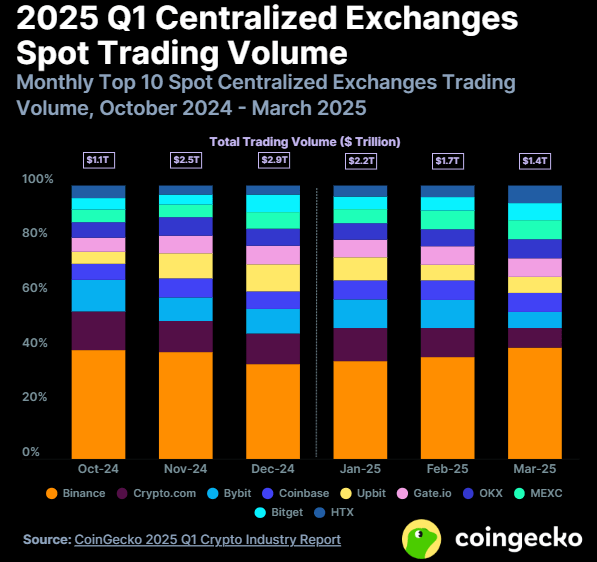

Spot buying and selling quantity throughout the highest ten centralized exchanges (CEXs) hit $5.4 trillion in Q1 2025, a 16.3% decline from the earlier quarter, as crypto market momentum cooled following a euphoric finish to 2024.

Prime Crypto Exchanges See 16% Quantity Dip in Q1 2025

Crypto buying and selling cooled off sharply within the first quarter of 2025. In accordance with CoinGecko’s Q1 crypto business report, spot buying and selling quantity on the highest ten centralized exchanges (CEXs) totaled $5.4 trillion, a 16.3% drop in comparison with This autumn 2024.

Binance held on to its lead with a 40.7% market share, though its month-to-month quantity tumbled from over $1 trillion in December to $588.7 billion in March. In the meantime, HTX stood out as the one change among the many prime ten to submit progress, up 11.4% for the quarter. Upbit suffered the steepest decline, with quantity plunging 34% to $371 billion.

Bybit, reeling from a major February hack, recorded the most important month-to-month drop, down 52.4% to $84.7 billion. This drop in buying and selling exercise coincided with broader market weak spot.

The entire crypto market cap fell 18.6% to $2.8 trillion, whereas every day buying and selling volumes shrank 27.3% quarter-on-quarter. Regardless of hitting an all-time excessive of $106,182 in January, bitcoin ended the quarter down 11.8%, although its dominance grew to 59.1%, its highest stage since 2021.

The report additionally highlighted declines in DeFi and NFTs, with DeFi TVL shrinking by 27.5% and meme coin exercise sharply retreating post-Libra incident.