Previously seven days, the tokenized U.S. Treasury bond market expanded by $450 million, with Blackrock’s BUIDL capturing 67.33% of that enhance.

Tokenized Treasuries Leap $450 million

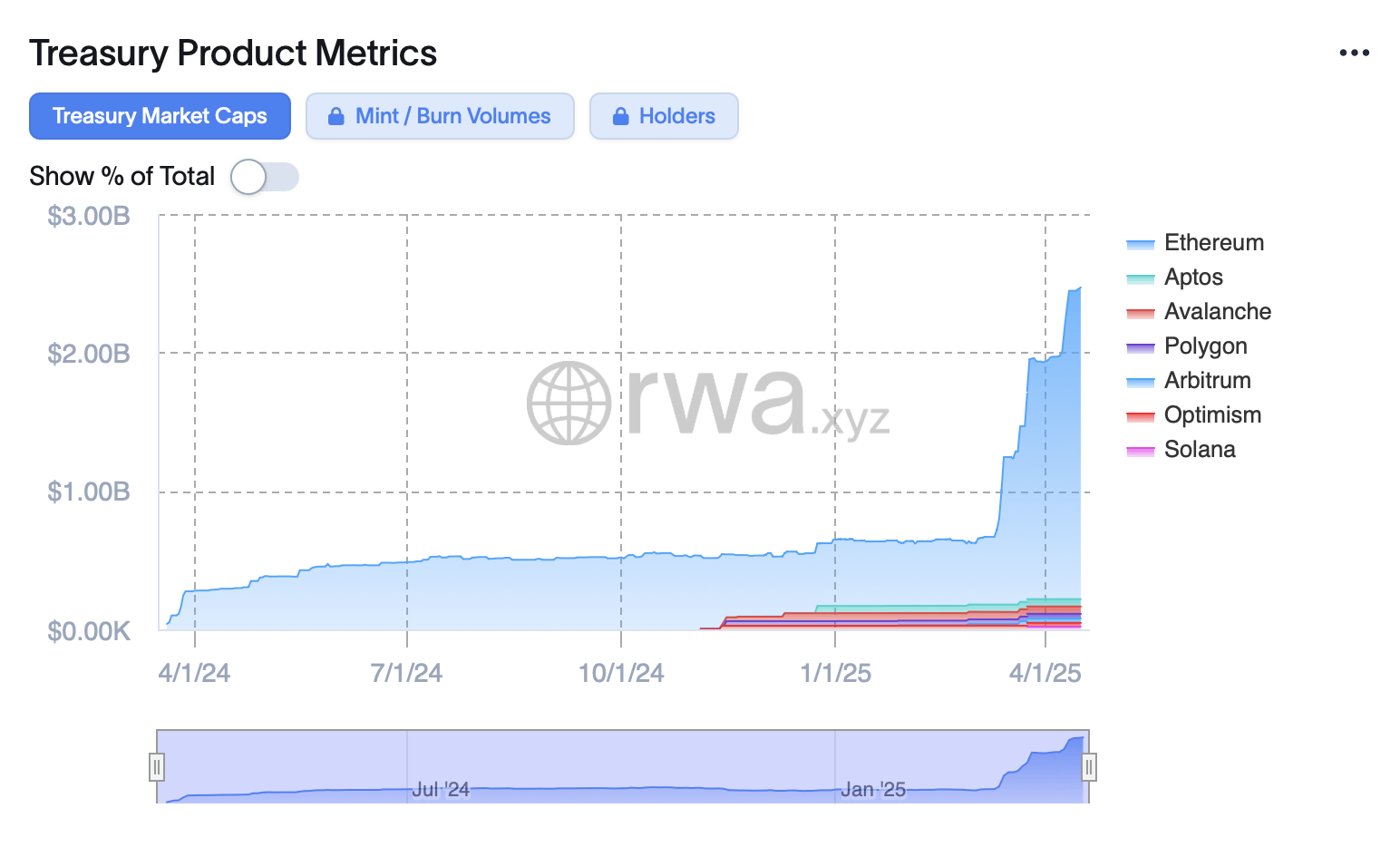

In 2025, tokenized Treasury bonds have seen extraordinary growth, pushed by substantial institutional issuances—most notably the Blackrock USD Institutional Digital Liquidity Fund (BUIDL) and several other friends. Throughout a seven‑day span, the tokenized Treasury market rose from $5.49 billion to $5.94 billion, putting it simply $60 million shy of the $6 billion threshold.

The Blackrock USD Institutional Digital Liquidity Fund (BUIDL).

Rwa.xyz stats present that BUIDL stays the most important fund by market capitalization at $2.469 billion, up $303 million from $2.166 billion every week earlier. It’s adopted by Franklin Templeton’s Onchain U.S. Authorities Cash Fund, dubbed BENJI, which stands at $702 million. BENJI shed $4 million from $706 million seven days in the past. Ondo’s USDY fund held comparatively regular, transferring from $586 million to $585.9 million over the identical interval.

Hashnote’s USYC slipped once more, falling from $557 million on Apr. 10 to $524 million right now. In the meantime, USTB, OUSG, JTRSY, TBILL and USTBL all logged minor positive factors over the week. The tokenized Treasury bond sector has grown exponentially since early 2023, and it’s projected to achieve $1 trillion by 2028.

A key benefit of tokenized Treasuries is that onchain settlement by way of blockchain cuts commerce finality from days to minutes, mitigating counterparty and operational dangers. Thus far in 2025, the tokenized Treasury bond market has grown by 48.13%. The speedy embrace of tokenized Treasuries indicators a broader shift in fixed-income markets, as digital infrastructure more and more meets institutional demand.

If effectivity positive factors and assured liquidity suppliers persist, blockchain-based authorities bond buying and selling might redefine conventional settlement norms and entice an ideal deal extra of recent capital this 12 months. BUIDL has additionally infiltrated the dollar-pegged token enviornment because it holds the sixth-largest market cap right now, in accordance with Defillama’s stablecoin ecosystem metrics.