Santiment studies a 2.6% development in Bitcoin whale wallets over the previous 5 weeks, marking the very best stage since December 2024.

This development comes amid Bitcoin experiencing lacklusture efficiency in current weeks. After hitting a low close to $81K yesterday, Bitcoin is now on a restoration run, climbing again as much as round $84K by April 1.

Regardless of the market’s volatility, constructive developments have emerged, notably within the development of Bitcoin whale wallets. Wallets holding between 1,000 to 10,000 BTC have seen a noticeable improve, as shared by market intelligence platform Santiment.

Bitcoin Whale Wallets Are Rising

Within the final 5 weeks, the variety of these whale wallets has grown by 2.6%, reaching a complete of 1,993. This marks the very best stage of such wallets since December 2024.

Whereas market circumstances have been risky, this rise in whale pockets numbers means that key stakeholders proceed to point out confidence in Bitcoin’s potential.

Bitcoin welcoming 50 extra new whales

Lengthy-Time period Holder Confidence

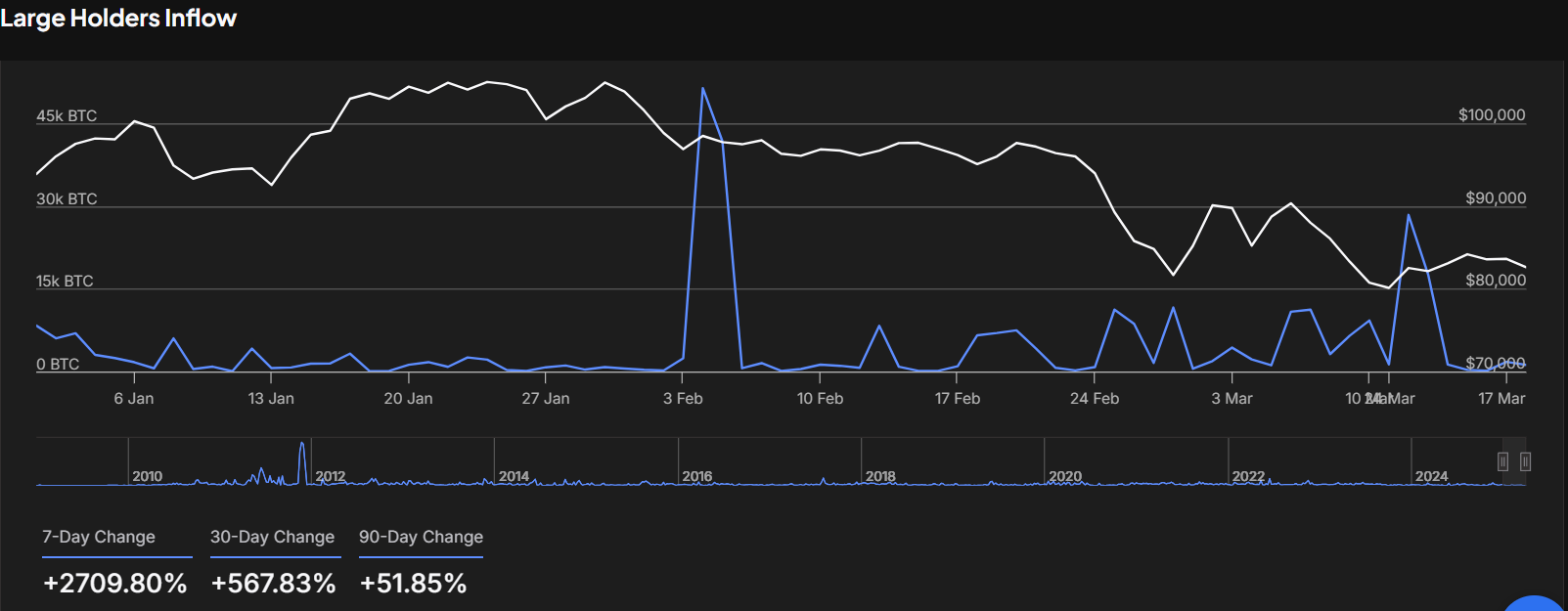

Additional evaluation from IntoTheBlock confirms a surge in Bitcoin accumulation by giant holders, which is contributing to the rising sense of stability. Over the previous week, giant holder inflows have elevated by a dramatic 2,709.80%, with a 567.83% rise over the previous 30 days.

