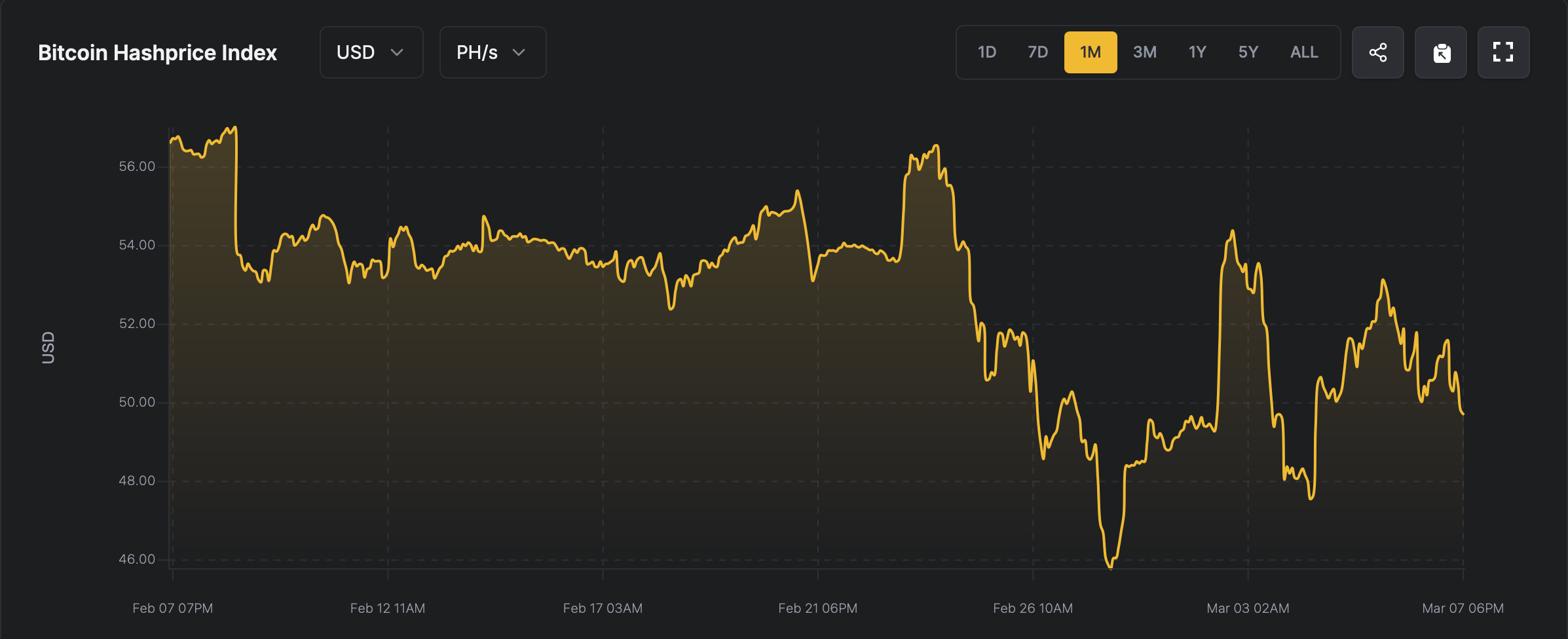

Bitcoin’s hashprice—the estimated earnings generated by working 1 petahash per second (PH/s) of mining energy—has dipped from $53.13 per petahash all the way down to its present worth of $49.81 over the previous seven days. In the meantime, Bitcoin’s whole hashrate bounced again impressively from its Feb. 25 low, including over 41 exahash per second (EH/s) to achieve the current price of 794 to 796 EH/s.

March Would possibly Lack Magic for Bitcoin Miners as Earnings Slide

In February, bitcoin miners earned $1.24 billion, down from January’s haul of $1.4 billion. This month’s first week alone noticed miners pocketing $250.75 million, together with $2.97 million derived immediately from onchain transaction charges. For comparability, 30 days in the past, Bitcoin’s hashprice beforehand stood at $56.73 per PH/s, considerably above right now’s extra modest determine of $49.81.

