Amid world financial volatility, america has once more raised its debt ceiling to avert a default and make sure the authorities’s operations proceed easily.

The US debt ceiling is a authorized restrict on the quantity the federal authorities can borrow to fulfill its monetary obligations, together with pension funds, social welfare applications like Social Safety and Medicare, and curiosity on authorities bonds.

US Debt Ceiling Improve

Elevating the debt ceiling stays contentious, usually sparking heated debates between Congress and the White Home. Negotiations over spending and budgets are usually extended and complicated.

U.S. debt. Supply: PGPF

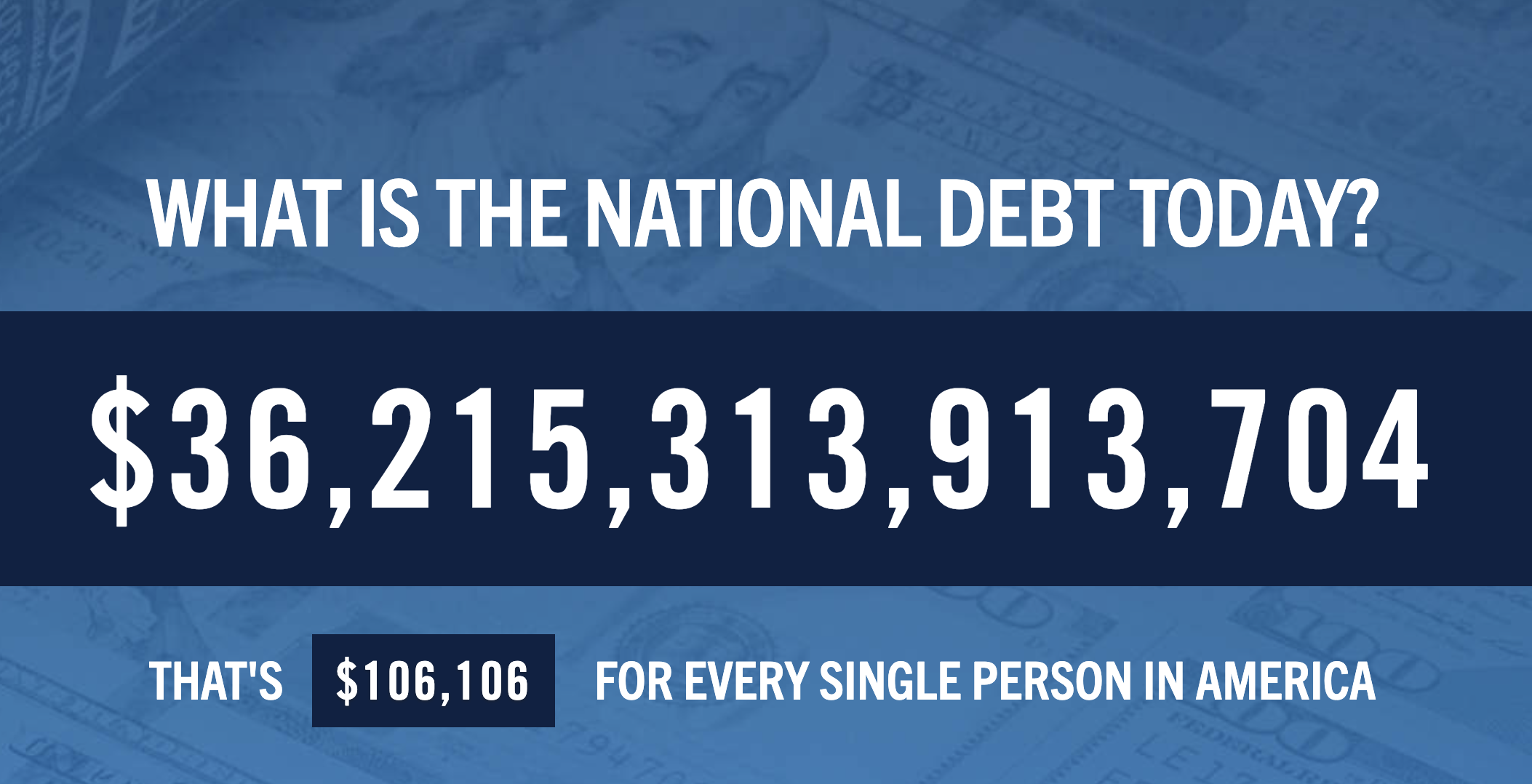

Based on knowledge from the Senate Joint Financial Committee (JEC), the US nationwide debt has surpassed $36.2 trillion as of April 2025. This marks a big rise from $22 trillion in March 2019, highlighting the fast escalation of nationwide debt in recent times.

Traditionally, elevating the debt ceiling is just not unusual. Based on NPR, since 1960, Congress has acted 78 instances to extend, briefly lengthen, or revise the debt ceiling definition—49 instances beneath Republican and 29 instances beneath Democratic presidents. This displays the recurring want to regulate the ceiling to keep up authorities performance, nevertheless it additionally raises questions concerning the long-term sustainability of US fiscal coverage.

Underneath President Donald Trump’s administration, daring financial insurance policies are being applied, together with utilizing tariff revenues to service debt. Trump has imposed a 125% tariff on Chinese language items, prompting retaliatory 84% tariffs from China on the US. imports.

Consequently, the Chinese language yuan (CNY) has hit an 18-year low, with the USD/CNY price reaching 7.394. The yuan’s depreciation escalates commerce tensions and ripple results throughout cryptocurrency markets.

Affect on Crypto

The rise within the US debt ceiling has multifaceted implications for the crypto market, each within the quick and long run.

Elevating the debt ceiling helps the US keep away from default, stopping a possible world monetary disaster. This usually reassures buyers, boosting confidence in conventional monetary markets like shares and US Treasury bonds. In consequence, demand for safe-haven property like Bitcoin—normally seen as a hedge throughout financial uncertainty—might decline.

Historic traits help this. Throughout previous debt ceiling crises, comparable to in 2021, Bitcoin costs surged as buyers feared a US default. Nevertheless, the stress eased as soon as the ceiling was raised, prompting some buyers to shift capital again to conventional property. This will create downward value stress on Bitcoin and different altcoins.

Moreover, a weaker yuan resulting from US insurance policies may drive capital from China into cryptocurrencies, probably offering a optimistic push for the market.

Frequently elevating the debt ceiling permits the US authorities to borrow extra to fund spending, usually resulting in elevated cash printing or issuance of Treasury bonds. This course of expands the cash provide, fueling inflation and eroding the US greenback’s worth.

Cryptocurrencies, significantly Bitcoin, are sometimes thought to be an “inflation hedge” resulting from their fastened provide and decentralized nature. Buyers more and more flip to different property to protect wealth because the greenback weakens. Bitcoin, usually dubbed “digital gold,” has confirmed its resilience throughout previous financial instability.

The rise within the US debt ceiling has a fancy impression on cryptocurrencies. Within the quick time period, it could scale back demand for safe-haven property like Bitcoin as confidence in conventional markets grows.

Nevertheless, in the long run, persistent debt ceiling hikes may drive inflation and weaken the greenback, positioning cryptocurrencies as a compelling hedge and different asset class.