A Constancy Digital Property report signifies that Bitcoin’s main scaling answer is rising at roughly twice the speed proven by public information as a result of a lot of its community exercise stays personal.

The Lightning Community Is Rising and Establishments Are Taking Discover

The entire capability of Bitcoin’s Lightning Community has jumped 384% since 2020 as an growing variety of establishments bounce onto the BTC bandwagon, based on a current analysis report by Constancy Digital Property, the crypto arm of behemoth cash supervisor Constancy Investments which manages greater than $15 trillion.

The report, revealed on Wednesday by Constancy Senior Digital Asset Analysis Analyst Daniel Grey at the side of Bitcoin infrastructure agency Voltage, paints an image of a maturing community that, whereas functionally secure sufficient for some institutional use, nonetheless requires essential tweaks earlier than it’s prepared for prime time.

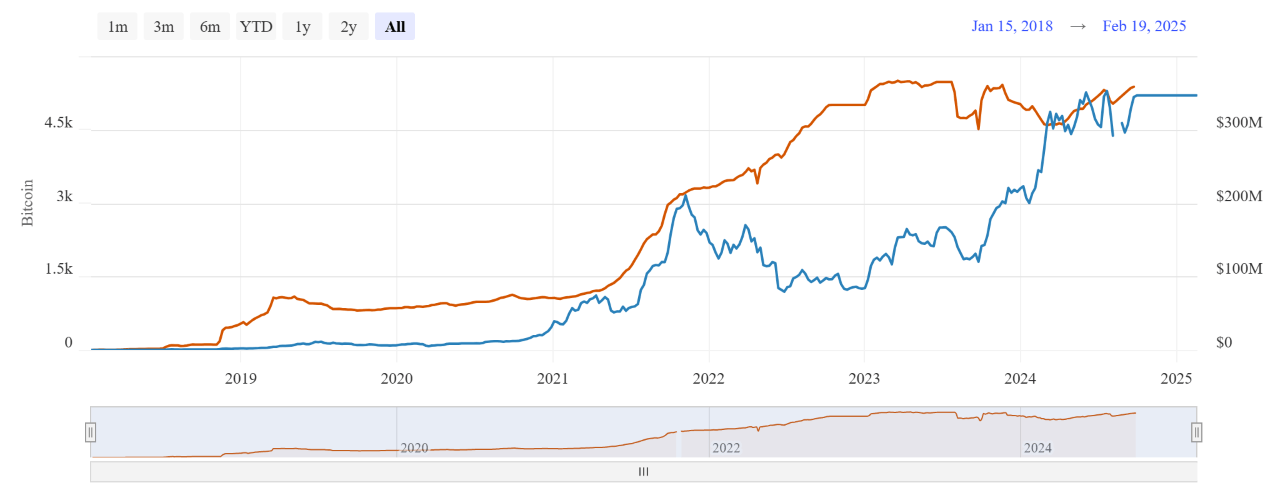

Again in 2018, the likelihood of efficiently shopping for a cup of espresso with bitcoin (BTC) utilizing Lightning was like flipping a coin. Lightning capability was a paltry $1.9 million in December of that 12 months and node rely was a dismal 2,329, based on Bitcoin Visuals. However now, Constancy’s report reveals small transactions had a 95% success fee in 2024 and the Lightning Community’s whole capability has soared 384% since 2020 and was roughly $509 million (5,358.50 BTC) throughout practically 17,000 nodes in January 2025.

(Historic capability of the Lightning Community / bitcoinvisuals.com)

“It’s price noting that this capability doesn’t embrace personal or unannounced channels,” Grey defined. “That are estimated to be simply as substantial,” he added, which implies Lightning’s capability might be double of what the report states.

Different Key Metrics

Non-public Lightning metrics may be estimated by reviewing information from infrastructure companies corresponding to Voltage which offered Constancy with entry to anonymized consumer information for that very objective.

