Bitcoin has not too long ago proven indicators of a rounding high sample, marked by a 6.4% decline during the last 24 hours. This sample was validated when BTC fell to $90,000 throughout an intra-day low, triggering panic promoting.

Regardless of the market’s response, one key cohort means that this drop could also be short-lived.

Bitcoin Buyers Panic

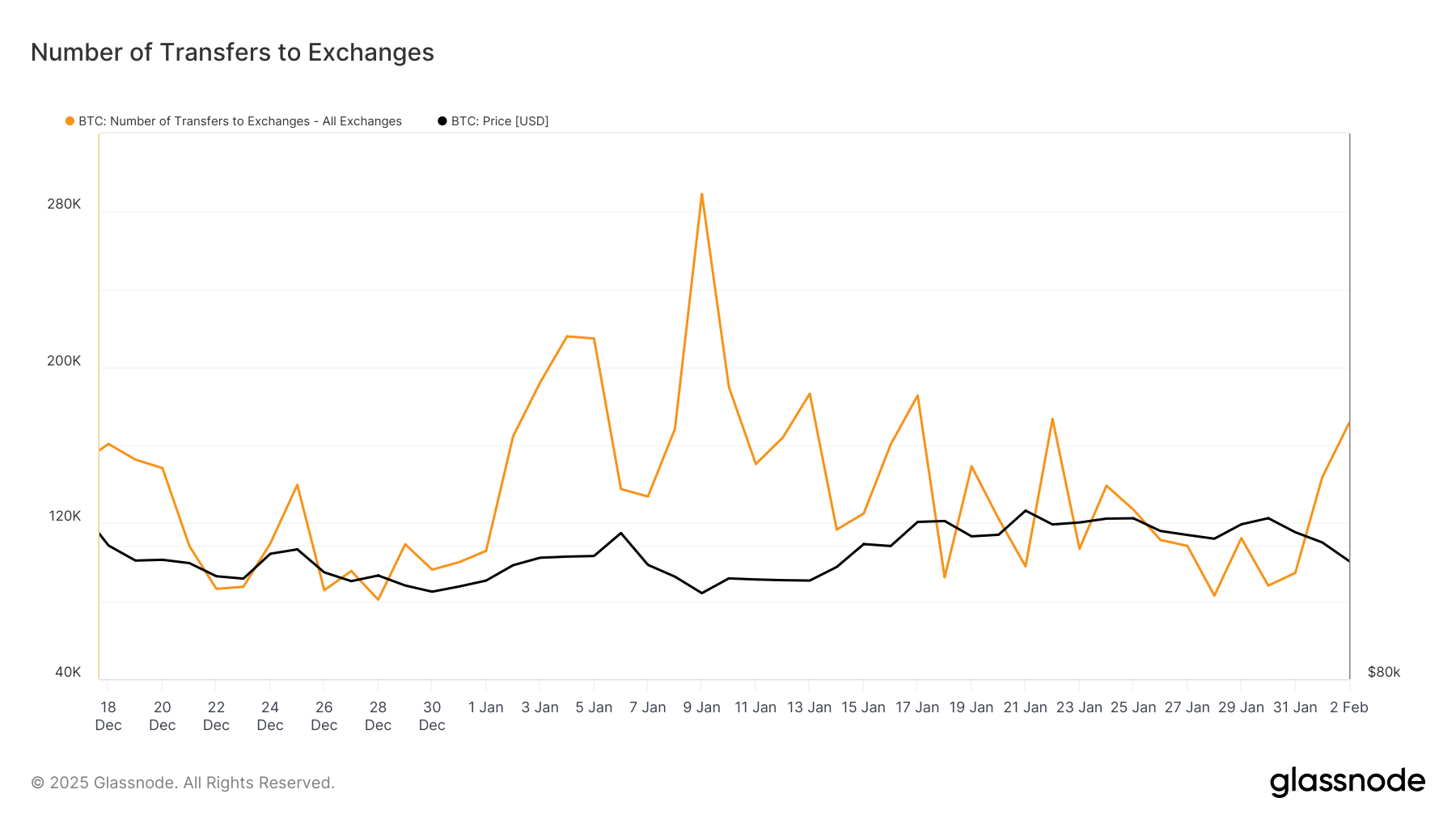

Previously two days, Bitcoin deposits to exchanges noticed a pointy uptick, with over 80,000 BTC, price roughly $7.5 billion, moved onto exchanges. This enhance is usually seen as an indication of impending promoting, as traders search liquidity throughout market downturns.

Nevertheless, this massive motion of BTC may merely replicate panic promoting moderately than a long-term shift in market sentiment. Buyers have a tendency to maneuver property to exchanges in occasions of uncertainty, however this habits isn’t at all times a sign of a sustained bearish development.

