The Bitcoin (BTC) market proved reasonably turbulent previously week after a value decline under $75,000 was adopted by a rebound to above $83,000. With the premier cryptocurrency exhibiting indications of a sustained uptrend, blockchain analytics agency CryptoQuant has recognized two potential key resistance zones mendacity in wait.

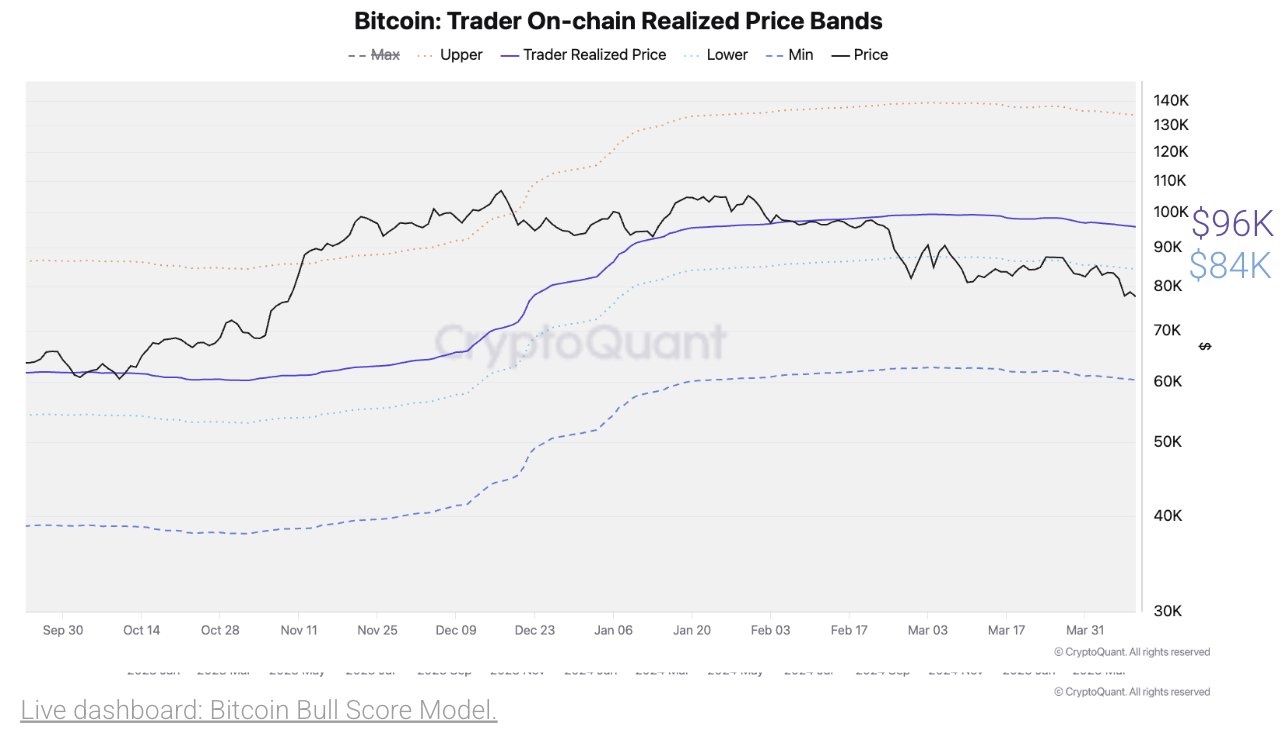

Bitcoin Realized Value Reveals Potential Sturdy Obstacles At $84,000 And $96,000

In an X submit on April 11, CryptoQuant shared an on-chain report on the BTC market indicating a possible encounter with two main resistances at $84,000 and $96,000 if Bitcoin maintains its present upward trajectory. These value obstacles are revealed by the Realized Value metric which displays the common value at which the present provide of BTC final moved on-chain thereby figuring out the market-wide price foundation.

When Bitcoin trades above this stage, it signifies a wholesome bullish momentum with the vast majority of holders in revenue. Conversely, when BTC is under the brink, it suggests underwater sentiment as most buyers are holding a loss. Due to this fact, the Realized value usually features as an important market pivot appearing as sturdy assist throughout bull markets and stiff resistance in bear phases. In response to Julio Moreno, Head of Analysis at CryptoQuant, BTC’s present on-chain realized value is $96,000 with an instantaneous lower cost band of $84,000.

Apparently, these two value ranges have served as key assist zones within the earlier bullish part of the present market cycle. Nevertheless, there’s potential for each zones to behave as resistance amidst the continued market correction. Nevertheless, if Bitcoin is ready to transfer previous $84,000 and $96,000, it might signify the resumption of the bull market with the potential for the premier cryptocurrency to commerce as excessive as $130,000. This projected achieve would characterize a 55% enhance in present market costs.

BTC Value Overview

At press time, Bitcoin continues to commerce at $83,180 reflecting a 3.65% achieve previously day. In the meantime, day by day buying and selling quantity is down by 11.99% and valued at $39.19 billion.

Amidst steady macroeconomic developments pushed by the US Authorities tariff adjustments, the crypto market continues to exhibit a robust stage of uncertainty and property fail to determine a transparent momentum. Nevertheless, blockchain analytics Glassnode experiences that Bitcoin buyers have shaped a robust assist zone at $79,000 and $82,080 at which over 40,000 BTC and 51,000 BTC have been amassed respectively.

Within the creation of any downtrend, each value ranges are to supply short-term assist and forestall an extra value fall. With a market cap of $1.66 trillion, Bitcoin stays the biggest digital asset accounting for over 60% of the crypto market cap.

Featured picture from CNN, chart from Tradingview.com

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.