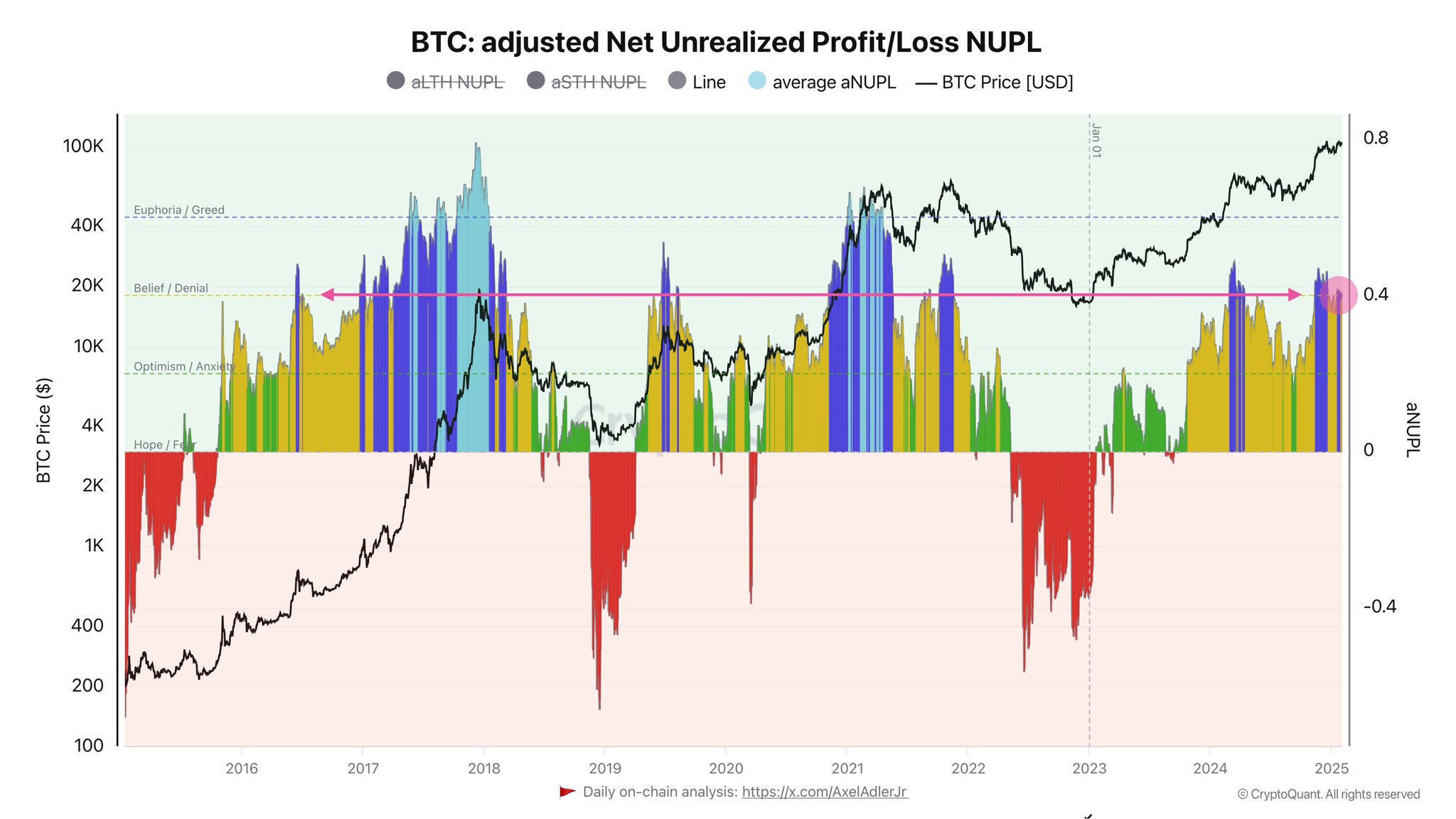

Crypto analyst Axel Adler Jr. has supplied some insights on the present standing of the Bitcoin (BTC) market primarily based on the adjusted Internet Unrealized Revenue/Loss (aNUPL) indicator. Regardless of latest consolidation, Adler states the BTC market stays bullish with a development reversal removed from occurring.

Bitcoin Has Extra Room For Development, No Euphoria But – Analyst

The aNUPL indicator is a crypto buying and selling metric used to evaluate the market sentiment and potential worth actions. Because the identify implies, it modifies the standard Internet Unrealized Revenue/Loss by contemplating market habits over time, thereby figuring out if traders’ unrealized earnings or losses are sustainable or merely speculative.

In accordance with Adler Jr., Bitcoin’s aNUPL presently stands at 0.4, indicating that traders are holding a big quantity of gathered revenue, which represents a wholesome however managed degree of market optimism. Moreover, this aNUPL exhibits that Bitcoin is sustaining its bullish momentum. Notably, the crypto asset has been in an uptrend since September 2024, translating into a sturdy bullish construction.

Nevertheless, in each circumstances, an aNUPL of 0.4 stays removed from the height ranges of 0.7-0.8 recorded within the earlier bull cycles in 2017 and 2021. These crucial excessive ranges signify the presence of investor euphoria/greed as evidenced by an overleveraged market. By interpretation, Adler’s market insights presently recommend that the Bitcoin market isn’t overheated and will probably expertise additional development barring any sudden macroeconomic improvement.

What Subsequent For BTC?

In accordance with its day by day buying and selling chart, Bitcoin is presently valued at $100,824 following a 1.72% decline prior to now day. The asset’s Relative Power Index presently stands at 50.43 which exhibits room for increased worth ranges earlier than getting into the overbought zone, thus aligning with Axel Adler’s postulation. This optimistic projection is additional supported by the 100-day easy transferring common which stays properly beneath Bitcoin’s worth in a traditional bullish sign.

Relating to worth obstacles, Bitcoin faces psychological resistance on the $106,000 worth area breaking previous which might spur a return to its present all-time excessive at $109,114. Nevertheless, one other rejection at $106,000 would drive the premier cryptocurrency to stay in a consolidation part that has lasted over the previous two weeks.

Within the long-term, traders retain bullish sentiments on Bitcoin pushed by historic knowledge and the crypto-friendly method of the Donald Trump administration. Earlier than the bull run concludes, the premier cryptocurrency is anticipated to commerce between $150,000 – $350,000.

Featured picture from Unsplash, chart from Tradingview