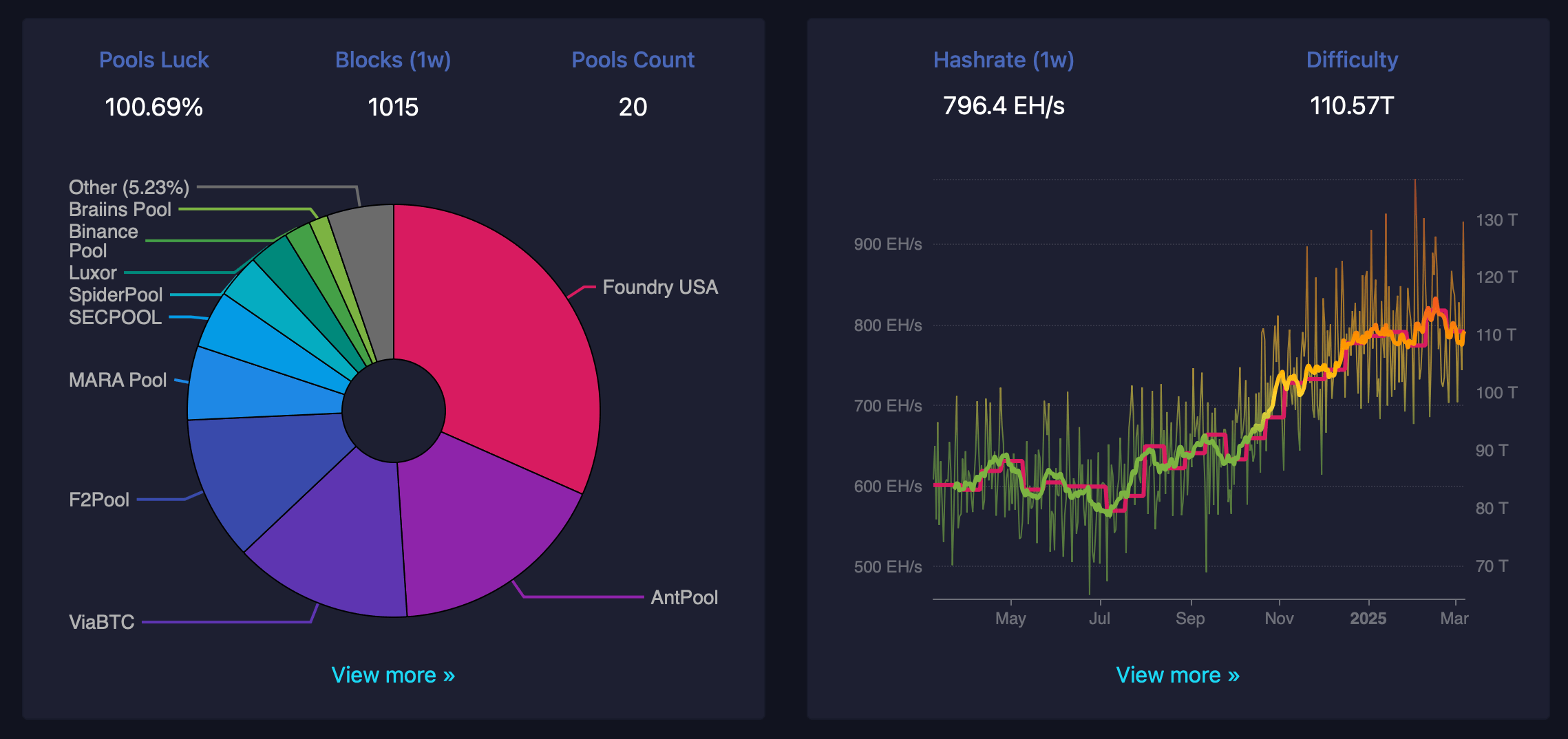

Present indicators counsel March may lack the appeal of the previous two months until situations shift favorably. Nevertheless, there’s excellent news on the hashrate entrance, with mining energy rising a stable 5.44% from its current low of 753 EH/s to a more healthy 794 EH/s. Inside that whole, the mining pool big Foundry dominates with a 31.43% share, whereas Antpool contributes a considerable 17.44%.

Viabtc comfortably occupies third place, accounting for 13.99%, which collectively places these three mining swimming pools accountable for 62.86% of Bitcoin’s 794 EH/s whole. Presently, the outlook for bitcoin miners isn’t precisely glowing, as they’re bracing for a possible problem improve of round 1.29% on or round March 9.

Proper now, blocks are arriving at a quick tempo, averaging about 9 minutes and 52 seconds every. In the meantime, these wanting to expedite transactions by way of a high-priority switch, face charges averaging 3 satoshis per digital byte (sat/vB), translating to roughly $0.36 per transaction. Given the present trajectory, bitcoin miners are more likely to navigate tightening margins until there’s a notable shift in market dynamics or transaction demand.

With swimming pools consolidating management and mining prices inching upward, profitability pressures may immediate strategic diversifications. In the end, the trade’s speedy future hinges on balancing rising community problem with sustaining environment friendly mining operations amid fluctuating income streams. And maintaining fingers crossed that bitcoin’s market worth takes a flip for the higher.