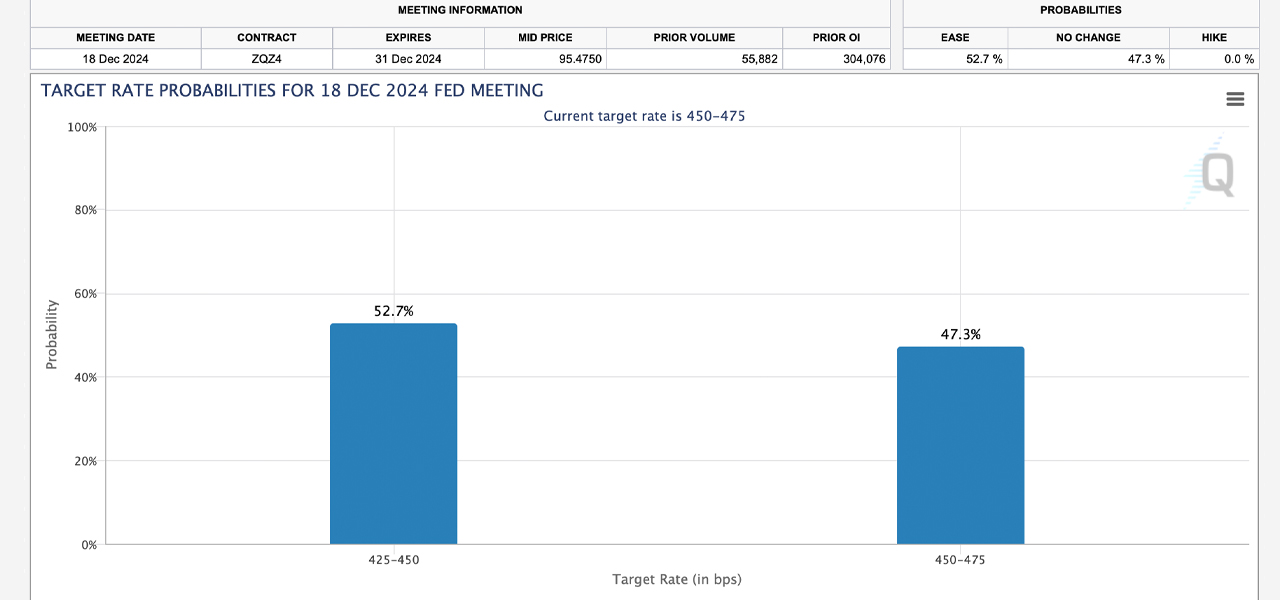

Primarily based on present information, 24 days earlier than the upcoming Federal Open Market Committee (FOMC) assembly, there’s a 52.7% chance of a quarter-point price minimize, in line with CME Group’s Fedwatch instrument.

Markets Sign Combined Messages Forward of FOMC Assembly

The U.S. Federal Reserve‘s federal funds price outlook for December stays a toss-up. The percentages of no price change and a modest 25 foundation factors discount are operating shut, however the quarter-point minimize barely leads. CME’s Fedwatch instrument, which leverages the pricing of 30-day Federal Funds futures contracts to foretell potential price shifts, locations the likelihood of a 25bps minimize at 52.7%.

CME Fedwatch instrument odds on Sunday, Nov. 24, 2024.

This instrument calculates possibilities by subtracting the futures contract value from 100, providing a market-driven perspective on anticipated rate of interest choices. In the meantime, the possibilities of no minimize are additionally important, sitting at 47.3%. Analysts proceed to carry combined views on whether or not the Federal Reserve will decrease charges in December.

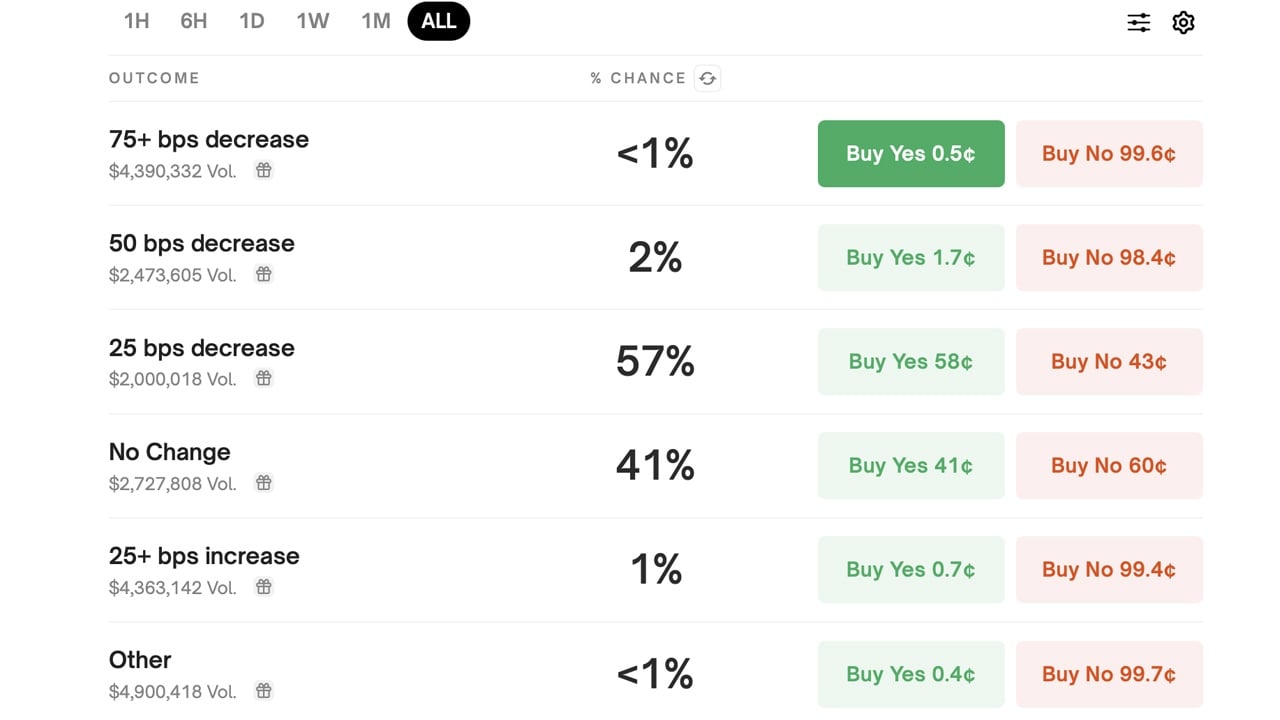

For example, Morningstar’s Preston Caldwell anticipates a 0.25% minimize, pointing to latest inflation metrics and broader financial circumstances. Then again, Nomura analysts predict a pause, citing robust financial alerts. Polymarket bettors mirror this divide, assigning 57% odds to a quarter-point discount. As of Nov. 24, Polymarket wagers have reached $20.85 million.

Polymarket odds on Sunday, Nov. 24, 2024.

Polymarket individuals additionally assign a 41% probability to no price adjustment, a slim 2% probability to a half-point minimize, and a mere 1% to a quarter-point hike on the Dec. 18 FOMC assembly. The evolving possibilities replicate a market grappling with conflicting financial alerts. As CME Group’s Fedwatch instrument and Polymarket information counsel a slight lean towards easing, the divergence in skilled opinions underscores the present uncertainty.