Bitcoin (BTC) is up 9% over the previous week and is at present attempting to determine help above the important thing $88,000 stage. Momentum indicators just like the DMI and Ichimoku Cloud are exhibiting clear bullish indicators, with patrons firmly in management.

If this trajectory continues, BTC may quickly check larger resistances close to $88,000 and doubtlessly goal for $90,000 and past. Nevertheless, analysts warn that renewed uncertainty round Trump’s commerce tariffs may disrupt the rally and set off a pullback towards the $81,000 help zone.

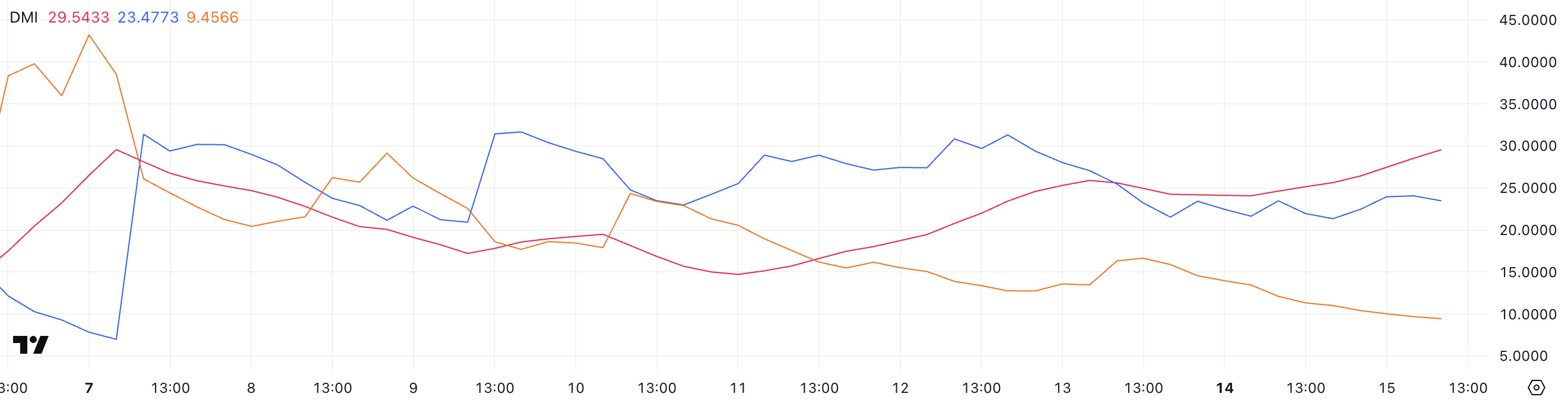

Bitcoin DMI Present Consumers In Full Management

Bitcoin’s DMI chart reveals a notable rise in development power, with the ADX climbing to 29.54 from 24.07 yesterday.

This enhance suggests rising momentum behind the present transfer, pushing the ADX near the 30 threshold—extensively seen as affirmation of a powerful, sustained development.

A rising ADX doesn’t point out course by itself, however when paired with directional indicators, it helps establish the prevailing pressure out there.

BTC DMI. Supply: TradingView.

Taking a look at these directional indicators, the +DI is at present at 23.47 and has remained regular between 21 and 23 over the previous two days.

In the meantime, the -DI has dropped sharply to 9.45 from 16.65, signaling a big decline in bearish strain.

This widening hole between bullish and bearish momentum factors to patrons taking management, and if the ADX continues to rise above 30, it may validate a brand new bullish part for BTC.

