China’s latest directive for its state-owned banks to lower reliance on the US greenback has amplified a rising pattern amongst international locations looking for options to the dominant reserve property. In some cases, Bitcoin has emerged as a viable competitor.

BeInCrypto spoke with specialists from VanEck, CoinGecko, Gate.io, HashKey Analysis, and Humanity Protocol to grasp Bitcoin’s rise as an alternative choice to the US greenback and its potential for better affect in international geopolitics.

The Push for De-Dollarization

For the reason that 2008 international monetary disaster, China has regularly lowered its reliance on the US greenback. The Individuals’s Financial institution of China (PBOC) has now instructed state-owned banks to scale back greenback purchases amid the heightened commerce battle with US President Donald Trump.

China is amongst many countries looking for to minimize its dependence on the greenback. Russia, like its southern neighbor, has obtained an rising variety of Western sanctions– particularly following its invasion of Ukraine.

The USA, the European Union, the UK, and different allies imposed unprecedented worldwide sanctions on Russia, focusing on its central financial institution and main monetary establishments and limiting entry to the Society for Worldwide Interbank Monetary Telecommunication (SWIFT) for some monetary establishments.

In response, Russia halted buying and selling of US {dollars} and euros on the Moscow Inventory Alternate (MOEX). Not too long ago, BeInCrypto additionally reported that Russia has been quietly utilizing Bitcoin for worldwide commerce to bypass sanctions.

Moreover, Rosneft, a significant Russian commodities producer, has issued RMB-denominated bonds, indicating a shift in the direction of RBM, the Chinese language foreign money, and a transfer away from Western currencies as a consequence of sanctions.

This international shift away from predominant reserve currencies shouldn’t be restricted to international locations affected by Western sanctions. Aiming to extend the Rupee’s worldwide use, India has secured agreements for oil purchases in Indian Rupee (INR) and commerce with Malaysia in INR.

The nation has additionally pursued creating an area foreign money settlement system with 9 different central banks.

As extra nations contemplate options to the US greenback’s dominance, Bitcoin has emerged as a useful financial instrument that may serve in its place reserve asset.

Why Nations Are Turning to Bitcoin for Commerce Independence

Curiosity in utilizing cryptocurrency for functions past worldwide commerce has additionally grown. In a notable improvement, China and Russia have reportedly settled some vitality transactions utilizing Bitcoin and different digital property.

“Sovereign adoption of Bitcoin is accelerating this yr as demand grows for impartial funds rails that may circumvent USD sanctions,” Matthew Sigel, Head of Digital Belongings Analysis at VanEck, informed BeInCrypto.

Two weeks in the past, France’s Minister of Digital Affairs proposed utilizing the excess manufacturing of EDF, the nation’s state-owned vitality big, to mine Bitcoin.

Final week, Pakistan introduced related plans to allocate a part of its surplus electrical energy to Bitcoin mining and AI knowledge facilities.

In the meantime, on April 10, New Hampshire’s Home handed HB302, a Bitcoin reserve invoice, by a 192-179 vote, sending it to the Senate. This improvement makes New Hampshire the fourth state, after Arizona, Texas, and Oklahoma, to have such a invoice cross a legislative chamber.

If HB302 is accredited by the Senate and signed into legislation, the state treasurer might make investments as much as 10% of the overall fund and different approved funds in treasured metals and particular digital property like Bitcoin.

Based on trade specialists, that is solely the start.

VanEck Predicts Bitcoin to Turn out to be a Future Reserve Asset

Sigel predicts Bitcoin will develop into a key medium of change by 2025 and, in the end, one of many world’s reserve currencies.

His forecasts recommend Bitcoin might settle 10% of worldwide worldwide commerce and 5% of worldwide home commerce. This situation would result in central banks holding 2.5% of their property in BTC.

Based on him, China’s latest de-dollarization will immediate different nations to comply with go well with and reduce their reliance on the US greenback.

“China’s de-dollarization efforts are already having second- and third-order results that create alternatives for various property like Bitcoin. When the world’s second-largest economic system actively reduces its publicity to US Treasuries and promotes cross-border commerce in yuan or by mechanisms just like the mBridge venture, it indicators to different nations—particularly these with strained ties to the West—that the greenback is not the one recreation on the town,” Sigel mentioned.

For Zhong Yang Chan, Head of Analysis at CoinGecko, these efforts might show catastrophic for the US’ dominance.

“Broader de-dollarization efforts by China, or different main economies, will threaten the standing of the greenback’s international reserve foreign money standing. This might have [a] profound affect on the US and its economic system, as this could result in nations decreasing their holdings of US treasuries, which the US depends on to finance its nationwide debt,” he informed BeInCrypto.

