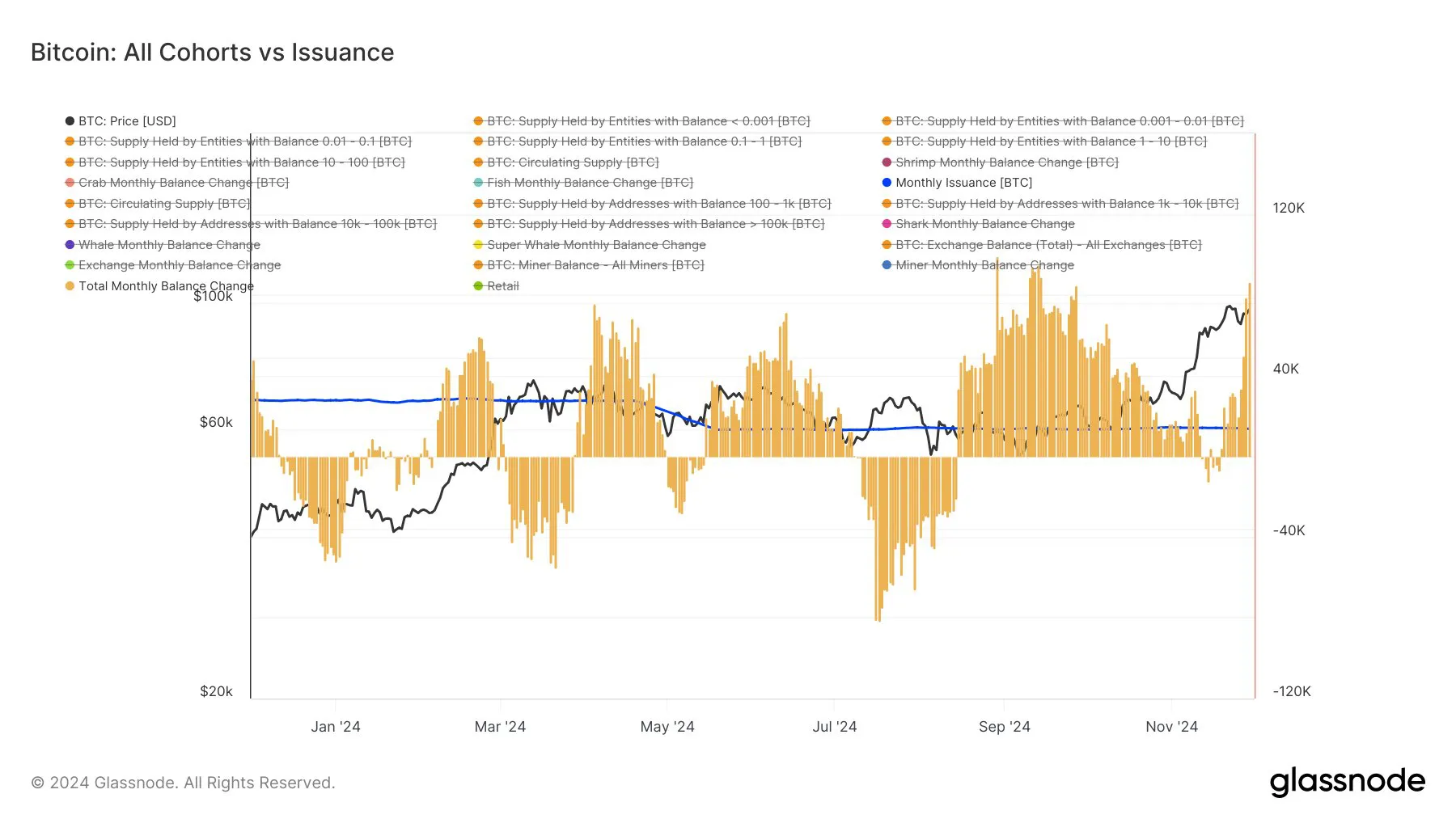

Crypto analyst James Van Straten believes that Bitcoin will cross $100,000 as lengthy the demand for the flagship continues to outstrip provide. Van Straten shared this view in a submit on X (previously Twitter), noting a web accumulation of 87,000 BTC over the past 30 days.

