Since closing at a low of $78,620 on March 10, Bitcoin (BTC) has staged a comeback and is presently trending upward regularly.

The main cryptocurrency has recorded a 1.2% worth uptick over the previous week, with on-chain knowledge signaling a contemporary wave of whale accumulation.

Bitcoin Whale Demand Surges as Buyers Purchase the Dip

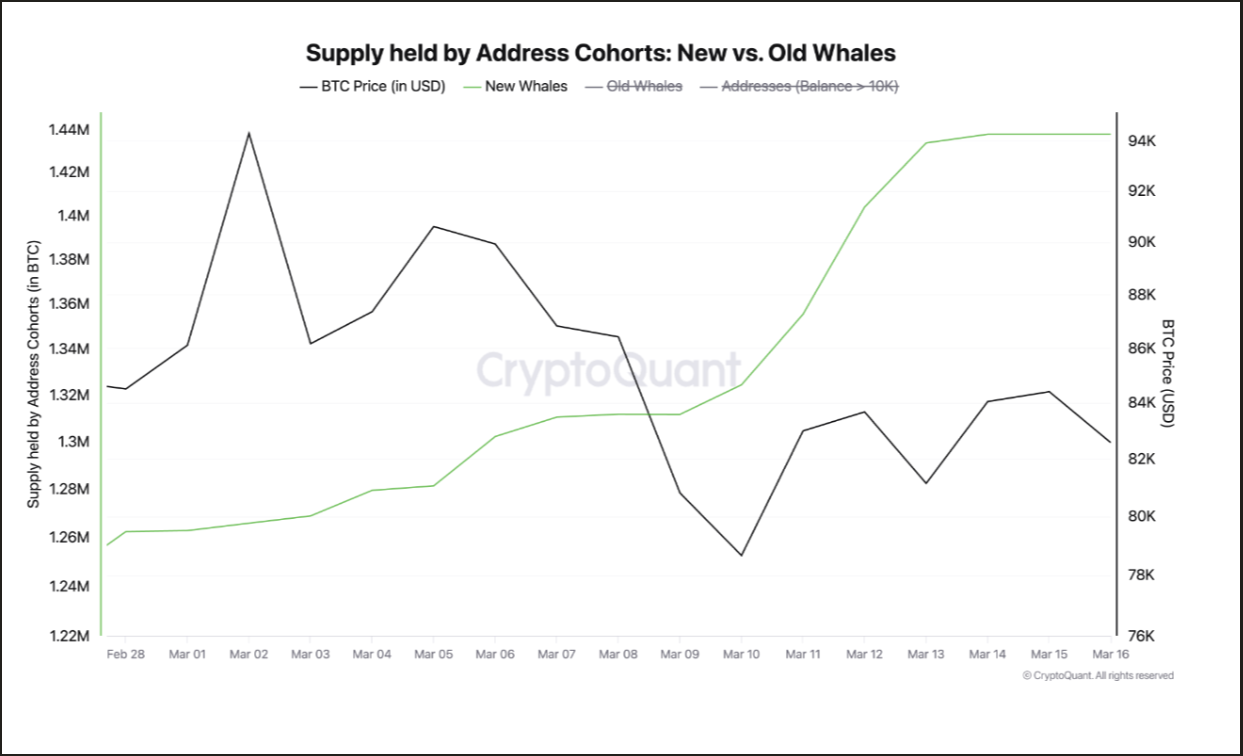

In a brand new report, pseudonymous CryptoQuant analyst Onchained discovered {that a} new wave of Bitcoin whales has emerged. These massive traders maintain not less than 1,000 BTC wallets and have a median acquisition age underneath six months.

BTC Provide held By Handle Cohorts. Supply: CryptoQuant

“On-chain knowledge confirms that since November 2024, these wallets have collectively acquired over 1 million BTC, positioning themselves as one of the vital influential market members. Their accumulation tempo has accelerated notably in latest weeks, accumulating greater than 200,000 BTC simply this month,” Onchained wrote.

When new whales present curiosity in BTC like this, it alerts a resurgence in bullish confidence in its long-term efficiency. BTC’s latest decline to multi-year lows has fueled this accumulation development, because it presents a major alternative for whales trying to “purchase the dip” and promote at a better worth.