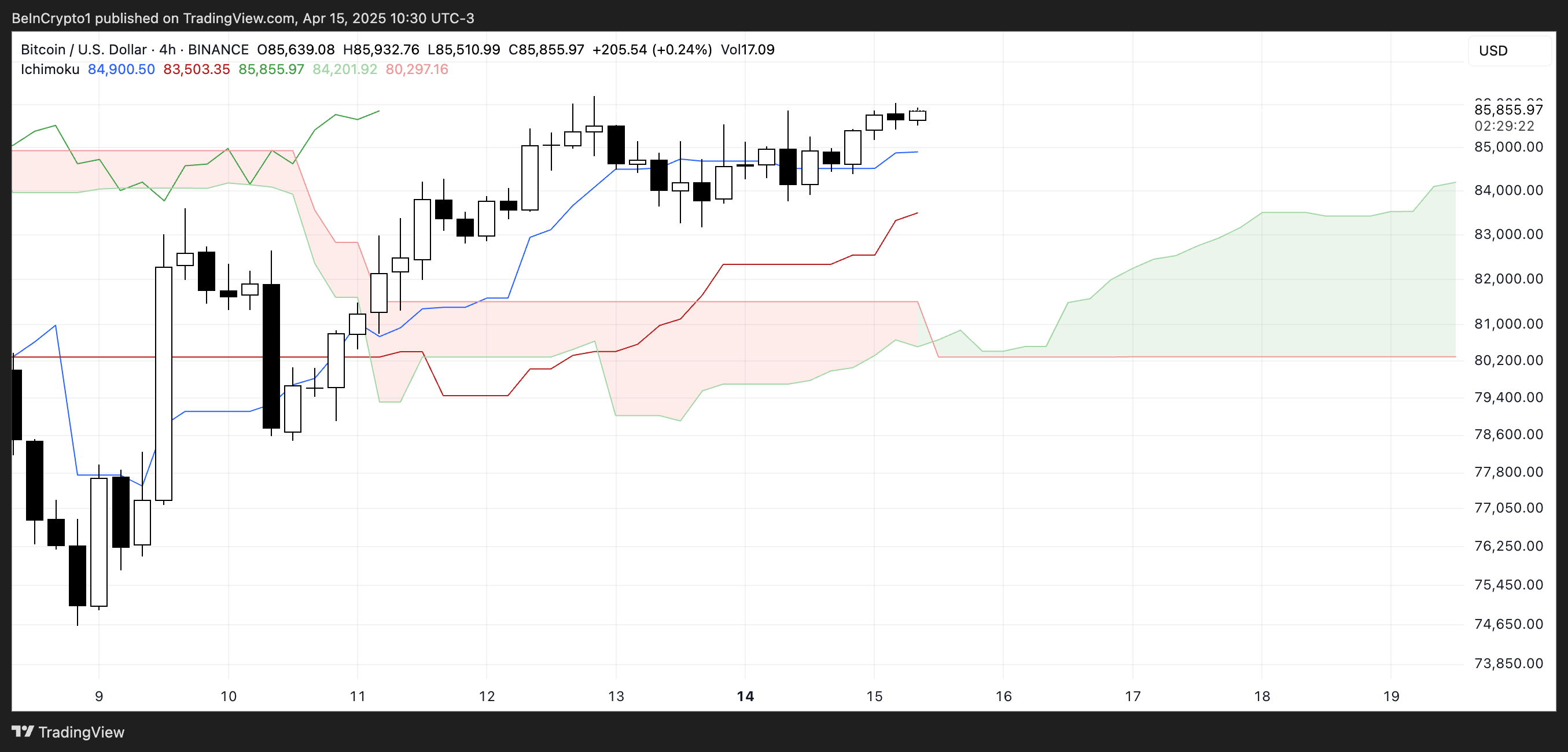

BTC Ichimoku Cloud Reveals A Clear Bullish Construction

Bitcoin’s Ichimoku Cloud chart continues to lean bullish, with value holding firmly above each the Tenkan-sen (blue line) and Kijun-sen (crimson line).

This positioning means that each short-term and medium-term momentum stays in favor of patrons.

The flat nature of the Kijun-sen may act as a powerful help space, whereas the rising Tenkan-sen reveals patrons are nonetheless energetic on smaller timeframes.

BTC Ichimoku Cloud. Supply: TradingView.

Wanting forward, the Kumo (cloud) is inexperienced and steadily rising, which reinforces a optimistic outlook for the approaching periods. The worth is nicely above the cloud, indicating the development is bullish and likewise firmly established.

There’s additionally a transparent hole between the present candle and the cloud, suggesting that the market has room to retrace with out shifting the general construction.

So long as the value stays above the Kijun-sen and the cloud stays inexperienced, the bullish development stays technically intact.

Will Bitcoin Break Above $90,000 Quickly?

If Bitcoin value maintains its present momentum, it may quickly problem the resistance at $88,839, with $90,000 as a psychological milestone.

Ought to the uptrend stay robust, additional targets lie at $92,920 and doubtlessly $98,484, marking a continuation of the bullish construction.

Nevertheless, crypto analyst and Coin Bureau founder Nic Puckrin warns that this momentum may very well be short-lived. He notes that renewed uncertainty round Trump’s commerce tariffs would possibly weigh on BTC:

“The caveat right here is that every one this optimistic momentum may disappear in a puff of smoke if there’s any backpedalling on tariffs or an surprising shock announcement – which everyone knows is all the time a risk. The truth is, we proceed to have fixed back-and-forth on tariffs: exemptions on electronics turned out to be non permanent, the small print of when tariffs will are available are missing, and so forth,” Puckrin instructed BeInCrypto.

BTC Worth Evaluation. Supply: TradingView.

He additionally defends that the $81,000 help may very well be examined once more:

“This, maybe, explains why Bitcoin is, as soon as once more, in a “wait and see” sample, with low liquidations at below $200 million pointing to uncertainty out there. If we don’t see any exterior shocks, $88,000-$90,000 is the following vary to look at, with liquidity pool clusters at this stage suggesting we are going to see an uptick of volatility right here. Nevertheless, a short-term correction to re-test help at $81,000 could be wholesome and, so long as BTC stays above this threshold, would even level to a sustainable value restoration,”

Total, it seems to be like the present macroeconomic elements are priced in. But, the market is cautious about sudden surprises, as Trump’s latest tariffs went past any standard financial development and disrupted virtually each world monetary market.