This constant accumulation during the last three months suggests that giant holders are steadily rising their positions regardless of short-term market fluctuations.

Bitcoin Giant Holder Influx | IntoTheBlock

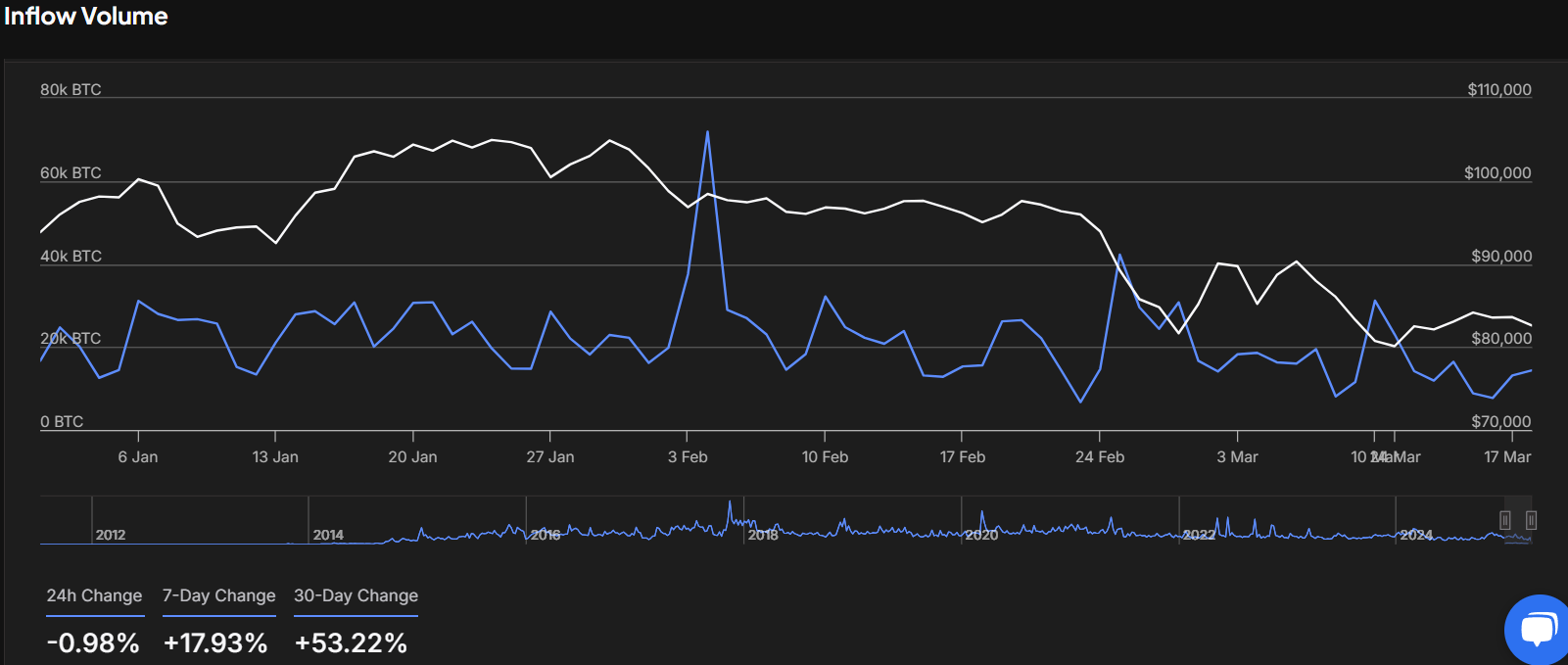

Bitcoin Change Influx Volumes Stabilizing

In the meantime, Bitcoin’s influx volumes to exchanges have additionally displayed indicators of stabilization. Over the previous 24 hours, inflows decreased by 0.98%, pointing to a stabilization within the provide of Bitcoin transferring to exchanges.

Bitcoin Change Influx Quantity | IntoTheBlock

Nonetheless, the 7-day and 30-day modifications reveal a rise in inflows, with a 17.93% rise previously week and a 53.22% rise during the last 30 days. These figures point out that whereas extra Bitcoin entered exchanges throughout the current worth decline, the current inflow is slowing.