Ethereum’s (ETH) dominance has steadily declined over the previous two years. This implies that investor capital is now not prioritizing ETH. As a substitute, funds are possible shifting towards Bitcoin and different altcoins like Solana or XRP.

Nonetheless, analysts see a significant alternative on this state of affairs. Many imagine there may be now a uncommon likelihood to build up ETH.

Might Ethereum’s 5-year Dominance Low be an Alternative?

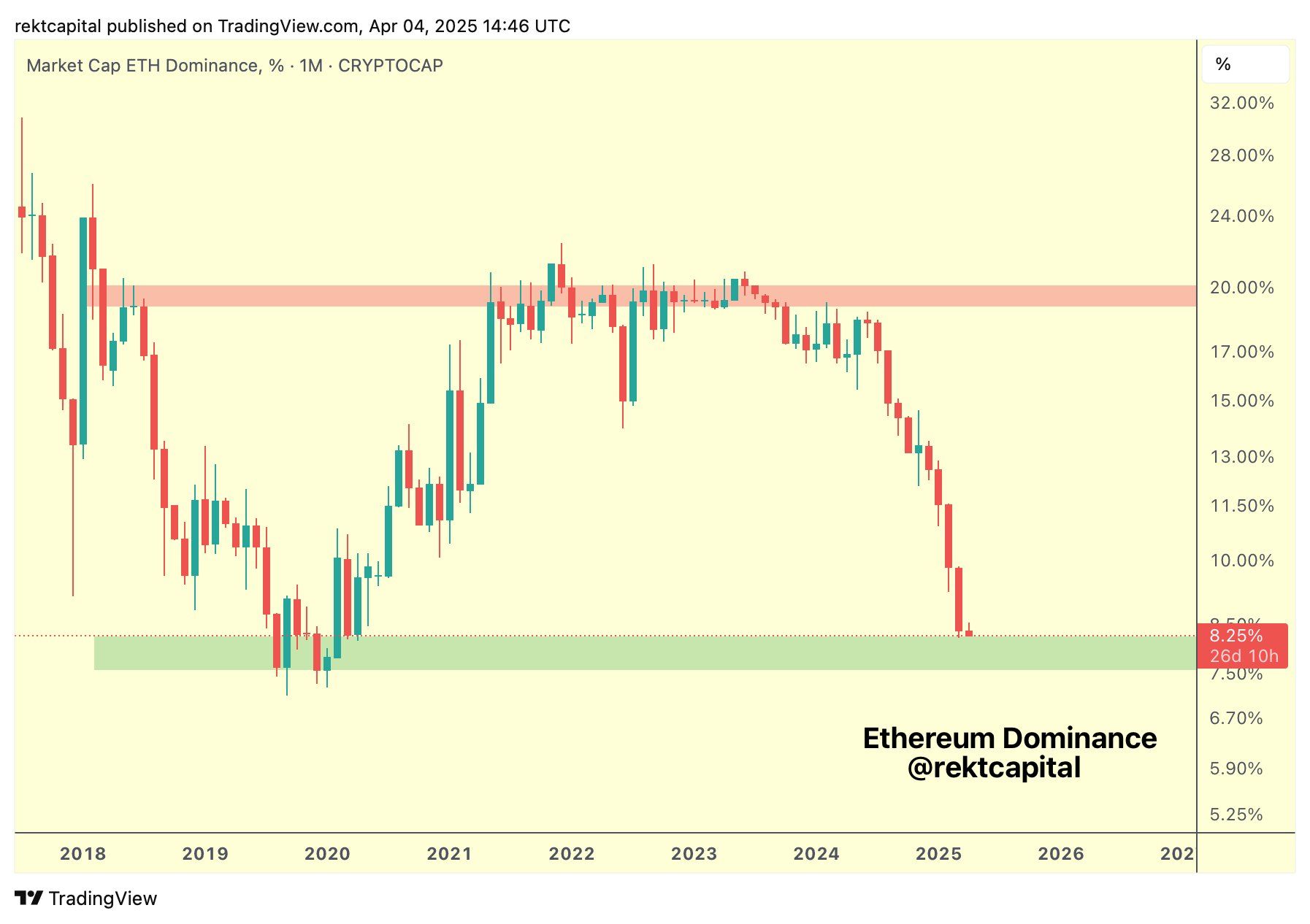

In line with analyst Rekt Capital, Ethereum dominance (ETH.D) dropped from 20% in June 2023 to eight% in 2025. On the time of writing, it was even decrease at round 7.3%.

ETH.D represents Ethereum’s market capitalization as a proportion of the full crypto market capitalization. A lower in ETH.D signifies that investor curiosity in ETH has diminished, not solely compared to the previous but in addition relative to different property available in the market.

Rekt Capital shared a chart exhibiting ETH.D touching a inexperienced help zone. Traditionally, Ethereum tends to reverse and acquire market energy from this space.

Ethereum Dominance Efficiency. Supply: Rekt Capital

Rekt Capital questioned whether or not Ethereum may repeat this historic sample and known as it a robust purchase sign.

