Bitcoin’s value has been scaring off lots of newcomers with uneven actions, which add to the general uncertainty.

But, issues may not be over for the asset’s bull run, as one other rally might be sure to occur quickly.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Every day Chart

On the each day chart, the cryptocurrency has been consolidating beneath the vital $100K degree after briefly rising above it twice. A big falling wedge sample is forming in the meanwhile, which has the market trapped inside.

If the worth is ready to break the sample to the upside with momentum, an aggressive rally will possible happen within the coming months, which may even see BTC contact the $120K mark.

The 4-Hour Chart

On the 4-hour timeframe, issues look much more fascinating, as Bitcoin is displaying early indicators of a brand new bullish section.

The market has hunted the cease losses of many merchants when it briefly dropped beneath the $90K space and has quickly rebounded. This can be a typical reversal sample, with the worth additionally breaking the current excessive and creating the next one. Consequently, a rally no less than towards the $100K degree might be anticipated quickly.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

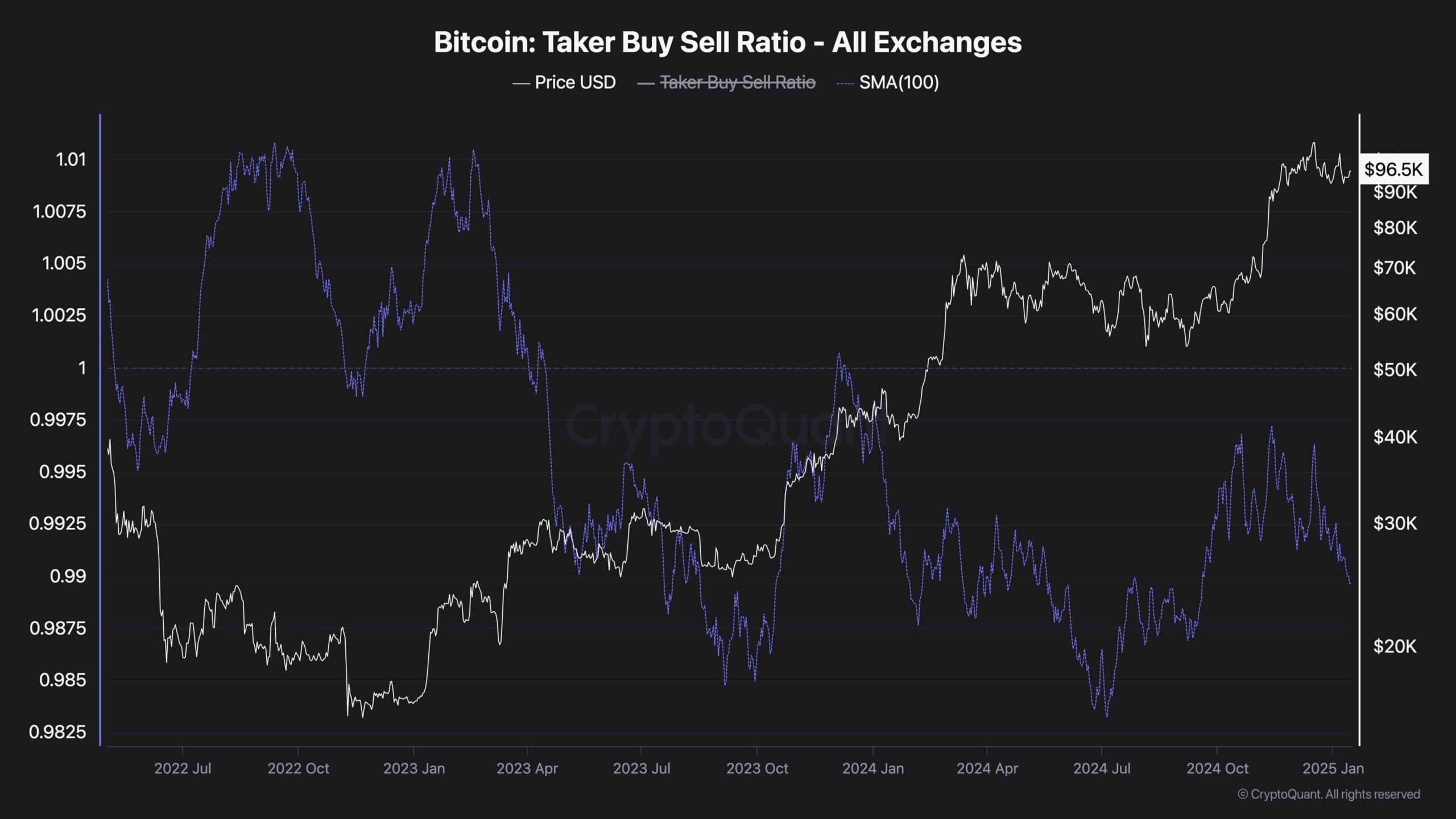

Bitcoin Taker Purchase Promote Ratio

With Bitcoin demonstrating rangebound value motion, traders are questioning what’s stopping the market from persevering with its rally greater. Analyzing the futures market metrics yields a possible reply.

This chart presents the Bitcoin taker buy-sell ratio, which measures whether or not the consumers or the sellers are executing their positions extra aggressively within the futures market. Aggressive orders are these executed on the market.

Because the chart exhibits, the 100-day transferring common of this metric has just lately skilled a downturn after months of trending greater. Which means that the sellers are as soon as once more the dominant drive within the futures market and have possible precipitated the present halt in Bitcoin’s bullish run.