Main Bitcoin holders management about 67.77% of the cryptocurrency’s provide, signaling sturdy confidence within the asset regardless of latest market volatility. These buyers, holding between 10 and 10,000 BTC, have added over 53,600 BTC since March 22, reinforcing long-term bullish sentiment.

🐳🦈 Bitcoin’s key stakeholders comprised of wallets holding between 10 & 10K BTC at the moment maintain 67.77% of the complete provide of crypto’s high market cap asset. Throughout the April volatility, these wallets proceed to build up, and have now added over 53.6K BTC since March twenty second. 👍 pic.twitter.com/eCalVW0FQf

— Santiment (@santimentfeed) April 19, 2025

The substantial Bitcoin holders maintained their shopping for momentum throughout April regardless of market worth variations. Robust institutional shopping for behaviour alerts long-term funding motives, granting gamers higher safety from market downturns. Brief-term buyers at the moment face accumulating losses, whereas long-term buyers maintain totally different funding methods.

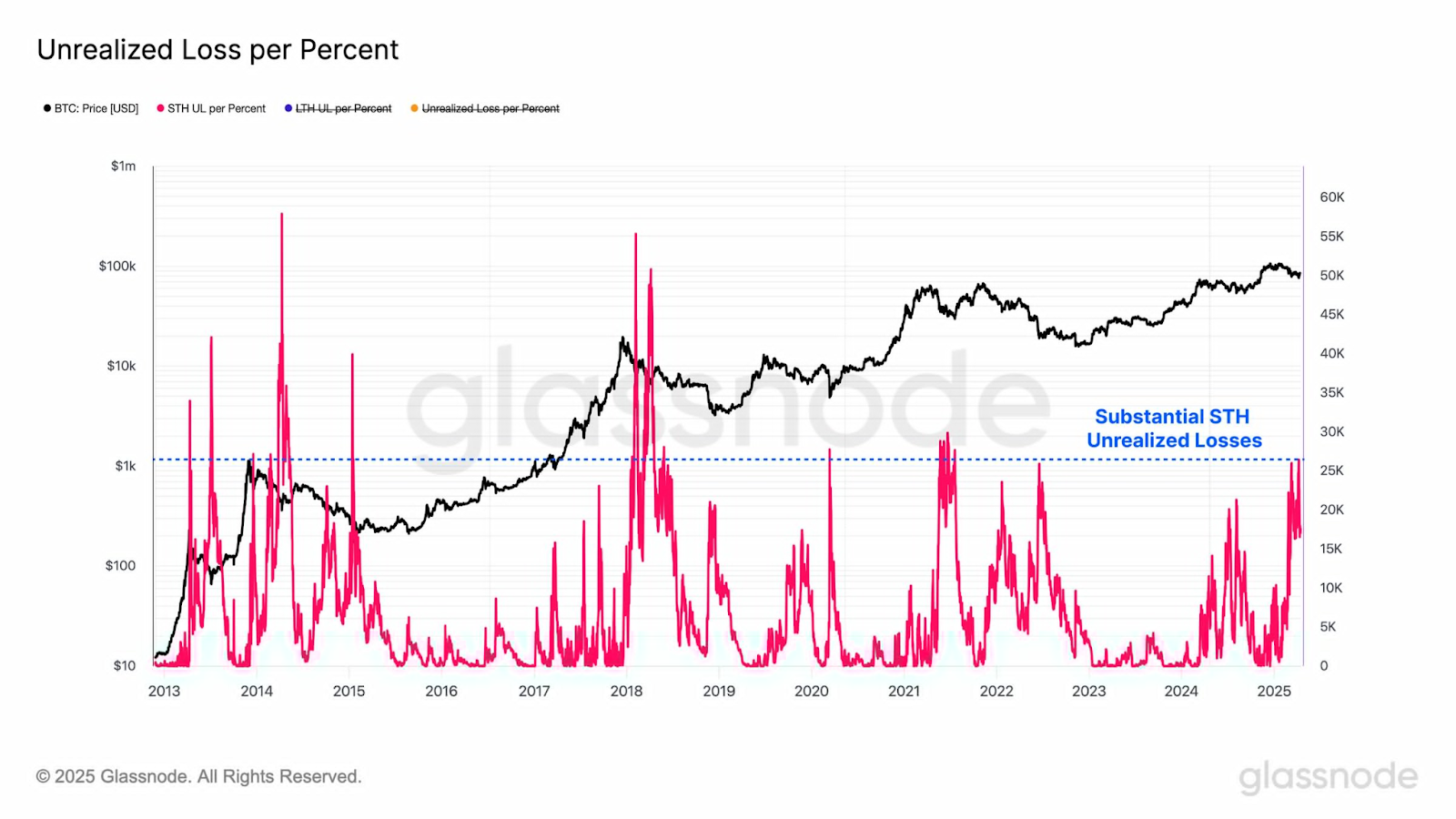

Brief-Time period Bitcoin Losses

Primarily based on information from Glassnode, it reveals that buyers holding Bitcoin just for quick durations at the moment are dealing with important losses in worth. The platform information demonstrates that the current market correction has reached comparable depths because the early durations of bear markets, which occurred throughout earlier Bitcoin cycles. Brief-term buyers have suffered appreciable losses due to this correcting market motion.

