The full worth of real-world property (RWAs) on the Arbitrum community has surged over 1,000-fold because the begin of 2024.

From a modest $100,000 to $200,000 in early January final 12 months, Arbitrum now hosts greater than $200 million in tokenized RWAs. This displays some of the explosive development trajectories in decentralized finance (DeFi) this 12 months.

RWA Complete Worth on Arbitrum Will increase 1,000X

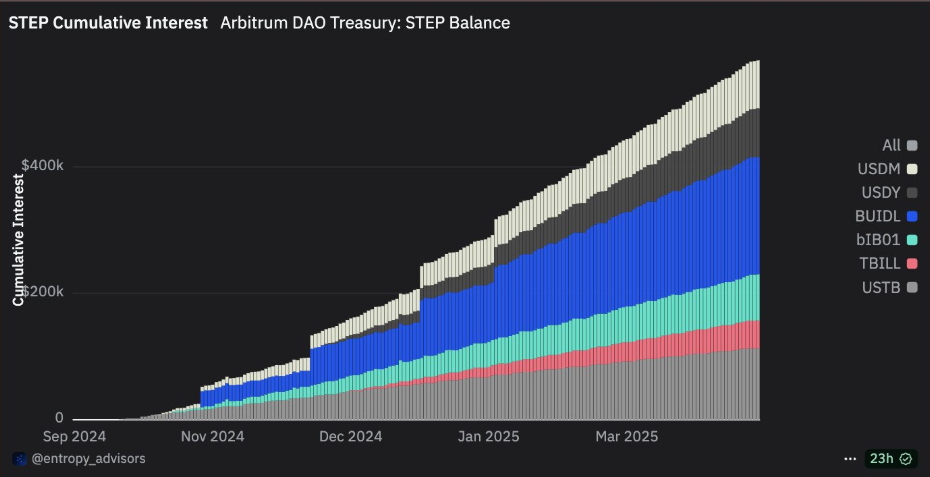

This exponential growth is essentially attributed to Arbitrum DAO’s Steady Treasury Endowment Program (STEP), which is at the moment in its 2.0 part. This system allotted 85 million ARB tokens to assist steady, liquid, yield-generating RWAs.

“The DAO simply authorized 35M ARB for RWAs through STEP 2.0. This brings the full RWA investments from the DAO treasury to 85M ARB, one of many largest DAO-led RWA allocations in Web3,” Arbitrum stated in February.

The technique goals to scale back the DAO’s publicity to unstable native crypto property and assist construct a extra resilient treasury, and it seems to be yielding outcomes.

Tokenization on Arbitrum. Supply: The Studying Capsule on X

US Treasuries dominate Arbitrum’s RWA ecosystem, making up 97% of the sector. Franklin Templeton’s BENJI leads the pack, which holds a 36% market share, adopted by SPIKO’s European treasuries, accounting for 18%.

This diversification past US-centric devices is a wholesome signal for world institutional engagement with Arbitrum.

“The eco welcomes world diversification past US devices,” The Studying Capsule remarked.

New entrants like Dinari have additionally added to the ecosystem’s momentum, providing tokenized variations of conventional securities. These embody shares, ETFs (exchange-traded funds), and REITs through its dShares platform.

Greater than 18 tokenized RWA merchandise stay on Arbitrum, masking numerous asset lessons from bonds to actual property. Arbitrum itself highlighted this institutional inflow on X (Twitter)

“RWA and Stablecoin adoption on Arbitrum has been monumental! A number of the largest establishments are bringing their tokenized property to the land of liquidity with $4.7 billion in Stablecoins and over $214 million in RWAs already onchain,” the community acknowledged.

Groups like Securitize, DigiFT, and SPIKO are tokenizing every part from sovereign debt to actual property portfolios, signaling the early formation of a brand new monetary substrate.

