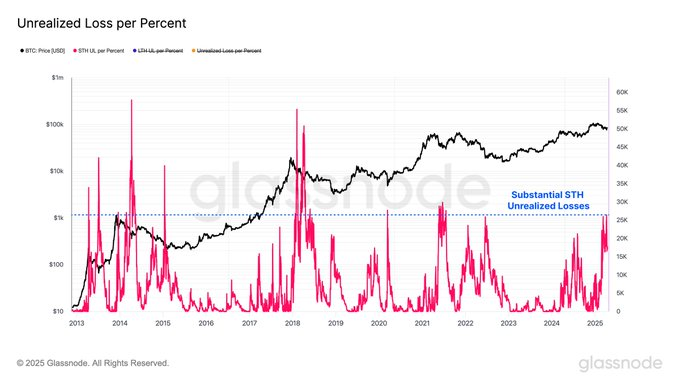

Bitcoin’s Quick-Time period Holders (STHs) face their greatest paper losses since previous bear markets because of latest value drops. Glassnode information exhibits these holders are down ~$30,000 for each 1% Bitcoin falls – echoing historic market bottoms and capitulation occasions, which works on to indicate that many latest Bitcoin consumers are underwater.

Traditionally, this case typically triggers panic promoting and sharp market swings, making merchants query if it is a deep correction or the beginning of a reversal.

How Are Lengthy-Time period Bitcoin Holders Doing?

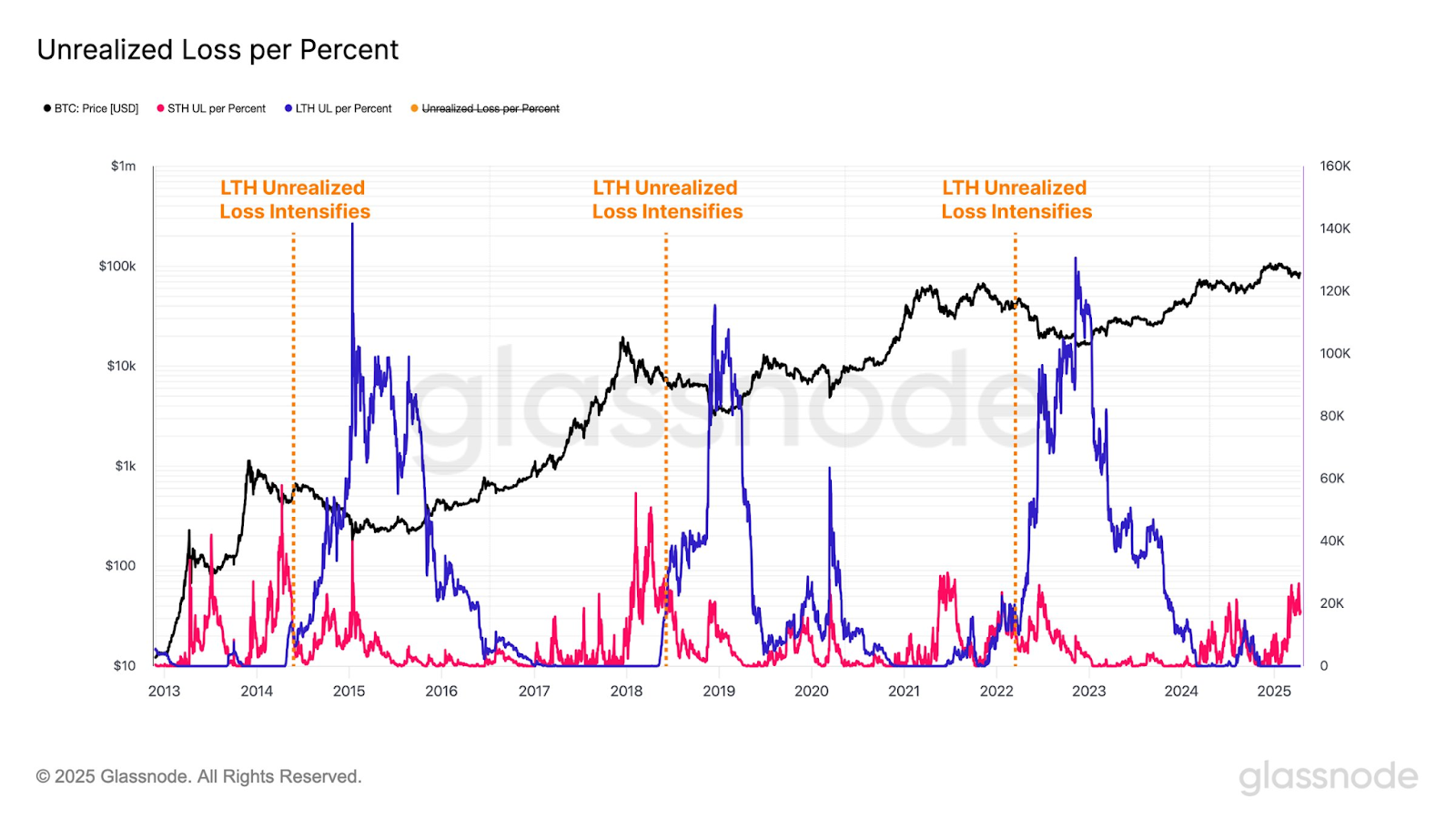

Lengthy-Time period Holders (LTHs), holding Bitcoin over 155 days, usually stay worthwhile with minimal paper losses now. However danger is brewing: buyers who purchased close to earlier highs have gotten LTHs.

If Bitcoin’s value retains falling, these newer, high-cost-basis LTHs might face main losses. Traditionally, this group feeling vital ache typically signaled deeper bear market bother and instability forward.

What Might This Imply for the Market Now?

The present strain on STHs suggests promoting might intensify quickly. Historical past exhibits these intervals carry extra volatility, however can even mark market bottoms. Total market sentiment does stay weak, nevertheless.

Whereas not confirming a bear market, the info exhibits stress on newer buyers. Detrimental macro elements, laws, or slower ETF inflows might push BTC costs decrease. But, historical past exhibits restoration from such phases stays doable.

Previous cycles (2015, ’18, ’22) additionally present LTHs typically took large hits after retail panicked and offered off utterly. That key sample raises the prospect of a delayed second downturn, particularly if the financial system struggles or general market temper stays bitter.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.