Nonetheless, the power of the US greenback and different dominant currencies has already proven indicators of weakening.

A Normal Wave of Foreign money Decline

Sigel’s analysis exhibits that the 4 strongest international currencies—the US greenback, Japanese yen, British pound, and European euro—have misplaced worth over time, significantly in cross-border funds.

The decline of those currencies creates a void the place Bitcoin can acquire traction as a key various for worldwide commerce settlements.

“This shift isn’t purely about selling the yuan. It’s additionally about minimizing vulnerability to US sanctions and the politicization of cost rails like SWIFT. That opens the door for impartial, non-sovereign property—particularly these which can be digitally native, decentralized, and liquid,” Sigel added.

This lack of nationwide allegiance additionally units Bitcoin aside from conventional currencies.

Bitcoin’s Enchantment: A Non-Sovereign Various

In contrast to fiat cash or central financial institution digital currencies (CBDCs), Bitcoin doesn’t reply to anyone nation, which makes it interesting to some international locations.

For Terence Kwok, CEO and Founding father of Humanity Protocol, latest geopolitical tensions have heightened this perception.

“Belief in conventional monetary infrastructure is eroded throughout geopolitical standoffs. Bitcoin, with its clear ledger and decentralized governance, provides a compelling various for worth storage and peer-to-peer settlement, particularly the place impartial, non-sovereign choices are preferable. In that sense, geopolitical stress can inadvertently catalyze innovation and adoption in decentralized finance,” Kwok informed BeInCrypto.

As a result of Bitcoin’s provide is proscribed, it gives a safer choice for nations whose native foreign money loses worth by inflation.

“Bitcoin, due to its shortage and decentralized nature, is utterly totally different from the centralized fiat foreign money system and is not affected by modifications in financial coverage. Subsequently, it can be used as a hedging instrument to cope with the depreciation of fiat currencies or geopolitical dangers. Particularly in the context of rising inflation or challenges to the dominance of the US greenback, allocating some Bitcoin can assist diversify funding dangers and supply traders with extra strong asset safety,” Kevin Guo, Director of HashKey Analysis, added to the dialog.

For these similar causes, specialists don’t count on Bitcoin to exchange fiat currencies totally however quite present a significant various for sure instances.

A Substitute or an Various?

Whereas Bitcoin provides a number of benefits over conventional currencies, Gate.io’s Kevin Lee doesn’t foresee its eventual adoption inflicting a whole overhaul of the foreign money reserve system.

“Bitcoin is more and more being acknowledged for its distinctive technological traits, such as mounted provide, decentralized governance, and borderless accessibility. Nonetheless, I don’t imagine it is meant to substitute [the] conventional fiat system, however quite an various to it for varied enterprise use instances, significantly for diversification and long-term worth preservation methods,” Lee informed BeInCrypto.

Guo agreed with this final level, including that Bitcoin can be extra interesting case-by-case.

“Nations might selectively undertake Bitcoin based mostly on their personal financial wants, however its software areas are primarily concentrated in area of interest markets such as cross-border remittances, circumventing sanctions, and hedging inflation,” he mentioned.

Bitcoin should first tackle a number of of its shortcomings earlier than it could actually develop into actually aggressive in the long term.

What Challenges Nonetheless Face Bitcoin’s Wider Adoption?

Resulting from its comparatively new standing and lack of full improvement, Bitcoin suffers from shortcomings that forestall mass adoption.

“As with any rising asset class, Bitcoin faces inherent challenges, together with market volatility, evolving regulatory frameworks, infrastructure maturity, and cyclical hypes. These elements might affect its short-term adoption tempo,” Lee defined.

To that time, Kwok added:

“Bitcoin’s value swings make it much less viable for day-to-day transactions or as a main reserve asset in the present day. Moreover, if main powers implement strict capital controls or implement hostile crypto insurance policies, it might gradual down adoption regardless of broader macro tendencies in its favor.”

In the meantime, there’s the aggressive benefit of stablecoins, which at the moment dominate cross-border funds.

“Crypto property represented by US greenback stablecoins (such as USDT and USDC) are quickly occupying the foremost market of cross-border funds and blockchain transactions. Stablecoins have low volatility due to their peg (largely to the US greenback), making them the most popular instrument for worldwide transactions and fund transfers, whereas Bitcoin is extra usually used as a retailer of worth or speculative asset,” Guo, Director of HashKey Analysis informed BeInCrypto.

The Bitcoin community has additionally skilled issues which have exacerbated international demand.

