Bitcoin’s worth correction throughout a number of timeframes reveals short-term bearish strain whereas sustaining a bullish outlook in the long run.

Bitcoin

Bitcoin’s (BTC) latest worth motion highlights a bearish correction throughout short-term timeframes, whereas the broader pattern stays bullish, with key ranges dictating potential alternatives for merchants.

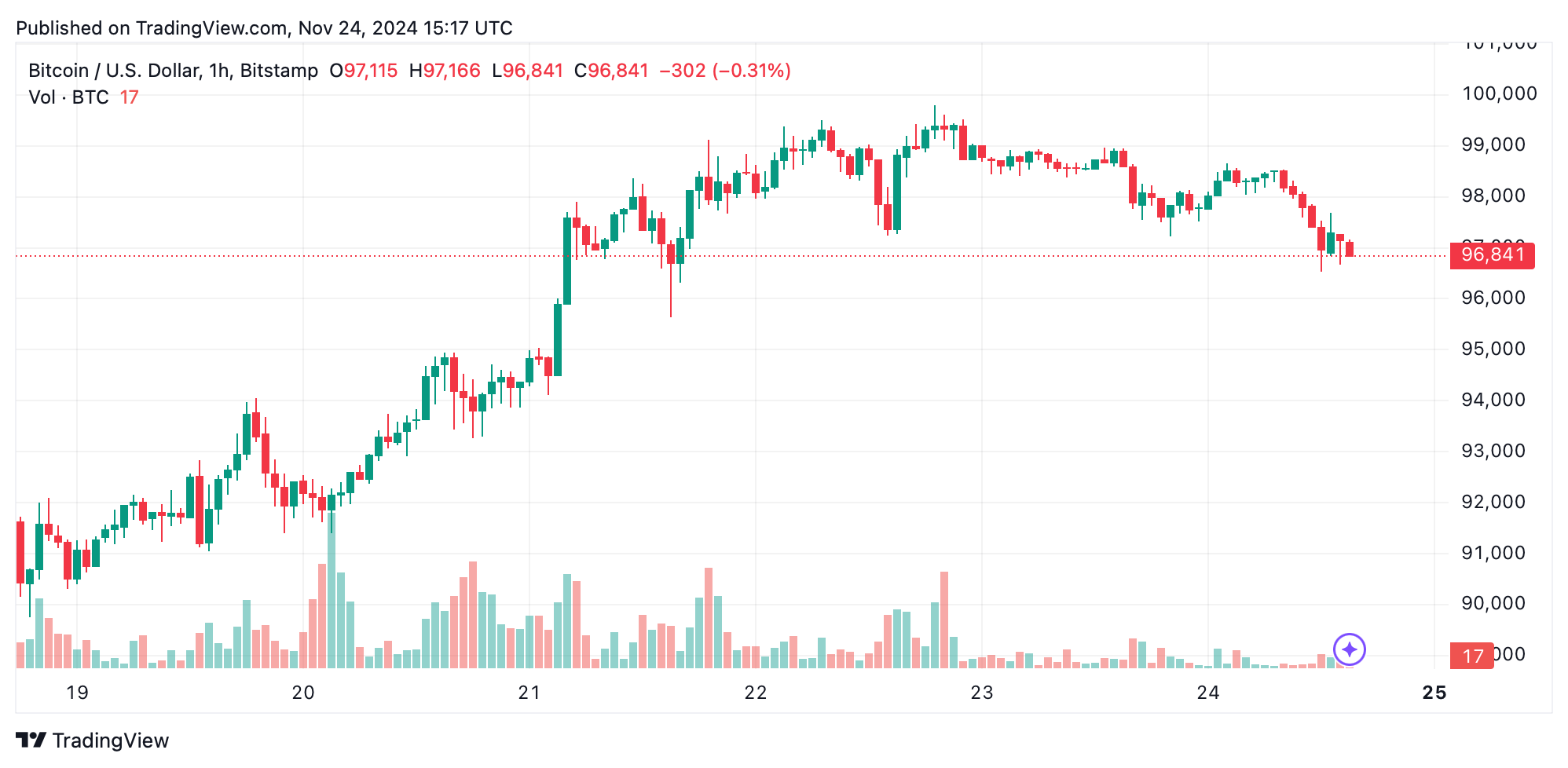

BTC/USD 1-hour chart through Bitstamp on Nov. 24, 2024.

The hourly chart reveals a short-term bearish pattern for bitcoin, with worth motion oscillating between $96,556 and $97,118. Growing promoting quantity and consecutive crimson candles point out a dominant bearish sentiment. A small inexperienced candle hinted at a reversal, however the lack of follow-through confirmed the downward momentum. Key help rests at $96,500; a break beneath this degree may set off additional promoting towards $95,000. Merchants ought to search for a decisive breakout above $97,500, supported by robust quantity, earlier than contemplating lengthy positions.

