Bitcoin’s value has struggled to reclaim the $100,000 mark, going through repeated rejections which have triggered sharp pullbacks. Regardless of these setbacks, BTC has demonstrated resilience and has held above essential assist ranges.

Whereas long-term holders are dropping confidence, new traders are utilizing the bearish market as a possibility to build up at decrease costs.

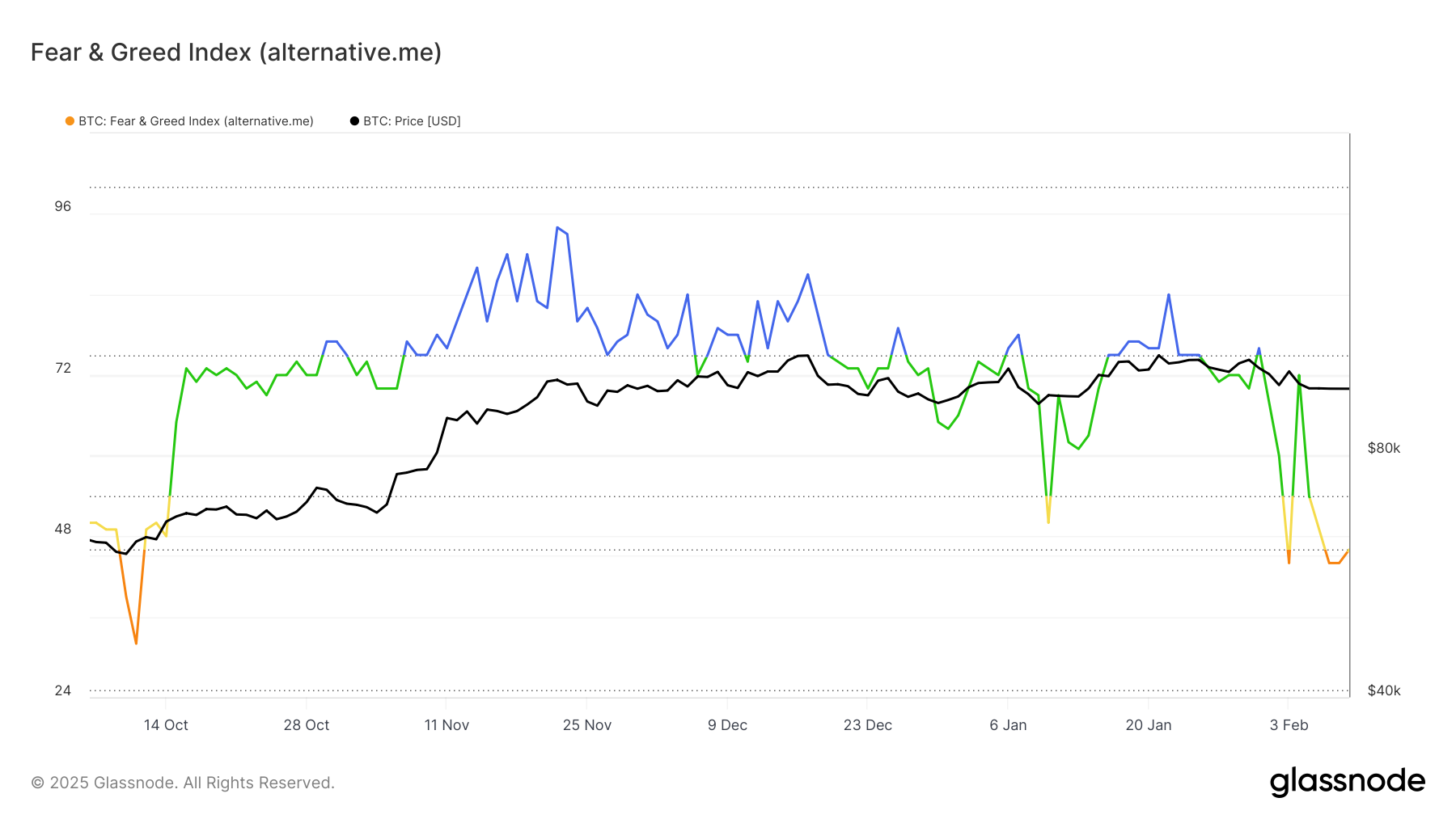

Bitcoin Buyers Are In Worry

The Worry and Greed Index presently signifies a bearish sentiment, reflecting rising uncertainty amongst BTC holders. The index has dipped into the Worry zone for less than the second time since October 2023. This shift means that many current traders are reluctant to take part actively out there, ready for a clearer restoration sign.

