Binance retains drawing larger stablecoin deposits, reaching a report stage of ERC-20 reserves. The trade leads leveraged buying and selling, the place stablecoins are key to constructing new positions.

Binance stays the chief for stablecoin reserves, as most merchants picked the market operator as their most important buying and selling venue. Inflows of stablecoins boosted spinoff markets, establishing the stage for peak obtainable liquidity.

The inflows of stablecoins into Binance went vertical within the final months of 2024, however slower progress continued within the first quarter of 2024. Regardless of the market slowdown, the availability of stablecoins stays excessive, and the property are ready on the sidelines for a chance to commerce. Stablecoins expanded as a option to decrease danger. Throughout this market cycle, the availability of stablecoins is rising, even because the crypto market suffers a 30% drawdown from the height.

Stablecoins on Binance expanded to ranges above the 2021 bull market, primarily based on demand for spinoff buying and selling positions. | Supply: Cryptoquant

The stablecoin inflows principally reached spinoff exchanges, with the availability peaking at over 47B tokens. Spot exchanges attracted a a lot smaller share of stablecoin turnover, as a lot of the exercise relied on leveraged positions for BTC and ETH.

Stablecoin inflows increase spinoff buying and selling

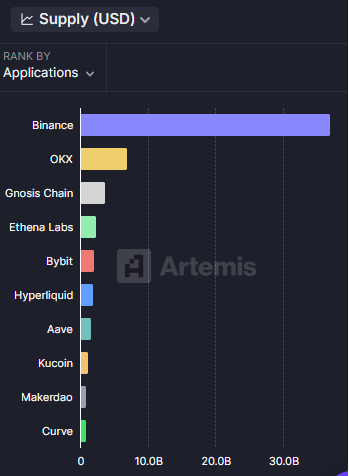

The entire provide of stablecoins on exchanges reached 45B tokens of assorted varieties, with USDT and USDC nonetheless the commonest. Binance carries over 33B tokens, together with its centrally managed FDUSD. Binance has a complete of $3.38B in USDC, $29.4B in USDT, and one other $1.5B in FDUSD. The trade additionally carries probably the most energetic buying and selling pair for USDT, with $1.67B in 24-hour volumes.

Binance buying and selling is the primary use case for stablecoins, with as much as $33B inflows from USDT, USDC, FDUSD and different main dollar-based tokens. | Supply: Artemis

The trade displays regional limitations, boosting the utilization of regulated USDC tokens within the Euro Space, whereas discontinuing USDT merchandise. The shift has not affected the final influx of tokens. Binance nonetheless achieves over $17B in each day buying and selling volumes, boosted by the worth of the native BNB token and a number of stablecoin markets.

The market can be carrying 5.34% of all USDC buying and selling, having probably the most energetic buying and selling pair in opposition to BTC. The current influx of stablecoins principally boosts the liquidity of spinoff BTC markets, in addition to spot markets. The influx to centralized exchanges follows the final growth of stablecoins to over 229B tokens, relying on which property are counted. A lot of the stablecoins are dollar-pegged, with round $2B in different currencies.

Stablecoins are considered one of Binance’s key reserve property. The trade carries over $133B in complete property, primarily based on its transparency report. USDT reserves are at 104% of person claims. The USDC market is much more over-supplied, with 161% of person claims. The surplus reserves develop with charges, liquidation charges, and different user-based funds.

Binance additionally stays the main centralized trade by property, carrying probably the most vital share of spinoff open curiosity.

BNB Good Chain carries 7B in stablecoins

The decentralized Binance ecosystem carries over 7B in bridged or native stablecoins. The chain is the fourth-largest community with a rising stablecoin provide.

Over 53% of all stablecoins are nonetheless on Ethereum. ERC-20 stablecoins are additionally those most frequently deposited into Binance. TRON carries over 28% of the full provide, whereas Solana has over 10B in USDC, or 5.4% of the full provide.

The three main stablecoins, USDT, USDC, and FDUSD on BNB Chain make up round 5.9B of the availability, up over 2.2B previously 12 months. The remaining steadiness is for different smaller bridged stablecoins.

BNB Good Chain is used for easy transfers and funds by means of stablecoins. USDT transfers make greater than $4.5B, round $500M strikes by means of USDC, and FDUSD has each day transfers of round $60M. A lot of the senders on BNB Good Chain favor USDT, the primary supply of liquidity for funds or decentralized swaps.

For now, the expansion of the BNB Good Chain decentralized ecosystem lags behind the success of Binance’s spinoff market.