“Since June 2023, Ethereum Dominance has dropped from 20% to eight%. Traditionally, Ethereum Dominance has reversed from this inexperienced space to grow to be extra market-dominant. Can Ethereum repeat historical past?,” Rekt Capital mentioned.

One other analyst, CryptoAnup, additionally noticed the drop as a can’t-miss alternative. He identified that when ETH.D hits a file low, it usually marks a great time to build up ETH earlier than a brand new development cycle begins.

“ETH Dominance appears to have discovered a flooring—rebound quickly!,” CryptoAnup predicted.

Nonetheless, latest evaluation from BeInCrypto revealed that ETH whale addresses are nonetheless actively promoting. This week, addresses holding between 100,000 and 1 million ETH bought round 1.19 million ETH, price over $1.8 billion. These gross sales are worsening the decline of ETH’s worth and dominance.

ETH Provide in Revenue Drops to Lowest Degree in 4 Years

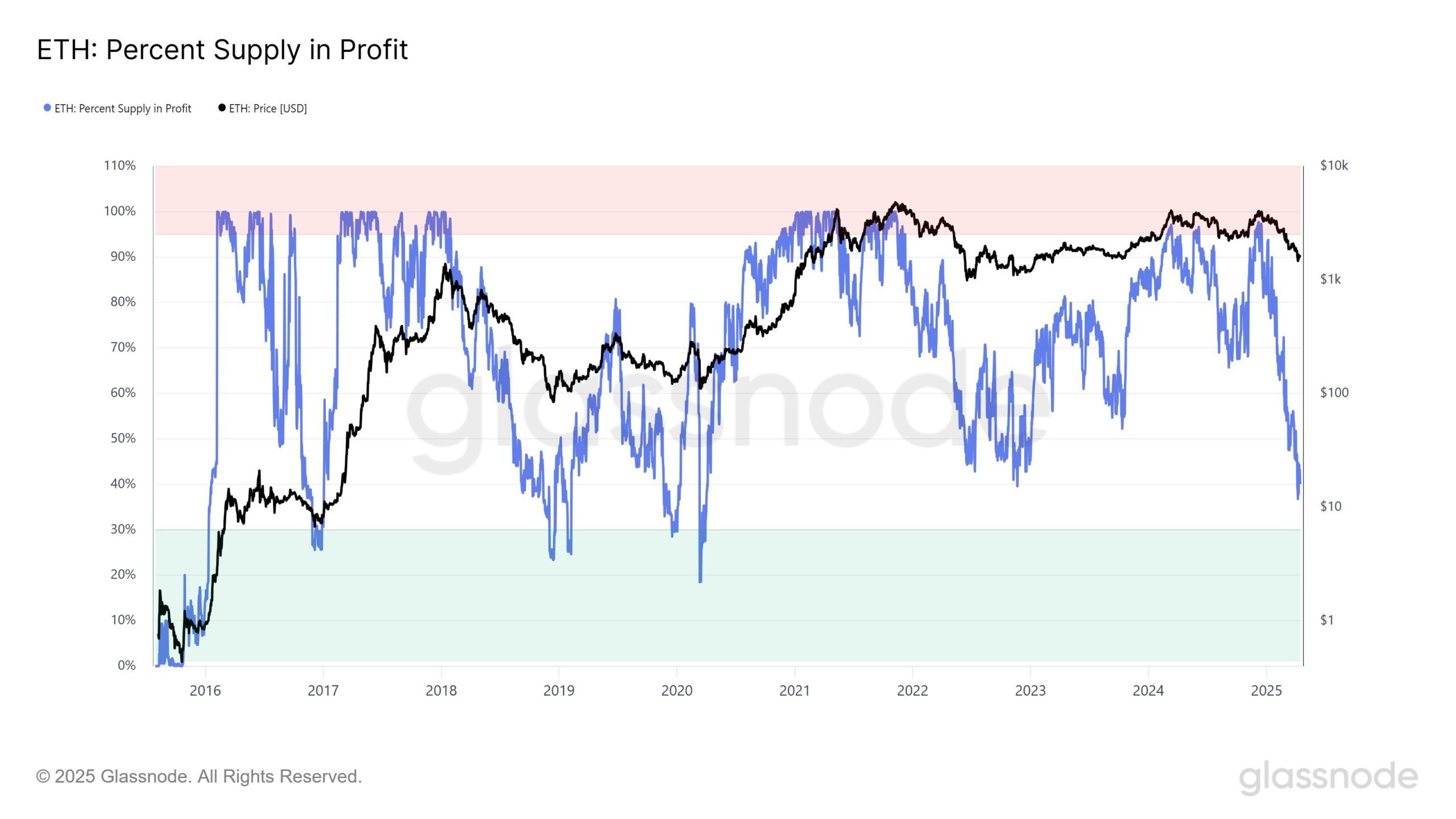

Past the drop in dominance, knowledge from Glassnode exhibits that the share of ETH provide in revenue has additionally fallen to a 4-year low.

ETH P.c Provide in Revenue. Supply: Glassnode

Solely 40% of the ETH provide is presently worthwhile—a major lower from 97.5% in early December 2024. Analyst Venturefounder mentioned that if this metric drops under 30%, it will sign a uncommon shopping for alternative that has solely appeared a number of instances prior to now decade.