Bitcoin Community Below Pressure

For the reason that starting of the yr, Bitcoin has skilled a major slowdown in community exercise, regardless of the asset’s bullish efficiency.

“The utilization charge of the Bitcoin community is declining, and its on-chain transaction charges have dropped to the lowest level since 2012, indicating that community exercise is regularly lowering,” Guo mentioned.

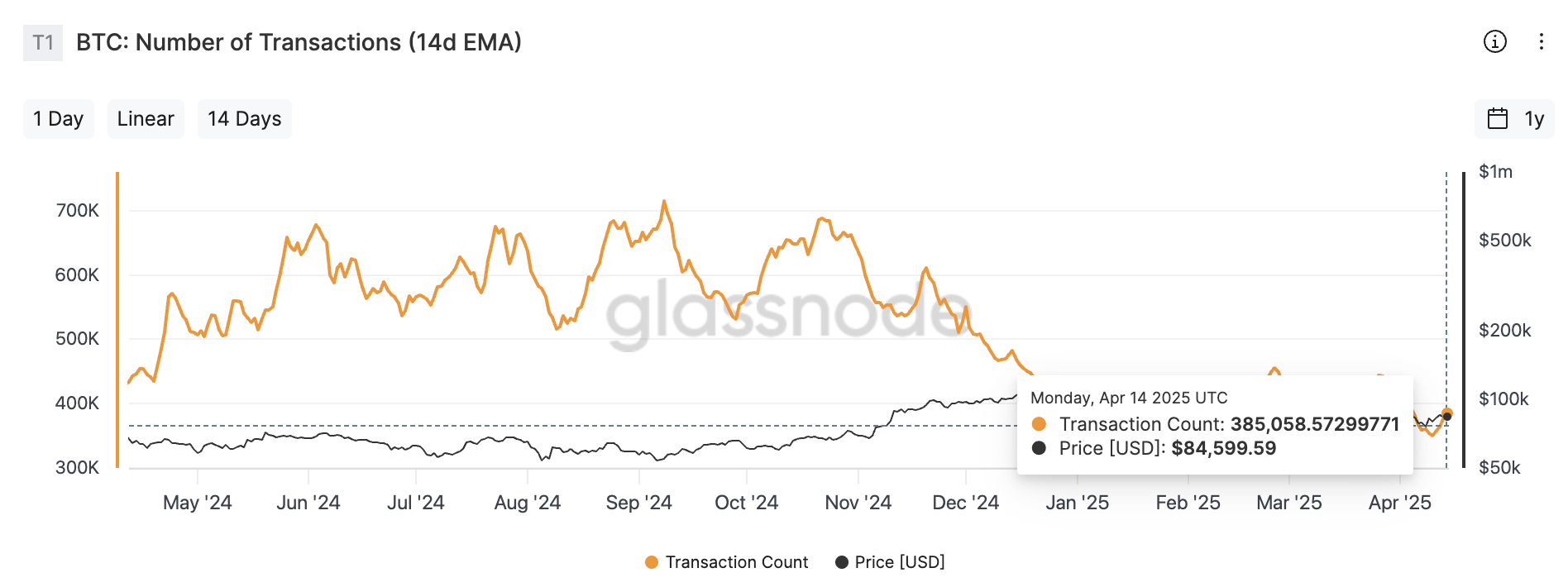

Latest knowledge confirms this. The variety of Bitcoin transactions has fallen considerably because the final quarter of 2024. Bitcoin registered over 610,684 transactions in November, however that quantity dropped to 376,369 in April, in accordance with Glassnode knowledge.

BTC variety of transactions. Supply: Glassnode.

