Bitcoin’s value on December 1, 2024, hovers round $97,124, reflecting a consolidation section because the cryptocurrency market evaluates its subsequent directional transfer.

Bitcoin

The 1-hour chart reveals bitcoin (BTC) just lately rebounded after touching a low of $95,758. It’s now buying and selling inside a slim vary of $97,000 to $97,500. Present chart patterns present indecision, and tapering quantity throughout this consolidation section signifies merchants are awaiting a breakout. A transfer above $97,500, confirmed by robust quantity, may sign bullish momentum, whereas failure to maintain $96,500 might set off a draw back.

Key technical indicators assist this combined outlook. The relative energy index (RSI) reads impartial at 67, aligning with the impartial alerts from the Stochastic oscillator, commodity channel index (CCI), and superior oscillator. Momentum at -1,188 and the transferring common convergence divergence (MACD) at 5,018 recommend bearish undertones within the brief time period.

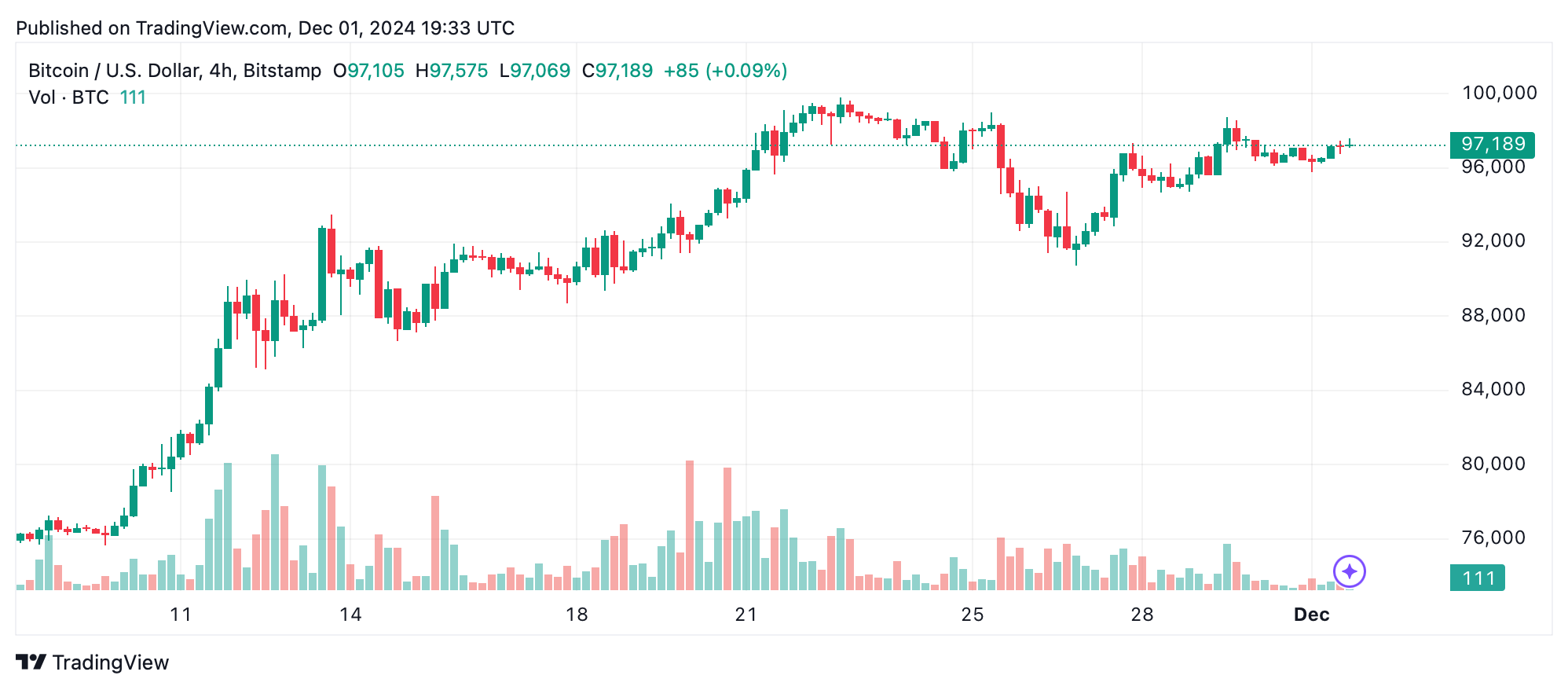

On the identical token, the 4-hour chart, bitcoin has been forming greater highs and lows, signaling an uptrend. Nonetheless, the slowing momentum close to $98,745, coupled with declining buying and selling volumes, signifies exhaustion. The mid-term chart suggests a possible breakout from tight value motion.

Essential ranges to look at embody assist at $95,000 to $95,500 and resistance at $98,745. A breakout above $98,745 may sign continuation towards $100,000, whereas a breach beneath $95,000 might check decrease ranges round $93,000. Shifting averages such because the exponential transferring common (EMA-20) and easy transferring common (SMA-20) point out bullish tendencies, reinforcing the potential for upward motion.

The day by day chart outlines a robust uptrend since bitcoin hit $66,798 in early November, reaching a lifetime excessive of $99,800 earlier than going through resistance close to the psychological $100,000 mark. Smaller candlestick our bodies on this chart across the $97,000 to $98,000 zone reveal hesitation amongst market individuals.

Main assist is positioned at $95,000, whereas a decisive breakout above $99,800 may propel costs to $102,000 or greater. Conversely, a day by day shut beneath $95,000 might invalidate the bullish sample. Quantity spikes in the course of the rally recommend robust shopping for curiosity remains to be evident, however declining exercise signifies a necessity for renewed momentum.

The transferring averages (MAs) stay a cornerstone of bitcoin’s technical profile, constantly pointing to bullish sentiment. The EMA (10) at $95,543 and SMA (10) at $96,260 assist short-term shopping for, whereas the EMA (100) at $75,158 and SMA (100) at $70,255 spotlight energy within the broader development. Notably, all monitored exponential and easy transferring averages, starting from 10 to 200 durations, recommend bullish situations.

Bull Verdict:

Bitcoin’s technical setup leans bullish because it consolidates close to important resistance ranges, supported by upward momentum on the 4-hour and day by day charts. Shifting averages throughout all timeframes underscore robust shopping for situations, suggesting a breakout above $99,800 may push costs towards $102,000 or greater. Merchants ought to monitor quantity spikes to substantiate a renewed rally.

Bear Verdict:

Regardless of the broader uptrend, bitcoin exhibits indicators of exhaustion with declining momentum and quantity throughout a number of timeframes. Bearish alerts from the momentum and MACD, coupled with key assist at $95,000 underneath menace, point out a possible pullback towards $93,000 or decrease if bulls fail to regain management.