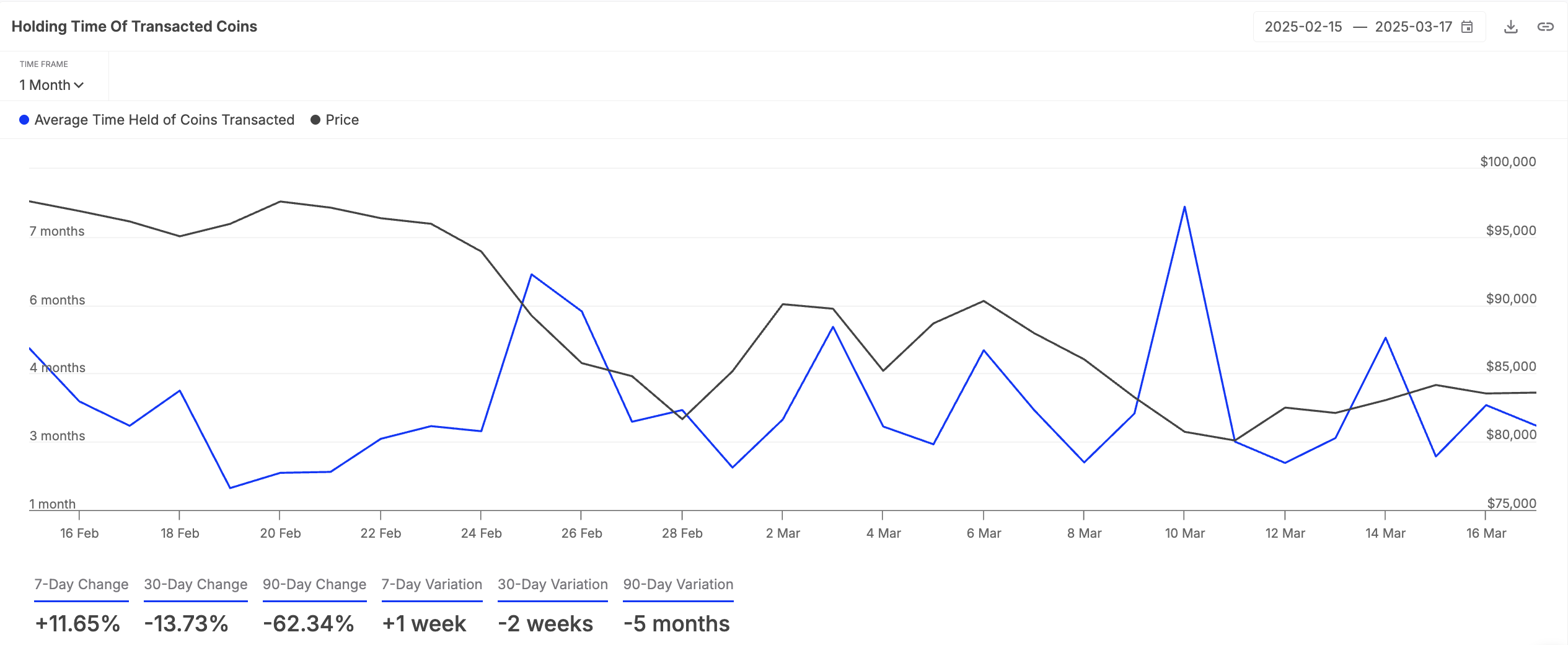

Furthermore, BTC holders have elevated their coin holding time up to now week, highlighting the gradual comeback in bullish sentiments towards the coin. In keeping with IntoTheBlock, this has climbed 12% over the previous seven days.

BTC Coin Holding Time. Supply: IntoTheBlock

The holding time of an asset’s transacted cash measures the common size of time its tokens are held earlier than being bought or transferred. When this extends, it displays stronger investor conviction, as traders select to maintain their cash reasonably than promote.

This can assist scale back the promoting strain as provide dries up regularly within the BTC market, driving up the coin’s worth within the close to time period.

Bitcoin at a Crossroads: Rebound to $89,000 or Drop to $77,000 Subsequent?

Though BTC’s Elder-Ray Index continues to put up purple histogram bars, their sizes have regularly diminished over the previous few days.

This indicator compares shopping for strain with selloffs to find out an asset’s worth traits. When its bars lower in peak, it signifies that bearish strain is weakening.

This means that BTC sellers are dropping momentum, and consumers could also be regularly stepping in. If this development continues, it may decelerate BTC’s downtrend. Its worth may rebound and climb towards $89,434.

BTC Worth Evaluation. Supply: TradingView

However, if promoting strain strengthens, the king coin dangers plummeting to $77,114.