Charges

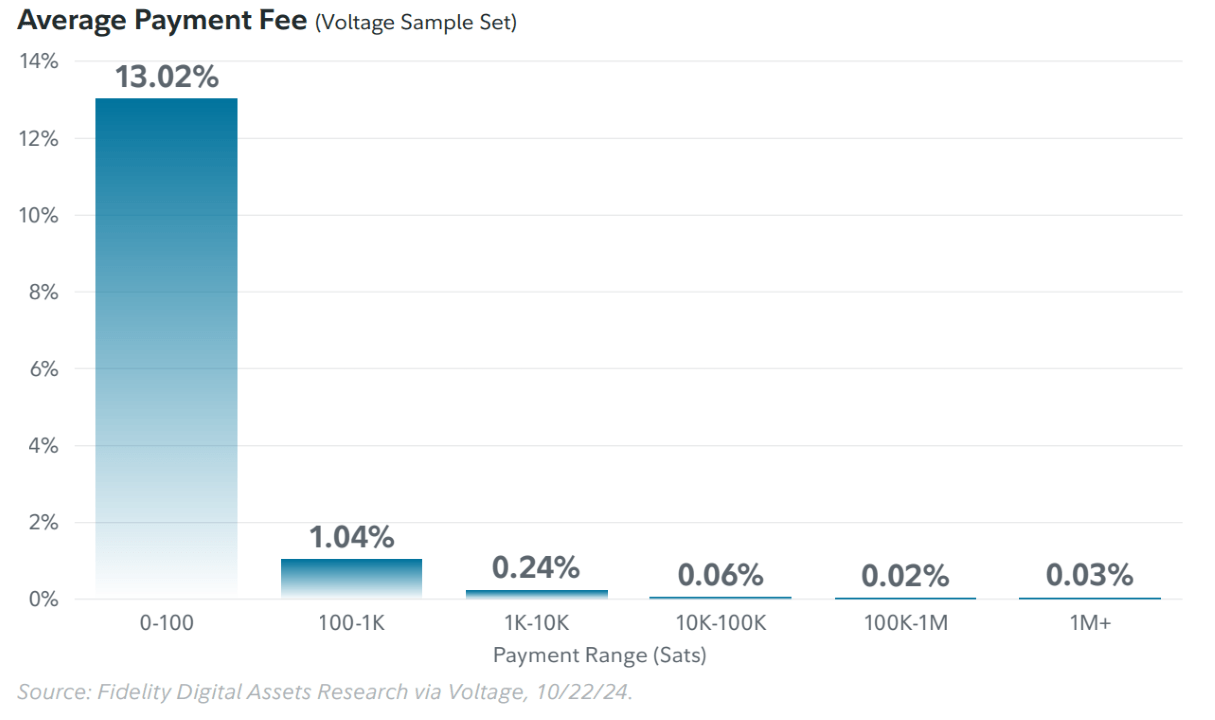

The report reveals that Lightning charges range extensively, largely relying on the variety of nodes a transaction should undergo earlier than reaching its vacation spot, known as the variety of “hops” a transaction takes. Apparently, cost measurement doesn’t immediately have an effect on transaction value, however the extra the hops, the upper the charges. In response to Grey’s report, a $1,000 transaction sometimes prices anyplace between $0.39 and $1.27, which represents a fraction of 1 %.

(Common charges on the Lightning Community / Constancy Digital Property and Voltage Inc.)

“By way of a well-connected self-hosted node, transactions that required one to a few hops paid a mean of 0.04%,” Grey stated

Velocity

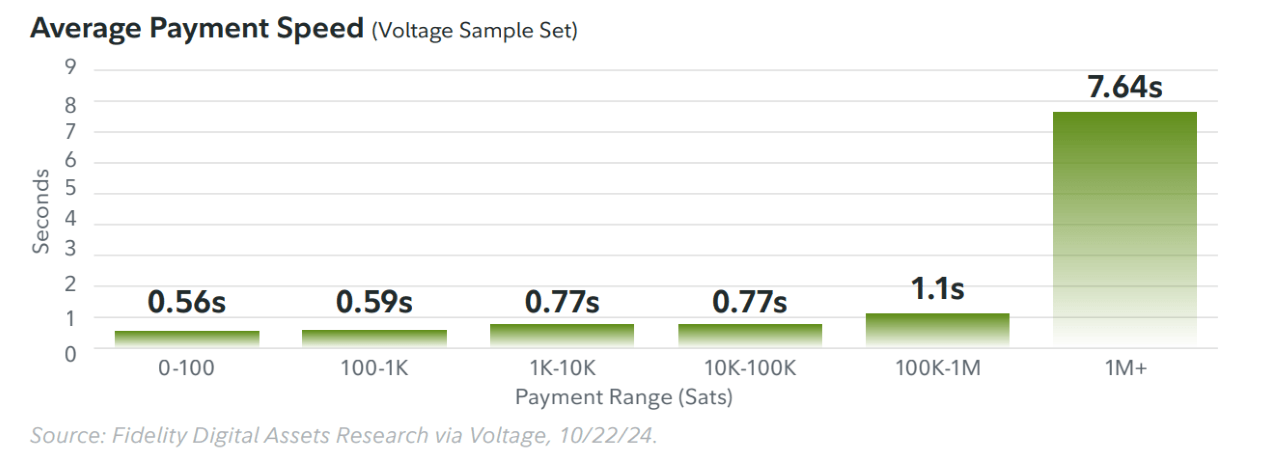

Whereas transaction measurement doesn’t immediately influence value, it does decelerate execution velocity. Probably the most noteworthy criticism of Lightning, actually from a retail consumer perspective, is its requirement for channel capability or liquidity earlier than a transaction may be routed.

