A Combined Image

The present Ichimoku Cloud setup for Bitcoin exhibits a combined however barely cautious sentiment.

The value lately dipped beneath the purple baseline (Kijun-sen), and regardless of a short push into the cloud, it was rejected and fell again beneath it—indicating that bullish momentum lacked follow-through.

The blue conversion line (Tenkan-sen) is now trending downward and has crossed beneath the baseline, which frequently displays short-term bearish momentum. In the meantime, the Main Span A (inexperienced cloud boundary) is beginning to flatten, whereas Main Span B (purple boundary) stays comparatively horizontal, forming a skinny and impartial cloud forward.

BTC Ichimoku Cloud. Supply: TradingView

This sort of skinny, flat cloud suggests indecision out there and an absence of robust trending momentum. The value hovering just under the cloud additional reinforces the concept BTC is in a consolidation section somewhat than a transparent pattern.

If the worth can break again above the cloud and keep that degree, it may sign renewed bullish power.

Nevertheless, continued rejection on the cloud and stress from the falling Tenkan-sen may maintain BTC in a corrective or sideways construction. For now, the Ichimoku setup displays uncertainty, with no dominant pattern confirmed in both course.

Will Bitcoin Rise Again To $88,000 In April?

Bitcoin’s EMA construction nonetheless leans bearish total, with longer-term EMAs positioned above the shorter-term ones. Nevertheless, the current upward motion within the short-term EMAs suggests {that a} rebound might be forming.

If this short-term power develops right into a sustained transfer, Bitcoin may first check the resistance at $85,103. A profitable break above this degree might sign a shift in momentum, opening the door to larger targets at $87,489. Just lately, Commonplace Chartered predicted that BTC is prone to break $88,500 this weekend.

BTC Worth Evaluation. Supply: TradingView

If bullish stress stays robust past that time, Bitcoin value may push even additional to problem $88,855, a degree that might mark a extra convincing restoration from the current pullback.

“(…) After Wednesday’s volatility, BTC has rebounded greater than 4% and stays firmly above $79,000, with a key assist degree forming at $80,000 and barely larger every day change volumes, which is a constructive signal. On prime of this, Bitcoin ETF flows recommend sentiment stays robust, with $220 million inflows on “Tariff Day”, April 2.,” Nic Puckrin, crypto analyst, investor, and founding father of The Coin Bureau, advised BeInCrypto.

Nevertheless, if Bitcoin fails to construct sufficient momentum for this rebound, draw back dangers stay. The primary key degree to observe is the assist at $81,169.

Because the commerce battle between China and the US escalates, a drop beneath this degree may see BTC falling below the psychological $80,000 mark, with the following goal round $79,069. If this zone can be misplaced, the bearish pattern may intensify, sending BTC additional down towards $76,643.