A chronic keep within the Worry zone may restrict BTC’s short-term momentum. Many merchants might hesitate to purchase or promote till market situations enhance. With out renewed optimism, Bitcoin may battle to generate the required demand for a robust breakout towards new highs.

Bitcoin Worry And Greed Index. Supply: Glassnode

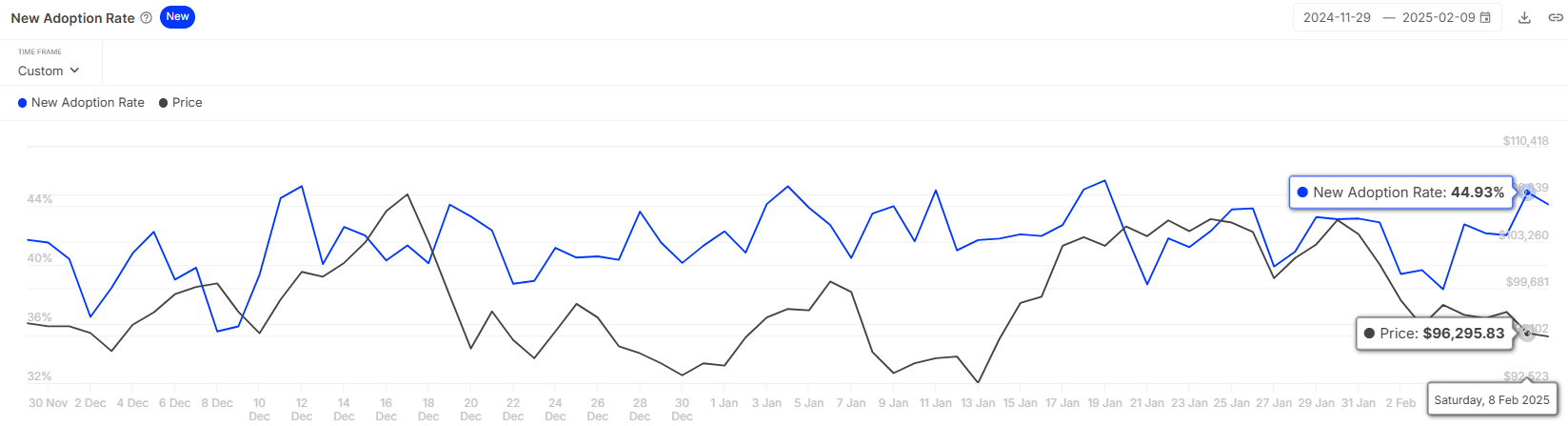

Bitcoin’s adoption fee, which measures new deal with participation in each day transactions, has proven indicators of enchancment. Presently at 44%, the metric signifies rising curiosity from first-time traders. This improve means that new market individuals are profiting from BTC’s lower cost ranges to place themselves for future good points.

If the development continues, it may present a much-needed increase for Bitcoin’s value motion. A rising adoption fee usually precedes main rallies as recent capital enters the market with new traders accumulating BTC; the chance of a long-term uptrend strengthens regardless of near-term value fluctuations.

