Bitcoin’s current value motion has put vital stress on a selected group of buyers. Lengthy-term holders are trying comparatively okay with Bitcoin’s current value motion, short-term members, alternatively, are beginning to really feel the warmth. Market knowledge now means that this cohort could also be nearing some extent of capitulation, however the larger image reveals a extra advanced story the place short-term holders can nonetheless cling on.

Quick-Time period Holders Face Losses However Keep Inside Limits

On-chain knowledge exhibits that Bitcoin’s short-term holders (STHs) have incurred realized losses of $7 billion over the previous 30 days. Quick-term holders are addresses who’ve held BTC for lower than 155 days. This development is famous by means of knowledge from on-chain analytics platform Glassnode, which identified that the run of losses marks probably the most extended loss occasion of the present market cycle.

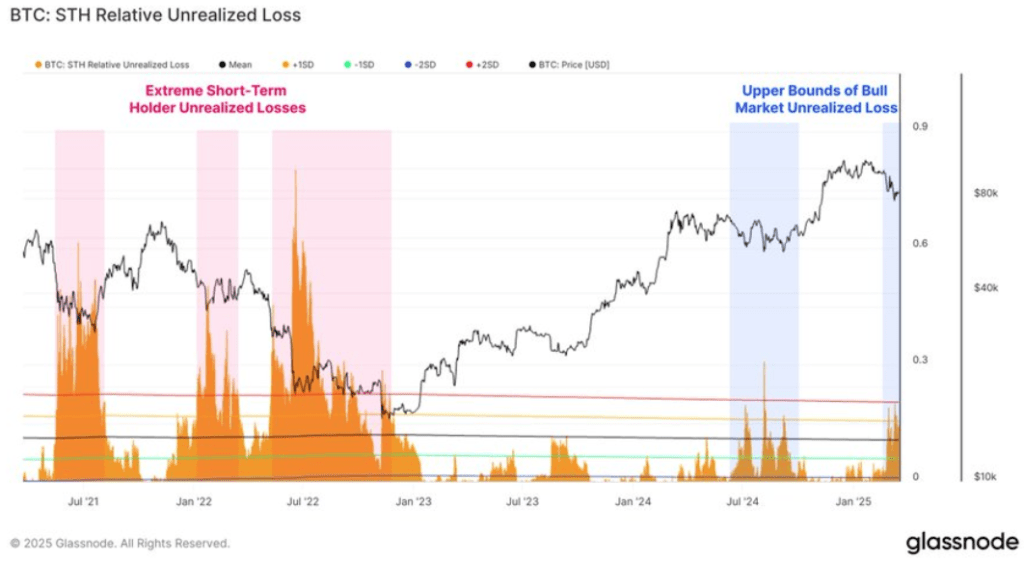

Along with realized losses, unrealized losses have intensified, pushing many STH-held cash underwater. Glassnode’s evaluation signifies that these losses are nearing the +2σ threshold, which is a degree that has traditionally pointed to an elevated threat of capitulation.

Picture From X: Glassnode

Regardless of the mounting capitulation threat, historical past exhibits that short-term Bitcoin holders should not within the worst place they could possibly be in. The present figures stay properly beneath the $19.8 billion and $20.7 billion loss spikes witnessed in the course of the 2021–2022 crash.

Picture From X: Glassnode

Though the losses are vital, they’re nonetheless aligned with patterns seen in the midst of earlier corrections throughout bull markets. This pertains to a technical outlook from crypto analyst PlanB that Bitcoin is nonetheless within the center of its bullish run.

Bitcoin Bull Rating Plunges, ETF Outflows Stress Sentiment

Though Bitcoin may nonetheless be mid-cycle, sentiment indicators paint a pressured image, with the value down by 23% from its current all-time excessive in January. Information from CryptoQuant reveals that Bitcoin’s Bull Rating has dropped to twenty, its lowest level in two years. Main value recoveries have solely taken place when the Bull Rating climbs above 60. This present low studying is an indication that the crypto market remains to be trapped in uncertainty, the place sellers are at the moment outpacing consumers and momentum.

Picture From X: CryptoQuant

A contributing issue has been the sustained capital outflow from Bitcoin exchange-traded funds. Since February, greater than $4.4 billion has flowed out of spot Bitcoin ETFs. These outflows have added weight to an already fragile value construction after Bitcoin began correcting from its all-time excessive in January.

As such, short-term holders who entered near this excessive and had been banking on a continued upside have been uncovered to a lot of the losses.

Picture From X: Ali_Charts

Regardless of the heavy outflows that outlined the previous few weeks, there are early indicators that this development could also be turning. Information from SosoValue exhibits that Spot ETF conduct shifted final week, with consecutive days of internet inflows into spot Bitcoin ETFs.

Picture From SoSoValue

Notably, Spot Bitcoin ETFs ended the week on a $744.35 million internet influx, bringing an finish to 5 consecutive weeks of outflows. This return of institutional curiosity could possibly be the primary signal of stabilizing optimistic Bitcoin sentiment.

On the time of writing, Bitcoin was buying and selling at $84,815.

Featured picture from Pexels, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.