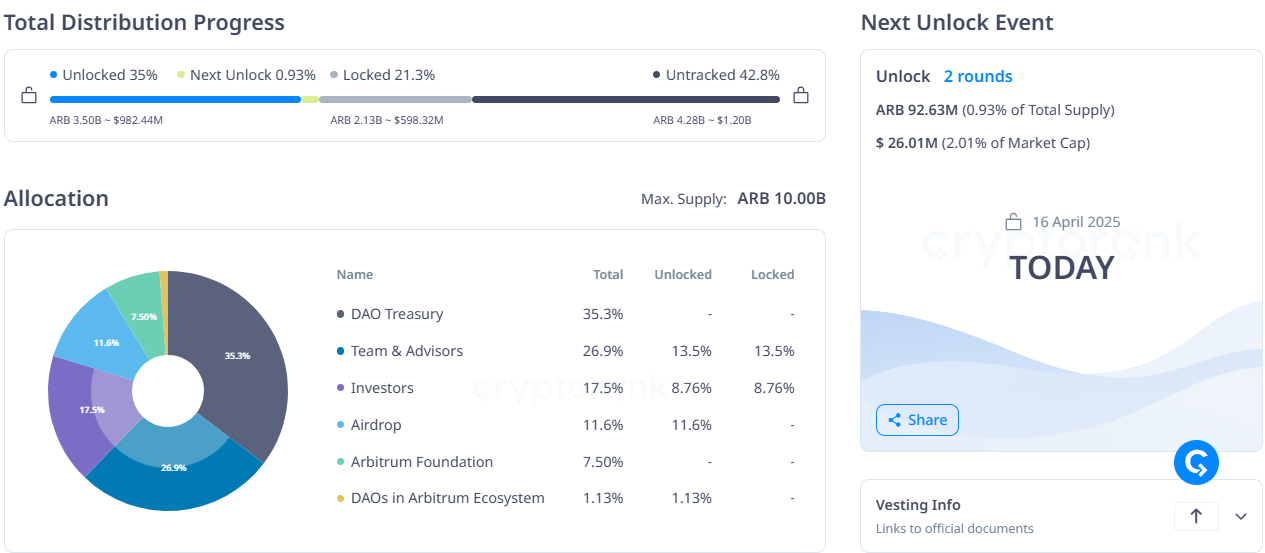

But, regardless of the robust ecosystem growth, ARB, the community’s native token, is down 88% from its all-time excessive.

Arbitrum (ARB) Value Efficiency. Supply: BeInCrypto

Additional draw back strain looms, with a 92.63 million ARB token unlock imminent. With solely 46% of the full provide at the moment in circulation, considerations about dilution and lack of direct token accrual from RWA development stay key market overhangs.

Arbitrum (ARB) Token Unlocks. Supply: Cryptorank.io

Tokenized RWA Cross $11 Billion, Ethereum Dominates Onchain Finance Frontier

Past Arbitrum, the broader real-world asset sector has quietly turn out to be some of the important traits in crypto, even when it doesn’t dominate headlines.

In line with DeFiLlama, on-chain RWAs have surpassed $11.169 billion in complete worth locked, up 2.5X over the previous 12 months.

RWA rankings TVL. Supply: DefiLlama

Tokenized US Treasuries and tokenized gold are the engines behind this growth. BlackRock’s BUIDL fund now holds over $2.38 billion in tokenized Treasuries alone. In the meantime, blockchain-based gold property, pushed by each market demand and rising metallic costs, have crossed $1.2 billion, based on a current BeInCrypto report.

Ethereum stays within the frontline, internet hosting roughly 80% of all on-chain RWAs. As TradFi giants search programmable publicity to greenback yields and actual property, Ethereum affords the infrastructure and liquidity wanted to bridge capital markets with blockchain rails.

“The highest RWA protocols aren’t chasing crypto narratives. They’re providing one thing TradFi understands: yield, greenback publicity, and gold. This isn’t the way forward for DeFi. It’s the way forward for finance,” DeFi analyst Patrick Scott noticed.

Builders level out that adoption is already deeply embedded in on-chain-native purposes like Pendle, Morpho, Frax, and numerous automated market makers (AMMs) and staking layers. The “actual yield” thesis has arrived, coded into the brand new monetary system’s base layer.

“The TradFi narrative is sweet, however the adoption up to now is on-chain-native,” DeFi builder Artem Tolkachev famous.

Whereas flashy DeFi experiments typically mimic casinos, RWAs present that gradual, steady, and scalable wins the race.

The subsequent frontier lies in bettering entry, liquidity, and incentives, notably on non-Ethereum chains like Arbitrum, the place the technical groundwork is powerful, however market confidence stays in flux.

Tokenized RWAs is probably not the loudest narrative in crypto, however they’re turning into its most consequential.

“Onchain RWAs are quietly turning into the spine of future finance, not hype, simply actual worth TradFi will get: yield, {dollars}, and gold,” Validatus.com quipped.