Bitcoin Adoption Fee. Supply: IntoTheBlock

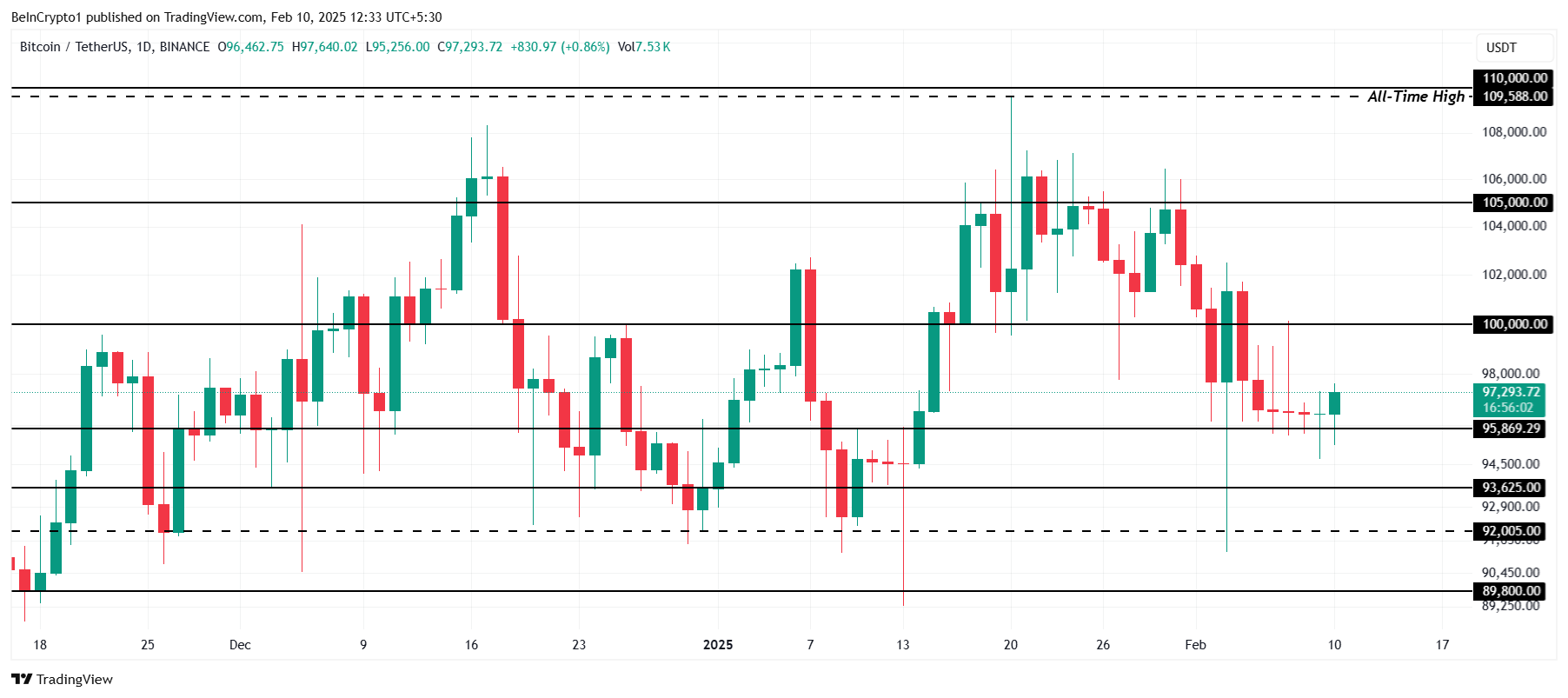

BTC Worth Prediction: Reclaiming Misplaced Help

Bitcoin’s present value of $97,293 displays its means to keep up assist above $95,869. This stage has held agency for the previous week, offering a basis for potential restoration. So long as BTC stays above this assist, a transfer towards the $100,000 resistance stays potential within the close to time period.

Nonetheless, combined market indicators may maintain Bitcoin trapped in a consolidation part. If bearish sentiment persists and new traders fail to drive robust demand, BTC might battle to interrupt previous $100,000. A chronic consolidation part may lengthen for a number of days, stopping a decisive breakout.

Bitcoin Worth Evaluation. Supply: TradingView

A shift in momentum could be essential to invalidate the neutral-to-bearish outlook. If Bitcoin efficiently flips the $100,000 barrier into assist, it may pave the way in which for sustained upside motion. A confirmed breakout would sign renewed investor confidence, pushing BTC towards larger value targets.