Inbound and outbound liquidity describe the flexibility to obtain or ship funds on the community. To ship funds, one should have already got funds, which is sensible, however surprisingly sufficient, Lightning additionally requires customers to obtain funds to determine inbound liquidity by committing funds and making outbound funds. For instance, to obtain one bitcoin, you have to have already got not less than one bitcoin.

This makes massive funds tougher to settle because the algorithm should discover a node with enough inbound liquidity to obtain massive quantities, decreasing the velocity of execution and probably growing the variety of hops, which subsequently will increase charges.

(Common cost velocity on the Lightning Community / Constancy Digital Property and Voltage Inc.)

“Nearly all transactions under a million sats finalize in lower than one second,” Grey stated. A million satoshis or “sats” is equal to roughly $1,000 at present costs. Bigger quantities take about 7.64 seconds, based on the report.

Success Price

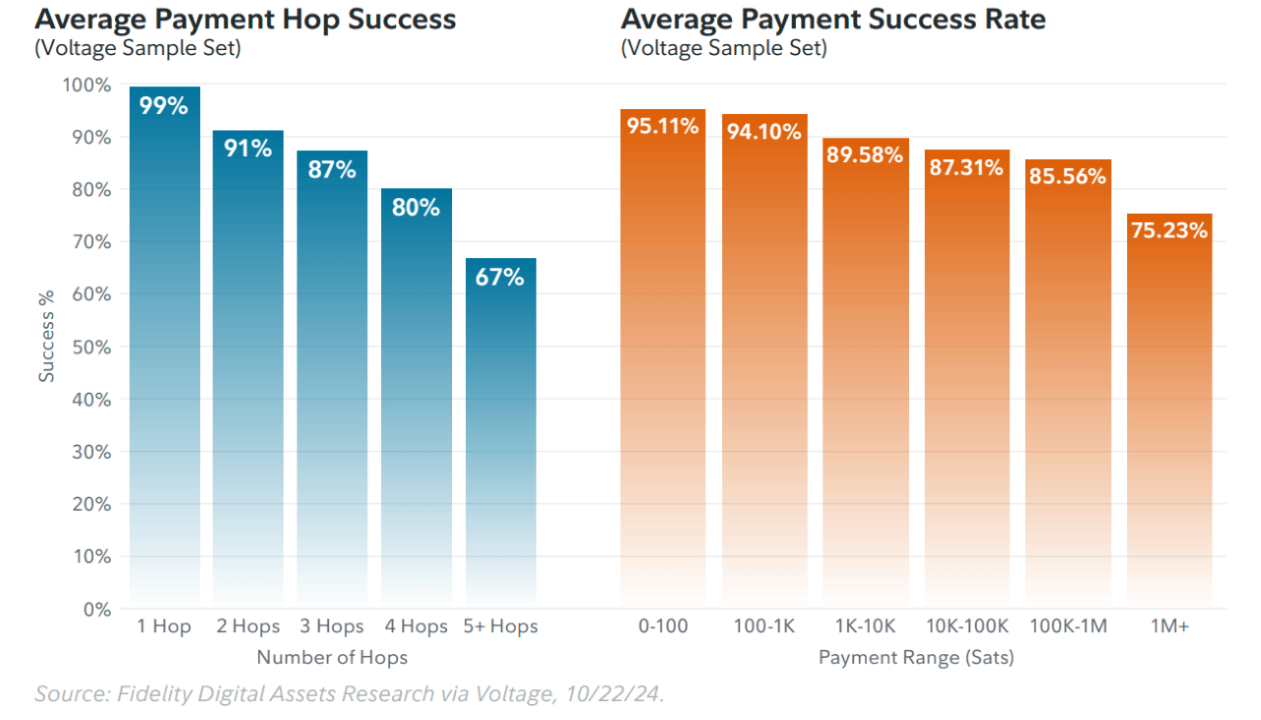

Earlier, a dismal 48% success fee for utilizing Lightning to pay for a cup of espresso was referenced. Fortuitously, that metric has vastly improved, and virtually all Lightning funds have a hit fee that falls inside a variety of 75-95%.

(Lightning Community success charges / Constancy Digital Property and Voltage Inc.)

“The 99%+ success fee is feasible with correct configurations,” Grey defined. “A key issue on this fee is engineering options corresponding to cost retries,” he added. “With these options in place, we anticipate that funds on Lightning will turn out to be simpler and extra dependable.”

Though Grey seems usually smitten by Lightning adoption, it’s clear that the community continues to be a work-in-progress. It feels prefer it’s on the stage the place the Web transitioned from dial-up to cable. And simply because the Web continued to progress and went from cable to DSL (digital subscriber line) then to fiber optic, many hope Lightning advances to its subsequent stage, which is the place the actual magic will occur.

“By adopting this expertise, banks, exchanges, and cost processors could possibly place themselves on the forefront of economic innovation,” Grey stated. “For Lightning to be really efficient, customers want Lightning funds to work 100% of the time.”