Bitcoin Alternate Deposits. Supply: Glassnode

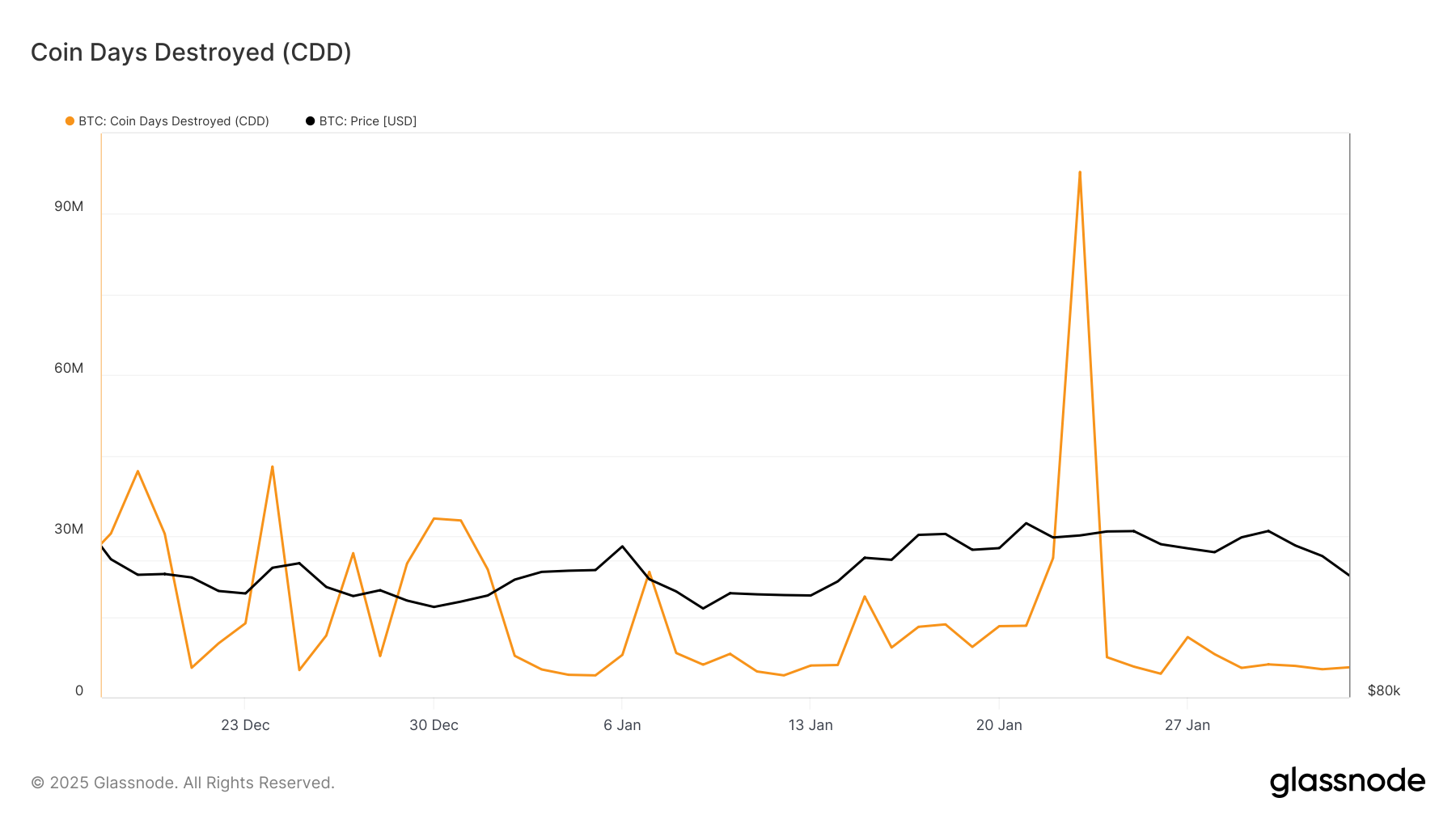

The Coin Days Destroyed (CDD) metric, which tracks the motion of long-term holders’ cash, gives perception into market sentiment. Spikes in CDD are usually related to market sell-offs. Curiously, regardless of Bitcoin’s sharp decline to $90,000, long-term holders (LTHs) remained largely inactive.

This resilience means that LTHs are assured in restoration, signaling that the market’s short-term volatility could not deter them. The inactivity of LTHs signifies they’re holding agency, and this decline could be a brief blip moderately than the start of a long-term bearish section.

Bitcoin CDD. Supply: Glassnode

BTC Value Prediction: Delaying A Drop

Bitcoin has fashioned a rounding high sample, nevertheless it’s doable that this might transition into an inverse cup and deal with sample. The bearish momentum at the moment isn’t as intense because it might be, offering BTC with an opportunity to bounce from the help at $93,625.

If Bitcoin efficiently bounces again, it may rise towards $100,000 after breaching $95,668. This is able to mark a vital restoration and sure see a return of investor confidence. Nevertheless, if the bearish sample persists, Bitcoin may even see an additional drop to $92,005 within the close to time period.

Bitcoin Value Evaluation. Supply: TradingView

A profitable breach and flip of the $100,000 resistance into help would invalidate the bearish outlook. This might doubtlessly set off an increase to $105,000, marking a restoration from latest losses.