At present, the Bitcoin market stands at the least 22.94% under the all-time peak, and is round 1.84% under the closing worth of March 1. This month, the US share market has additionally skilled a decline of 6%. Specialists blame the sharp drop within the world liquidity for the downtrend within the markets. Nonetheless, studies recommend that the worldwide liquidity has touched its backside. Might Bitcoin see a reversal? Here’s what you need to know!

Why Specialists Imagine Bitcoin Might Reverse Quickly

Studies recommend that the worldwide liquidity has bottomed. This means that the liquidity is more likely to begin growing quickly.

In keeping with specialists, there’s a 80% correction between Bitcoin and world liquidity. A correlation of 80% may be very excessive. Because of this there’s an 80% likelihood that the value of Bitcoin will go up if the worldwide liquidity improves.

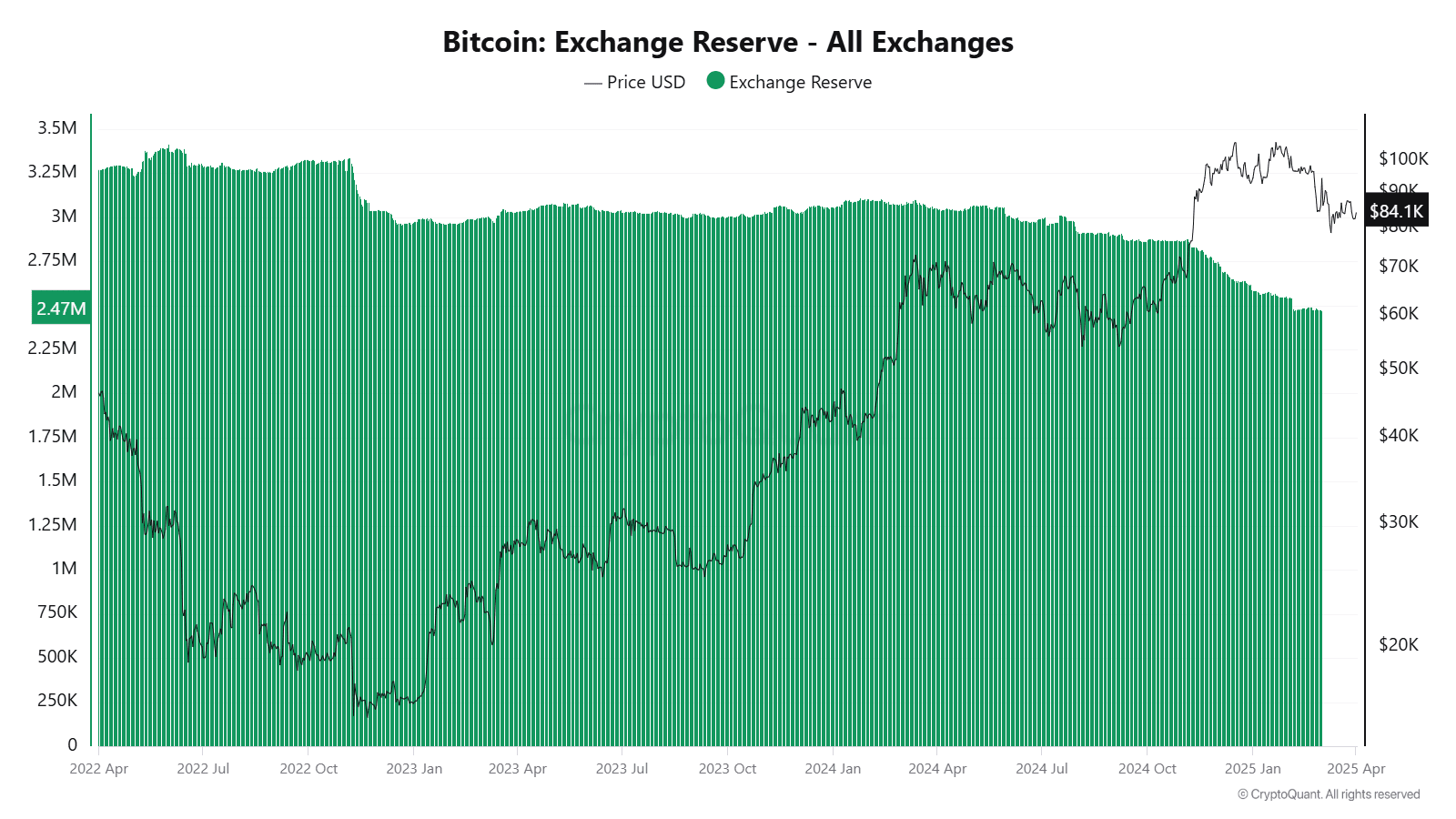

In keeping with Coinglass, the full change stability of BTC sits at 2,197,123.37. Its 24-hour change is +16629.17 and its 7-day change is -7184.75. Yesterday, the Bitcoin Pockets web move was +3.81K BTC.

Technical Indicators

A golden cross, the place a shorter-term shifting common crosses above a longer-term one is commonly seen as a bullish sign. The SMA-50 of BTC stays at $88,254.66, and the SMA-200 of the asset stands at $86,180.45.

BTC’s RSI stays at 46.57. If the RSI strikes constantly above the impartial 50 degree and heads in direction of overbought territory (above 70), it will possibly point out growing shopping for momentum.

In conclusion, with world liquidity exhibiting indicators of restoration, Bitcoin could possibly be poised for an upward transfer.