Bitcoin (BTC) has triggered a robust technical sign that might push the main digital foreign money to $170,000, primarily based on historic returns.

Particularly, BTC has flashed the ‘Final VIX Backside Sign,’ a uncommon incidence that has constantly marked long-term bottoms in Bitcoin’s value cycle, in keeping with an evaluation by outstanding on-line cryptocurrency analyst TradingShot.

This sign is predicated on the BTC/VIX ratio, which compares Bitcoin’s value motion to the Volatility Index (VIX), which measures market worry.

In an X publish on April 15, the analyst famous that the ratio has made direct contact with a 10-year trendline of upper lows, which has acted as a launching pad for Bitcoin on a number of events.

Related touches occurred on August 24, 2015, March 16, 2020, and August 5, 2024. Every of those cases was adopted by aggressive rallies, with the “weakest” nonetheless producing a formidable achieve of roughly 100%.

Every time this ratio rebounded off the trendline, Bitcoin adopted with a big surge.

Bitcoin’s subsequent attainable cease

Given this historic context, TradingShot instructed {that a} comparable transfer might see Bitcoin reaching at the very least $150,000 throughout its subsequent main advance.

Whereas no technical sign ensures future outcomes, the consistency of this sample gives a compelling case for bullish momentum, particularly with Bitcoin nonetheless buying and selling under its all-time highs.

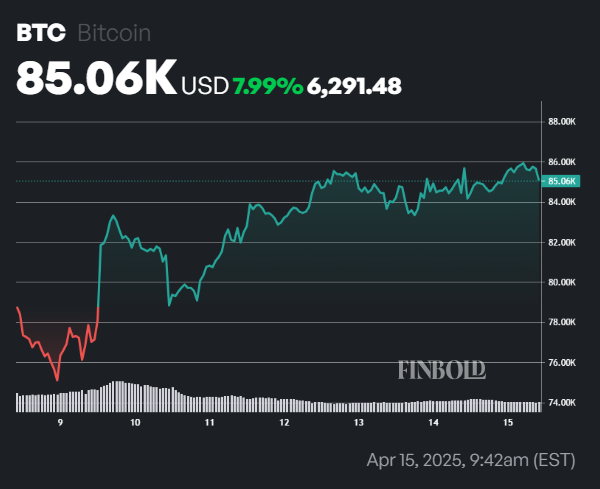

Notably, after days of consolidation, Bitcoin is at present displaying energy within the quick time period after reclaiming the $85,000 resistance stage.

Nevertheless, general sentiment stays subdued, with market observers noting that for the asset to make any decisive transfer, it must breach the $90,000 mark.

On the identical time, as reported by Finbold, one other analyst warns that within the short-term Bitcoin can be liable to a short-term pullback after flashing a promote sign primarily based on the TD Sequential indicator on the 1-hour and 4-hour time-frame, making a drop to $75,000 a possible prospect.

Bitcoin value evaluation

At press time, Bitcoin was buying and selling at $85,680, up 1.4% within the final 24 hours. On the weekly chart, the asset has rallied over 7%.

As issues stand, Bitcoin’s sentiment might be thought-about impartial to mildly bullish within the quick time period, and on the present value, the asset is buying and selling barely above its 50-day easy shifting common (SMA) of $84,902 however slightly below the 200-day SMA of $86,714. The 14-day Relative Energy Index (RSI) stands at 52, indicating neither overbought nor oversold situations.

Featured picture through Shutterstock