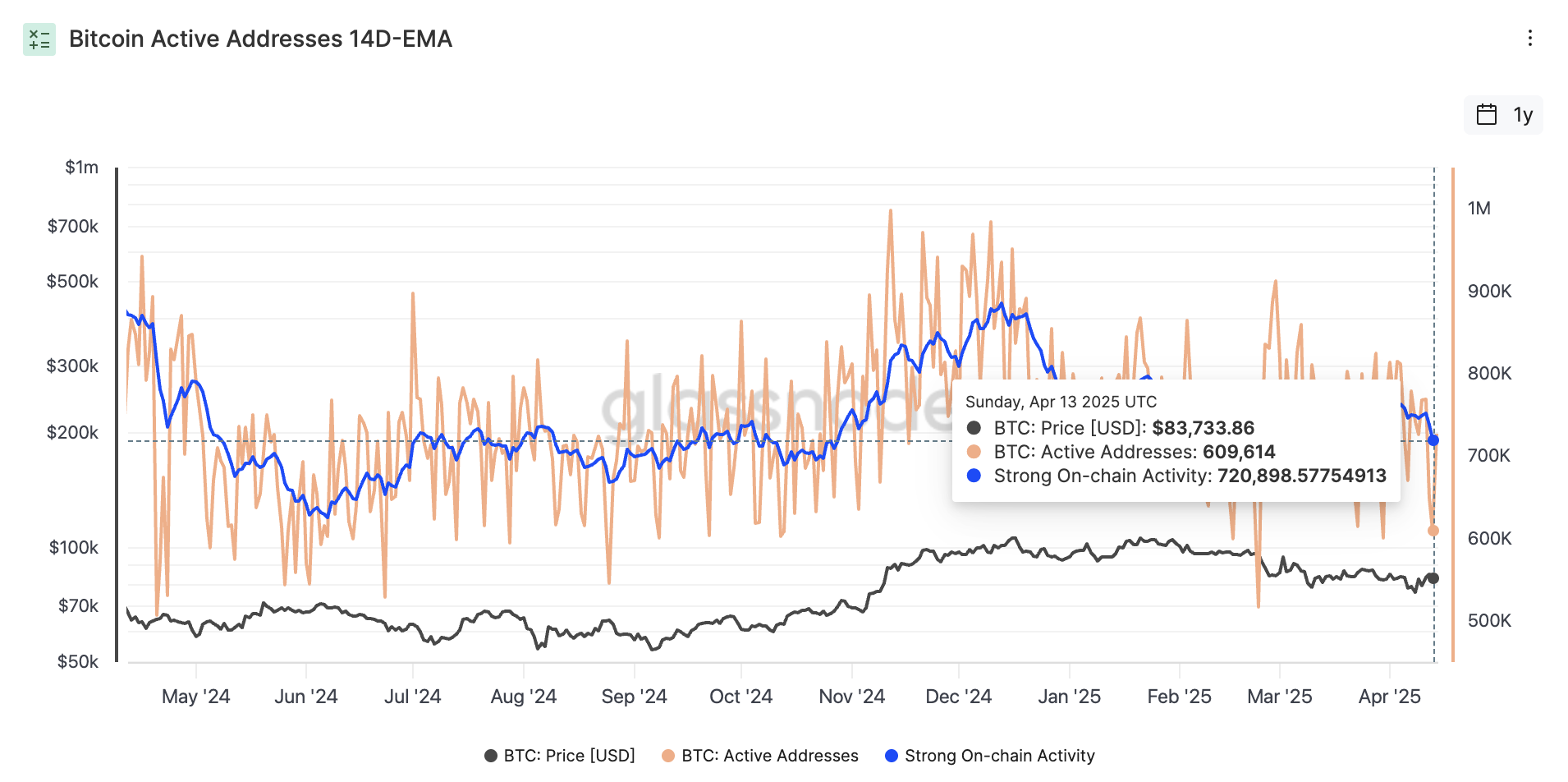

The variety of Bitcoin lively addresses paints an analogous image. In December, the community had practically 891,623 addresses. Right now, that quantity stands at 609,614.

Bitcoin variety of lively addresses. Supply: Glassnode.

This decline suggests lowered demand for its blockchain when it comes to transactions, utilization, and adoption, that means fewer individuals are actively utilizing it for transfers, enterprise, or Bitcoin-based purposes.

In the meantime, the Bitcoin community should additionally guarantee its infrastructure is environment friendly sufficient to satisfy international demand.

Can Bitcoin Scale for World Use?

In 2018, Lightning Labs launched the Lightning Community to scale back the price and time required for cryptocurrency transactions. At present, the Bitcoin community can solely deal with round seven transactions per second, whereas Visa, for instance, handles round 65,000.

“If growth options (such as the Lightning Community) fail to develop into in style, Bitcoin’s potential to course of solely about 7 transactions per second will be tough to help international demand. At the similar time, as Bitcoin block rewards are regularly halved, the decline in miners’ revenue might threaten the long-term safety of the community,” Guo, Director of HashKey Analysis defined.

Whereas the confluence of geopolitical shifts and Bitcoin’s inherent traits undeniably create an area for its elevated adoption as an alternative choice to the US greenback and even a possible reserve asset, vital hurdles stay.

Attaining mainstream Bitcoin adoption hinges on overcoming scalability, volatility, regulatory hurdles, stablecoin competitors, and making certain community safety.

The unfolding panorama suggests Bitcoin will carve out an essential position within the international monetary system, although a whole overhaul of established norms appears unlikely within the instant future.