In response to the analyst, the return to accumulation is a superb signal, displaying that long-term holders (LTHs) promoting off the flagship that has been taking earnings have lastly slowed down. Based mostly on his evaluation, this sell-off has been the rationale behind Bitcoin’s wrestle to achieve $100,000.

Bitcoin noticed 87k web accumulation within the final 30 days (Supply: X/James Van Straten)

He mentioned:

“Any LTH that needed to take revenue close to 100k has just about performed so. On high of all of the STHs that capitulated on that 10% correction. If demand continues to outstrip provide, I don’t see what stops $BTC going by 100k.”

Van Straten’s view is shared by a number of market specialists, together with technical analyst Ali Martinez, who famous that the Bitcoin LTHs have booked earnings on the flagship asset’s value enhance. Nevertheless, he noticed that that is normal conduct in each bull market and warned towards getting bearish or shorting Bitcoin primarily based on that alone.

This cohort of holders’ selloff in November was the best since April. In response to CryptoQuant, LTHs offloaded 728,000 Bitcoin in November.

Whales again to accumulation mode

With the sell-offs now over, accumulation has returned, significantly amongst whales. Whales reportedly purchased round $1.5 billion value of Bitcoin over the last dip, making the most of the panic sell-offs by short-term holders (STHs) who despatched virtually $4 billion value of BTC to exchanges, promoting at losses.

STHs, who’re possible resellers, have been promoting off Bitcoin (BTC), presumably in anticipation of a value dip. Nevertheless, a number of analysts, together with Martinez, have noticed that Bitcoin tends to maneuver towards market expectations.

Indicators of a return to accumulation are evident within the outflows of BTC from exchanges, with Binance seeing traditionally low BTC inflows from different exchanges and Coinbase Prime recording the best Bitcoin influx since July 31.

CryptoQuant head of analysis Julio Moreno additionally noticed that Bitcoin demand development is accelerating once more, noting that demand enlargement will enhance Bitcoin’s value.

Historic knowledge reveals Bitcoin will cross $100k earlier than the 12 months ends