Supply: Glassnode

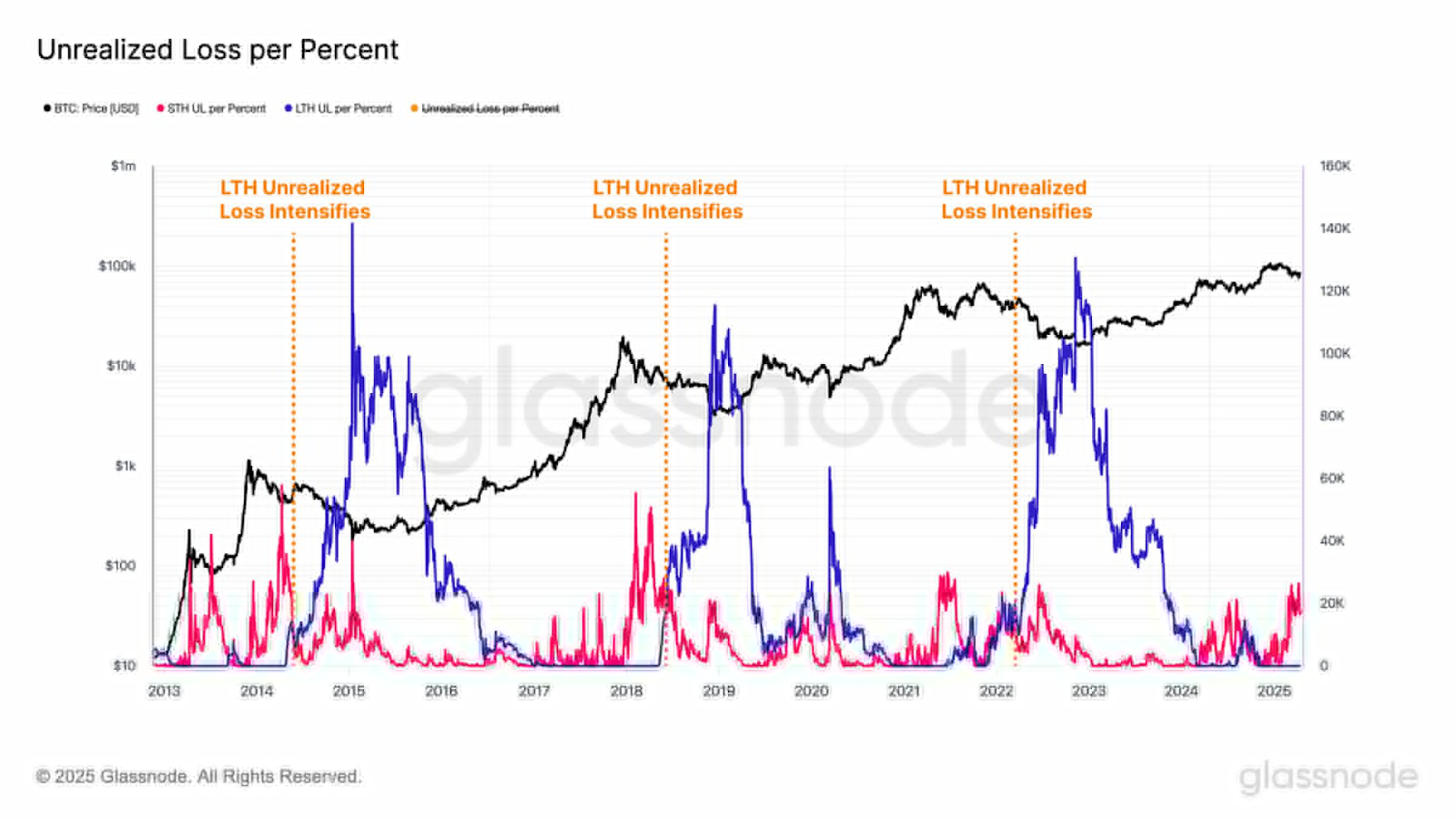

Additional, the information reveals that long-term holders (LTHs) primarily stay worthwhile throughout this era. Buyers with long-term funding methods have managed higher than these holding for brief durations.

A number of early Bitcoin patrons have transitioned to the LTH class, strengthening their means to endure volatility. Traditionally, this transition into the long-term holder class led to bear market confirmations, however an official bear market is but to happen.

Supply: Glassnode

Bitcoin’s Unsure Market Outlook

Bitcoin’s market outlook stays unsure for the approaching years. Lengthy-term holders might expertise elevated loss absorption, however a full bear market collapse appears unlikely. Though short-term holders turning into long-term holders might convey adjustments to the market, future stability stays undetermined, given the present unpredictable situations.

The foremost holders are altering their methods, and that is an upcoming sign available in the market. The way forward for Bitcoin is ruled by the actions of main holders and short-term merchants who successfully mitigate these dangers. The market stays looking out for extra indicators to find out if the prevailing market shift is simply short-term hype or the onset of an extended bear development.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.