Bitcoin mining problem has recorded its first decline in 4 months, marking the top of a streak that noticed it rise eight consecutive occasions. In line with knowledge from Cloverpool, the mining problem fell 2.12% in its newest adjustment on January 27, which occurred at block peak 880,992.

With the adjustment, mining problem fell from its report excessive of 110.45 trillion to 108.11 trillion. Mining problem determines how a lot work miners do in validating transactions on the Bitcoin community and incomes rewards. Its present stage implies that it’s 108.11 trillion occasions tougher for a miner to mine BTC now than the genesis block.

The decline in problem represents a constructive improvement for Bitcoin miners because it signifies that the computing energy required for mining Bitcoin has barely lowered. Nonetheless, the BTC hash worth, the quantity Bitcoin miners will earn per PH/s, has additionally been lowered to $58.15.

That is largely because of the latest plunge in BTC worth, with the flagship asset shedding greater than 5% of its worth and dropping beneath $100,000 for the primary time since Donald Trump’s inauguration. Regardless of the decline, MicroStrategy introduced the acquisition of 10,107 BTC for round $1.1 billion.

Why mining problem lowered

The autumn in mining problem after eight consecutive will increase isn’t a shock, given Bitcoin hashrate efficiency over the previous few weeks. The hashrate, which refers back to the out there computing energy on the Bitcoin community, determines how mining problem adjusts each two weeks.

In line with CoinWarz, the Bitcoin hashrate fluctuated throughout that interval, rising as excessive as 884.16 EH/s and falling to 671.6 EH/s with a median of 774.06 EH/s. Cloverpool now estimates that there might be consecutive declines in mining problem if the hashrate stays low.

In the meantime, declining hashrate indicators that a number of Bitcoin miners have stopped or lowered manufacturing capability prior to now few weeks. Mining capability elevated considerably within the final quarter of 2024 and earlier this 12 months. It reached a peak of 955.61 EH/s on January 2, 2025.

Nonetheless, consecutive will increase in mining problem and the stagnating worth of Bitcoin after peaking at $109,000 meant that a number of miners struggled to remain worthwhile below these situations, forcing lots of them to capitulate as soon as Bitcoin dropped beneath $100,000.

Bitcoin miners’ shares battle

In the meantime, mining problem and the declining Bitcoin worth should not the one challenges dealing with Bitcoin miners at present. The success of the Chinese language AI mannequin DeepSeek additionally led to an enormous meltdown within the inventory market.

Publicly traded miners comparable to Core Scientific CORZ, IREN Restricted IREN, Terawulf WULF, Bit Digital BTBT, and Marathon Digital all noticed declines of their pre-market worth, starting from 15.77% for CORZ to five% for MARA.

The decline displays a broader market capitulation, which noticed huge tech corporations comparable to Nvidia, Microsoft, and Amazon report sizable drops in worth attributable to issues that DeepSeek, with its restricted monetary and {hardware} sources, is rivaling OpenAI fashions.

Core Scientific, Terawulf, and different miners which have centered on diversifying their income by internet hosting high-performance computing infrastructure (HPCs), which is required for AI coaching, suffered probably the most losses.

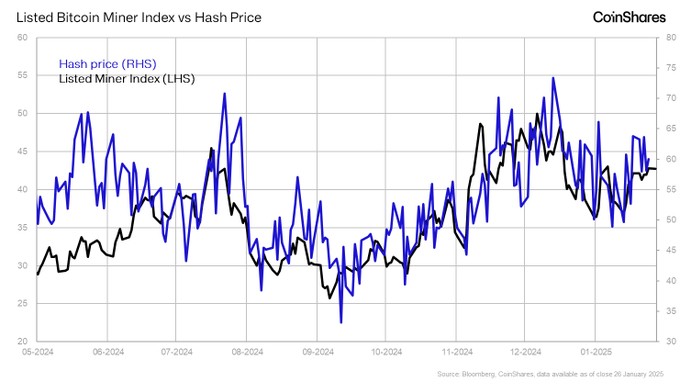

Correlation between listed miners’ efficiency and BTC Hash worth since halving. (Supply: James Butterfill)

Regardless of the premarket decline for publicly listed Bitcoin miners, CoinShares knowledge exhibits that their efficiency has correlated with Bitcoin hash worth for the reason that halving occasion. If something, this suggests that the shares are buying and selling at par with the miners’ precise efficiency.