Company bitcoin adoption is exploding as establishments pour billions into BTC, signaling the tip of altcoin hype and the rise of crypto’s fundamental-driven future.

‘No Extra Alt Season’: Bitwise CIO Declares Finish of Hypothesis Period in Crypto

Bitwise Asset Administration executives are signaling a shift within the crypto panorama, as their newly launched Company Bitcoin Adoption report for Q1 2025 highlights accelerating institutional curiosity. CEO Hunter Horsley posted on social media platform X this week:

By the tip of 2025 persons are going to be shocked by what number of well-known tradfi establishments have crypto merchandise and choices. The work is underway. The mainstream period has began.

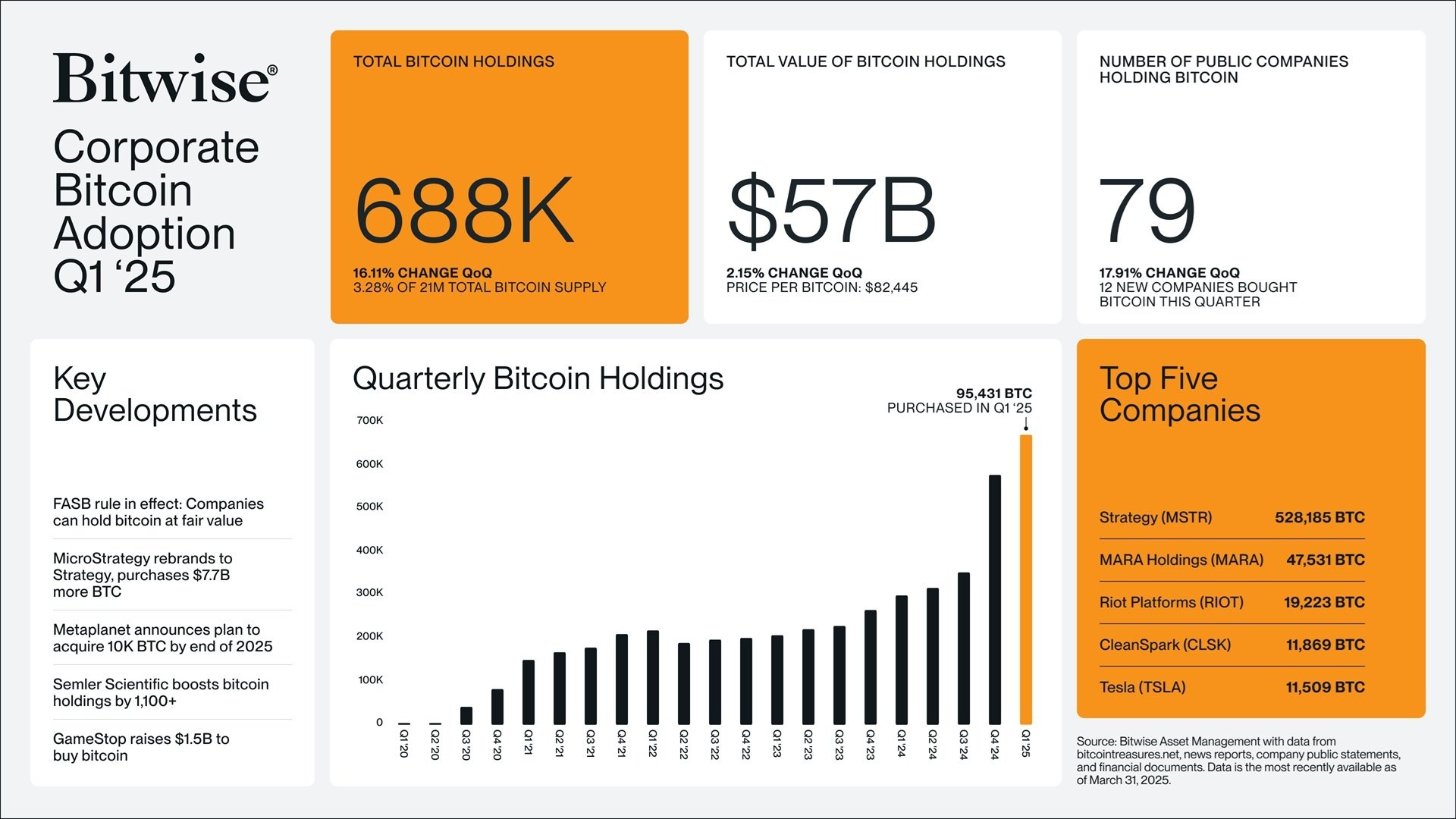

The report reveals that public corporations collectively held 688,000 bitcoin within the first quarter, representing a 16.11% enhance over the earlier quarter and accounting for 3.28% of bitcoin’s mounted 21 million coin provide. The full worth of those holdings has climbed to $57 billion, based mostly on a per-bitcoin worth of $82,445. The variety of corporations taking part grew to 79, as 12 new companies added bitcoin to their steadiness sheets. In whole, 95,431 BTC had been bought in Q1, marking the most important single-quarter acquisition to this point. Technique, aka Microstrategy, stays the highest holder, adopted by MARA Holdings. Riot Platforms, Cleanspark, and Tesla spherical out the highest 5 company holders.

The expansion coincides with favorable regulatory developments. The U.S. Monetary Accounting Requirements Board’s determination to permit bitcoin to be reported at truthful worth has opened the door for extra clear accounting, which some imagine reduces danger for public companies. Gamestop is elevating $1.5 billion to purchase bitcoin, Semler Scientific added BTC to its treasury, and Metaplanet unveiled plans to accumulate 10,000 BTC by the tip of the yr. Whereas skeptics proceed to flag volatility and regulatory uncertainty, advocates level to rising institutional buy-in and rule modifications that counsel a maturing market poised for long-term integration.

Echoing this momentum, Bitwise’s Chief Funding Officer Matt Hougan acknowledged on X this week:

We’re not entitled to an ‘alt season.’ That idea arose in an period when the first worth of crypto was speculative. We’ve entered into the elemental period of crypto, which implies extra dispersion in particular person asset returns.