“ETH proportion provide in revenue (40%) now decrease than the final bear market cycle backside (42%) when ETH was buying and selling at $800. Wanting on-chain, that is already sign to deploy,” Venturefounder mentioned.

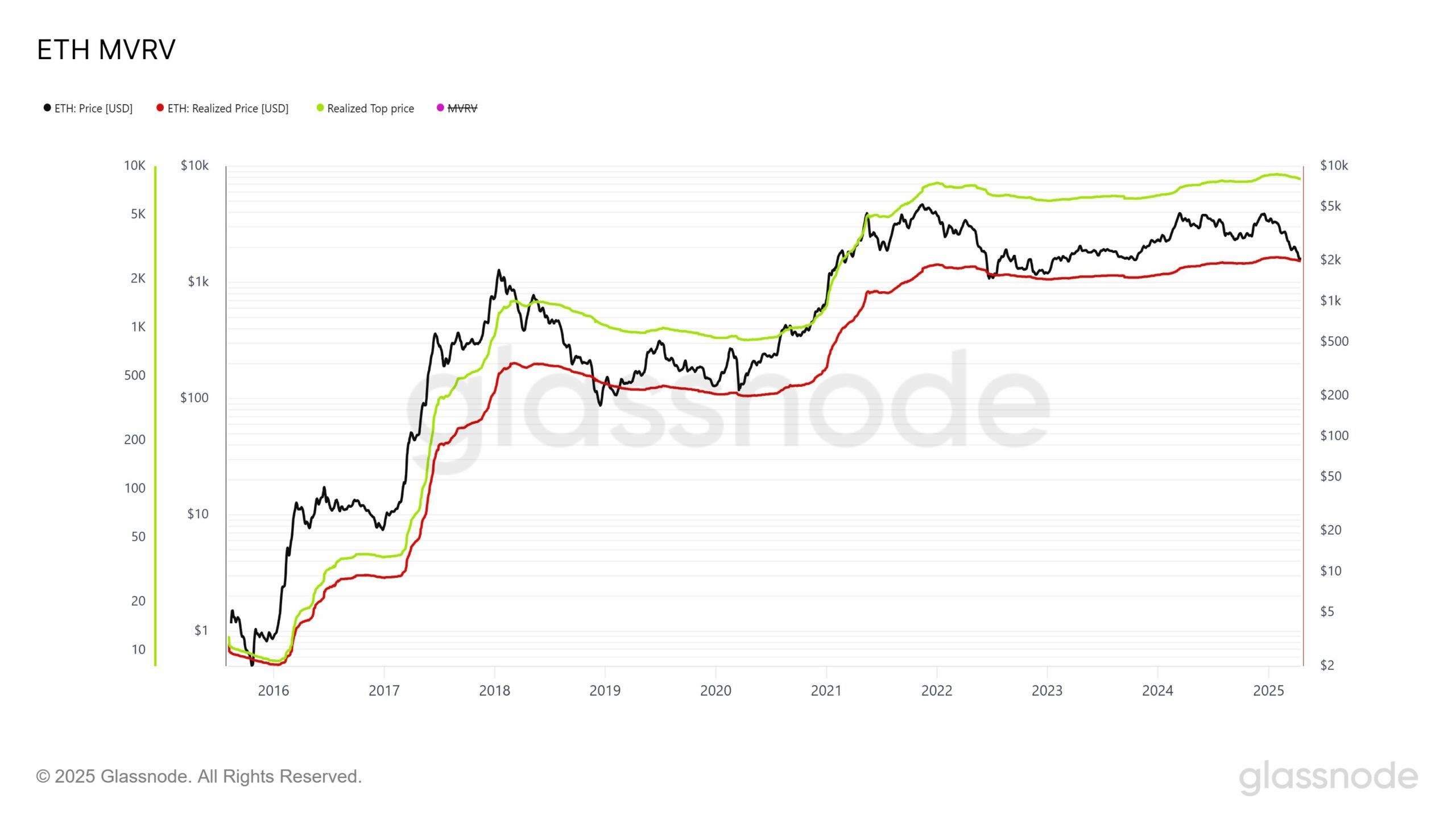

Venturefounder highlighted one other necessary metric: Ethereum’s present market worth has fallen to match its on-chain realized worth. The Realized Worth displays the typical worth at which all ETH tokens final moved. When the market worth drops to this stage, it usually alerts a uncommon shopping for window. Traditionally, such moments are likely to precede sturdy worth rallies.

Ethereum MVRV. Supply: Glassnode

“Taking a look at this ETH long run chart. Does it make you need to purchase Ethereum or promote Ethereum? Be sincere,” Venturefounder commented.

Regardless of ETH’s 60% decline from its late-2024 excessive, a latest report from BeInCrypto confirms Ethereum stays the highest DApp platform. DApp price income surpassed $1 billion in Q1 2025.

Moreover, the upcoming Pectra and Fusaka upgrades are anticipated to launch on the mainnet in Might 2025 and late 2025, respectively. These upgrades may considerably enhance community efficiency and increase investor sentiment.