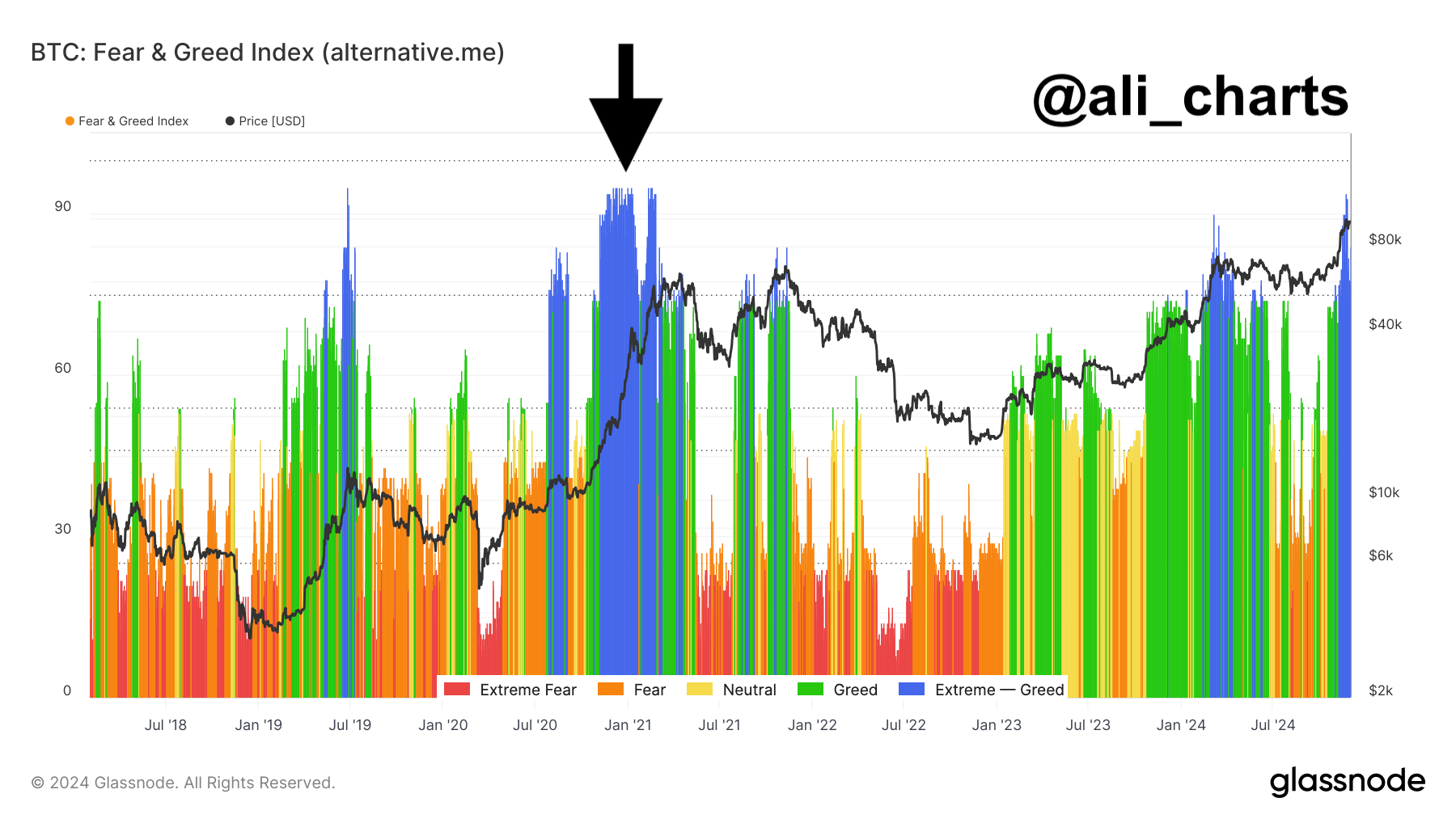

In the meantime, present sentiments recommend market contributors are very bullish on the asset. The Worry & Greed index is at the moment at Excessive Greed, the identical sentiment as over the last bull market, the place Bitcoin went from $15,000 to $57,000.

Bitcoin Worry & Greed Index is at Excessive Greed – Ali Martinez through glassnode

Moreover, Bitcoin’s historic efficiency within the final two Decembers after the US elections has been constructive, gaining 30% and 46% in 2016 and 2020, respectively. If the identical occurs now, Bitcoin might end 2024 buying and selling between $125,000 and $140,000.

Regardless of the flagship asset gaining over 35% in November, on-chain knowledge recommend it nonetheless has a lot room to run. Santiment knowledge reveals that Bitcoin’s Imply Greenback Invested Age has been dropping, with the typical age of Bitcoin sitting in wallets now all the way down to 466 days per coin. The Santiment analysts declare that steady decline on this metric is proof that we’re nonetheless within the bull market.

In the meantime, Cryptoquant analysts additionally consider the present bull market is nowhere close to the highest. They level to the Bitcoin worth held by new buyers, which is at the moment round 50%, far decrease than the earlier market, which tops at over 90% in 2017 and over 80% in 2021.

The analysts wrote:

“Bitcoin value tops sometimes happen when new buyers enter the market to purchase at extraordinarily excessive costs, which causes them to carry a big proportion of the overall worth invested.”

Moreover, retail exercise on this cycle has been comparatively low. Retailers have really lowered their holdings by 41,000 BTC since October, whilst whales elevated theirs by 130,000 BTC throughout the identical interval. This absence of excessive retail exercise means there isn’t any worry of lacking out (FOMO), because the market high comes when retail begins shopping for aggressively.

Past that, the Bull-Bear Market Cycle indicator is at the moment within the bull part and has not crossed to the overheated bull part, which often signifies a high. However, the Bitcoin high value goal primarily based on realized value valuation is at the moment at $146,000. Traditionally, this metric has marked the highest of the earlier Bitcoin cycles.

A Step-By-Step System To Launching Your Web3 Profession and Touchdown Excessive-Paying Crypto Jobs in 90 Days.