Bitcoin value has carried out effectively this week, crossing the necessary milestone of $100,000 and peaking at $104,000.

Bitcoin (BTC) surge occured as knowledge indicated continued investor urge for food for the digital forex, even at a six-digit value. Notably, knowledge from SoSoValue reveals that spot Bitcoin exchange-traded funds noticed a web influx of over $33 billion.

These funds now maintain a file $109 billion in property after six consecutive days of constructive inflows.

Analysts are optimistic that the coin will proceed doing effectively within the subsequent few years. In separate notes, analysts from Customary Chartered and BitWise predicted that the coin will get to $200,000 in 2025. They each cited robust institutional demand amid falling provides.

Historic knowledge helps the opportunity of accelerated progress. As an example, the Dow Jones rose to $10,000 in 2000, then doubled to $20,000 in 2017, and reached $40,000 this 12 months. Equally, the S&P 500 doubled from 1,000 in mid-2008 to 2,000 in mid-2014 after which took seven years to double once more.

You may additionally like: AERO value regular as good cash accumulates, Nansen knowledge reveals

Along with institutional adoption, Bitcoin value may bounce as governments begin shopping for. The US already holds 198,109 Bitcoins, whereas China, the UK, and Ukraine have 190,000, 61,000, and 46,000 cash, respectively. Different prime holders are Bhutan, El Salvador, and Venezuela.

With geopolitical tensions prone to improve through the Trump administration, extra international locations might take into account shopping for Bitcoin. The U.S. may additionally convert its holdings into strategic property below the management of newly appointed crypto czar David Sacks.

Bitcoin value technicals level to extra features

Bitcoin value chart | supply: crypto.information

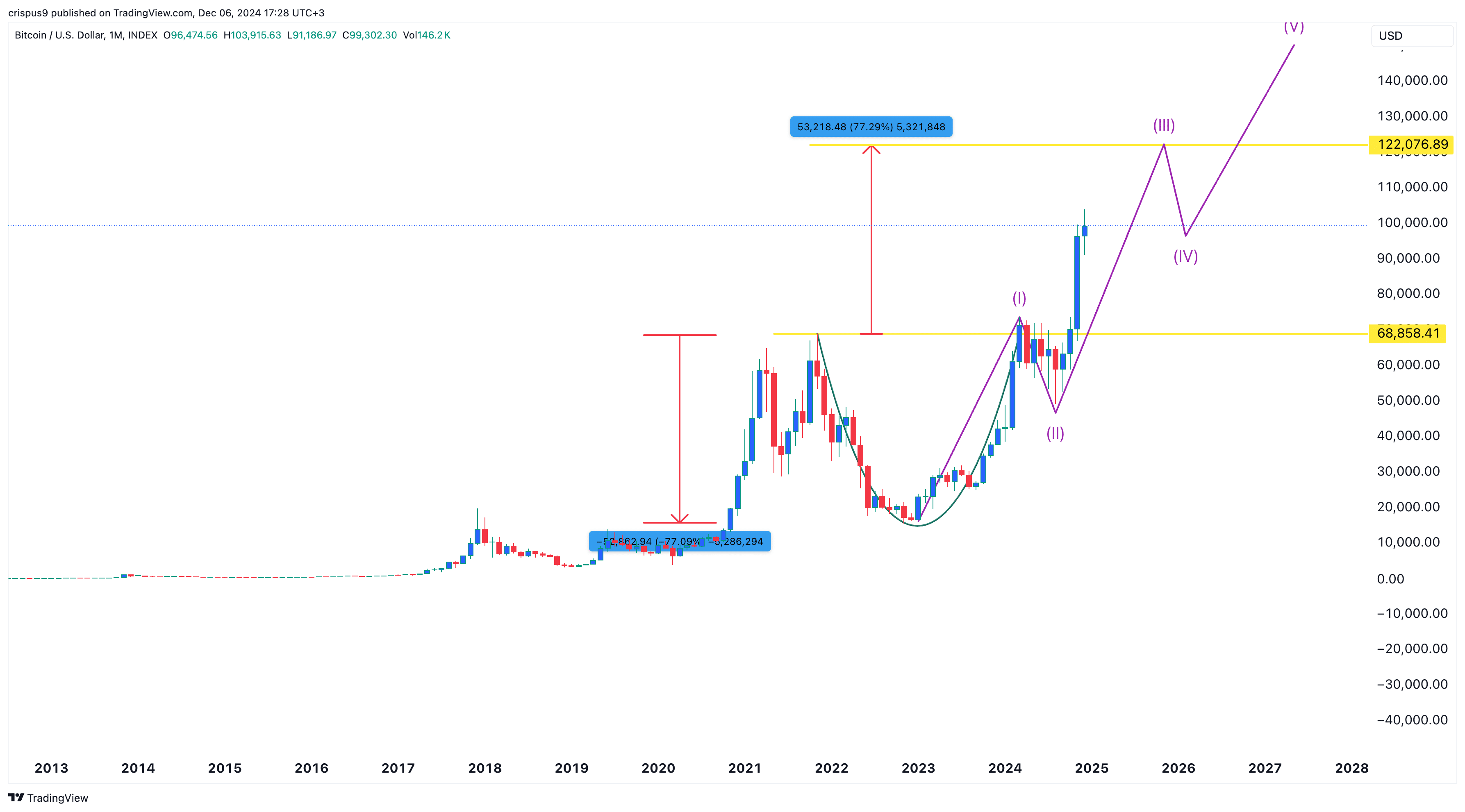

In style crypto analysts forecast BTC reaching $200,000, however the long-term chart suggests potential resistance at $122,000.

The month-to-month chart reveals that Bitcoin has simply accomplished the formation of a cup and deal with sample. The higher aspect of this cup was at $68,858. It then shaped the deal with between March 2024 and November.

This cup was about 77% dip. Subsequently, if we measure the identical distance from its higher aspect of the cup, it implies that the coin will rise to $122,000. Because of this it has about 25% upside from the present degree to go from the present degree.

This outlook aligns with Elliot Wave patterns, suggesting the transfer to $122,000 can be the third wave, adopted by a minor fourth-wave pullback and a remaining breakout to $200,000.

Subsequently, whereas Bitcoin value will probably hit $200,000, it may face some volatility or an enormous pullback when it will get to $122,000.

You may additionally like: Czech Republic exempts three-year previous Bitcoin from capital tax features