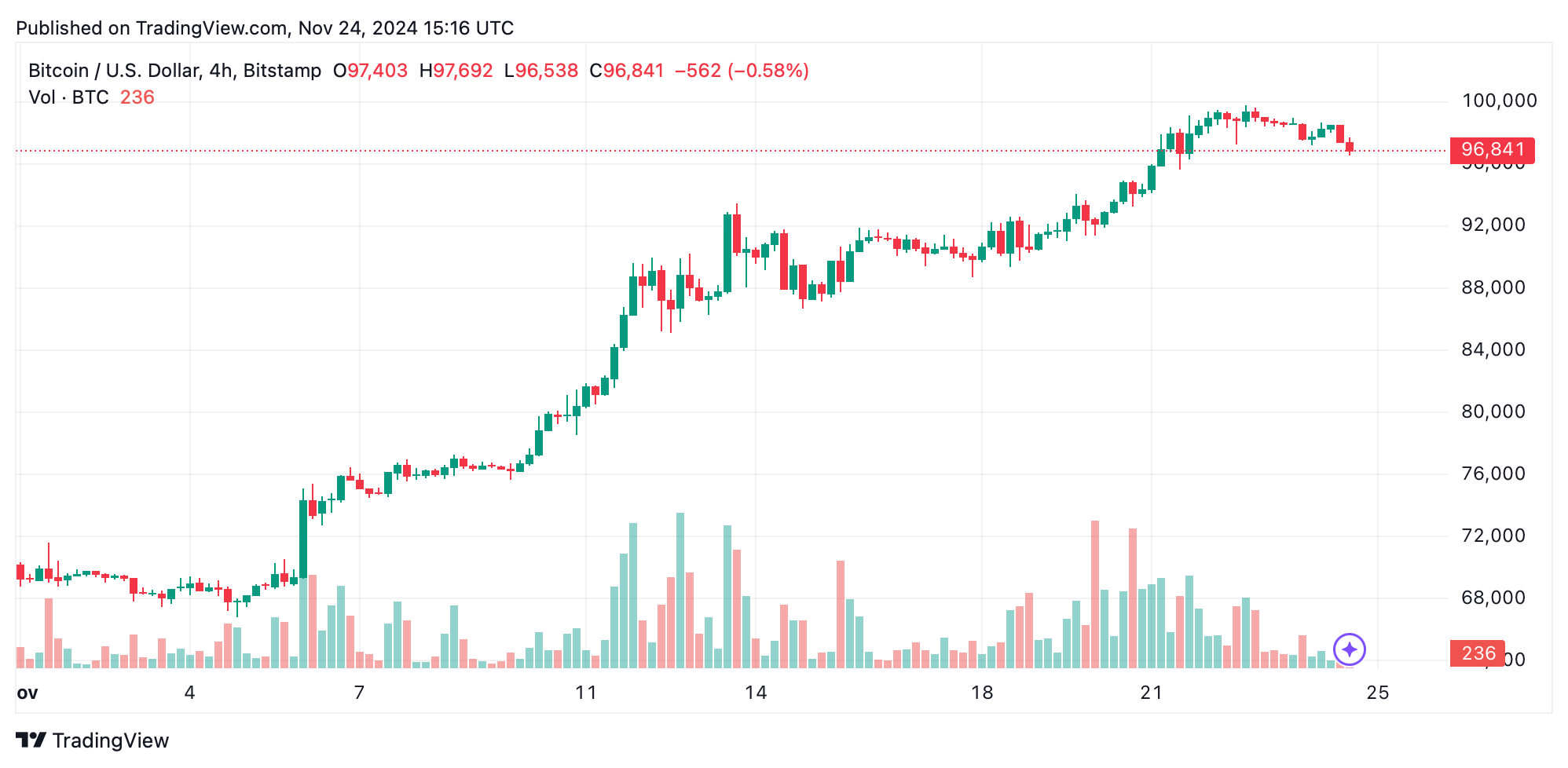

BTC/USD 4-hour chart through Bitstamp on Nov. 24, 2024.

On the 4-hour chart, bitcoin is in a transparent downtrend, characterised by decrease highs and decrease lows. The worth has retraced from a neighborhood peak of $99,800, and help at $96,500 stays pivotal. Promoting quantity surpasses shopping for quantity, reinforcing bearish momentum. Ought to bitcoin maintain this help, a short-term bounce is believable; nevertheless, failure to maintain this degree may push costs right down to $95,000 or decrease. Resistance at $98,000 to $99,800 should be reclaimed for the mid-term pattern to shift bullish.

BTC/USD every day chart through Bitstamp on Nov. 24, 2024.

The every day chart displays a broader bullish pattern, although latest worth motion suggests exhaustion. Bitcoin’s rally to $98,907 is adopted by declining commerce quantity, hinting at waning momentum. A doji candlestick close to the latest peak emphasizes market indecision, resulting in a pullback. Assist at $96,000 could present a sexy entry level for lengthy positions, supplied quantity confirms a shopping for resurgence. Ought to this degree fail, bitcoin may retrace to $90,000.

From an oscillator perspective, the relative energy index (RSI) at 75 suggests bitcoin is overbought on the hourly chart, signaling warning for brand spanking new longs. The shifting common convergence divergence (MACD) degree stays constructive at 6,922, indicating upward momentum on increased timeframes. Momentum indicators just like the superior oscillator and exponential shifting averages (EMAs) from 10-period to 200-period all favor shopping for, highlighting the long-term energy regardless of short-term corrections.

Bull Verdict:

Bitcoin’s long-term bullish pattern stays intact, supported by robust momentum indicators and upward-moving averages, making pullbacks to $95,000 or $96,500 potential shopping for alternatives for merchants searching for the subsequent rally.

Bear Verdict:

Brief-term bearish strain dominates, with key help at $96,500 below menace; a decisive break beneath this degree may speed up bitcoin’s decline towards $95,000 or decrease, signaling warning for bullish positions.