The main digital asset continued its ascent as corporations akin to stablecoin behemoth Tether revealed billions price of BTC on the books.

BTC Reclaims $85k As Bullish Companies Go Purchasing

The world’s largest stablecoin agency revealed on April 1 that it had acquired 8,888 BTC in the course of the first quarter of 2025 and now holds almost $8 billion price of bitcoin. On the identical day, Japanese bitcoin treasury agency Metaplanet introduced a 696 BTC buy, signaling to markets that institutional curiosity within the cryptocurrency is simply growing.

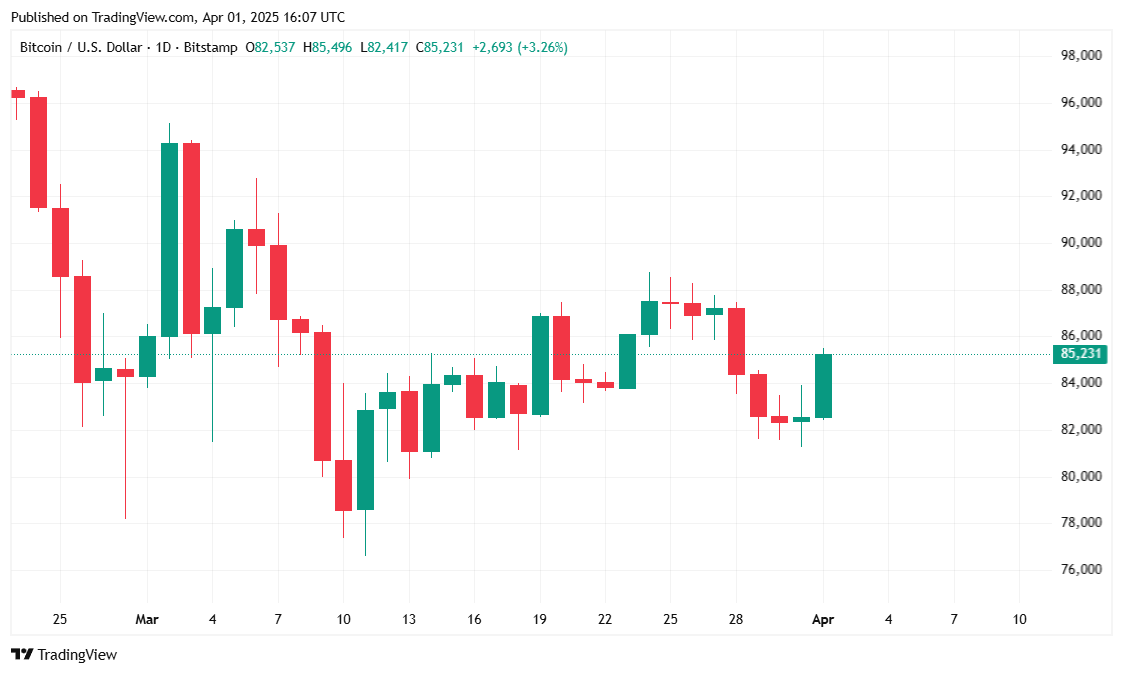

On the time of reporting, bitcoin was buying and selling at $85,240.06, marking a 2.01% improve since yesterday, though it stays down 2.86% over the previous week. The digital asset traded inside a 24-hour vary of $82,263.41 to $85,487.37, whereas its 24-hour buying and selling quantity climbed to $27.45 billion, up 0.37%.

( BTC value / Buying and selling View)

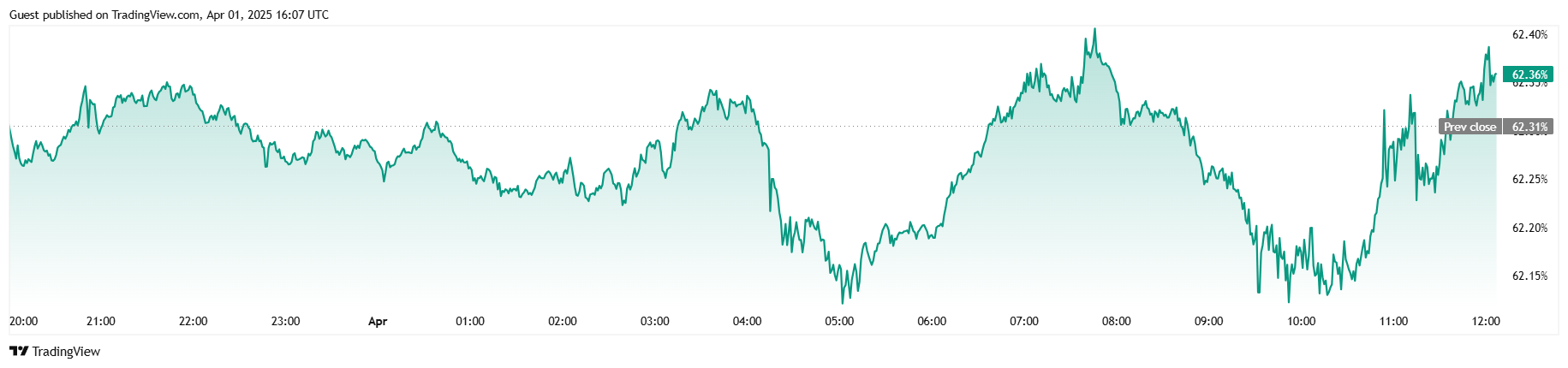

Market capitalization for bitcoin now stands at $1.69 trillion, up 2.22% from yesterday, reflecting renewed investor curiosity. Regardless of this, bitcoin’s dominance dipped barely, resting at 62.37%, a minor decline of 0.09% over 24 hours. In the meantime, whole BTC futures open curiosity reached $55.38 billion, exhibiting a 3.03% improve as merchants maintained leveraged positions forward of key market strikes.

( BTC dominance / Buying and selling View)

Liquidation information from Coinglass revealed that over the previous 24 hours, bitcoin noticed $25.64 million in whole liquidations. Notably, lengthy liquidations amounted to only $443,490, whereas brief liquidations had been considerably larger at $25.19 million, suggesting that bearish merchants largely guess within the improper course.

Establishments Proceed BTC Shopping for Frenzy

Stablecoin large Tether, introduced on April 1 that it bought a complete of 8,888 BTC in the course of the first quarter of 2025, bringing its total bitcoin holdings to $7.8 billion.

Japanese bitcoin treasury agency Metaplanet, which just lately introduced a $13.3 million (¥2 billion) bond issuance, has bought 696 extra bitcoin bringing its whole holdings to 4,046 BTC, in line with an X publish from the corporate on April 1.

(Metaplanet publicizes 696 BTC buy / Simon Gerovich on X)

The purchases display continued institutional curiosity within the digital asset which contributes to bitcoin’s long-term value stability.

Market Outlook

Trying forward, market contributors are conserving a detailed watch on institutional strikes and total buying and selling sentiment. With strong backing from main gamers like Tether and Metaplanet, bitcoin’s fundamentals seem stable. Nevertheless, ongoing bearish liquidation pressures and market volatility imply that short-term value actions might stay uneven.

For now, analysts recommend that bitcoin might take a look at the mid-$80K ranges additional, however sturdy institutional assist could assist push it towards the low $90K vary within the coming weeks.