March exercise on centralized exchanges slowed down as a complete, following the pattern for the entire of Q1. Crypto derivatives remained extra resilient, ending the month with a smaller contraction.

In March, centralized buying and selling for all crypto belongings slowed down, following the general pattern of shedding volumes for the entire of Q1. By-product buying and selling proved extra resilient, solely contracting by 5%.

Centralized exchanges introduced in international visitors, although principally from crypto-friendly areas. The March outflow mirrored bearish attitudes and outflows from the South Korean market, in addition to the US market. Binance’s visitors and exercise mirrored sturdy ranges of curiosity from different international markets.

Spot buying and selling misplaced 16.6% regardless of inflows from whales and promoting strain for Bitcoin (BTC), in addition to Ethereum (ETH) and Solana (SOL). Spot exchanges additionally carried smaller liquidity within the type of stablecoins, whereas many of the further liquidity nonetheless supported by-product buying and selling.

In March, stablecoins on all centralized exchanges declined, with the whole stability sinking from over 48B right down to 45B tokens.

US-based merchants drive trade outflows for spot quantity and crypto derivatives

The lack of momentum affected principally three exchanges – Crypto.com (down by 43.9%), Bybit (down by 52.6%), and Bitfinex (down by 31.1%). A few of the spot buying and selling visitors moved to HTX, growing volumes by 29.4% for the month.

By-product trade exercise moved again to Kraken, up by 28.3% for March. The visitors moved from Crypto.com, which misplaced 39.3% of by-product exercise. Each Crypto.com and Coinbase misplaced visitors, signaling an outflow of US-based merchants. Regardless of this, US-based markets remained essentially the most liquid for the first quarter of 2025.

Visitors to crypto exchanges solely declined by 3% up to now month. The trade exercise on spot and by-product markets can also be not sorted primarily based on market makers or bots. A few of the extra dramatic buying and selling spikes could also be anomalies or deliberate bot-driven trades.

Exchanges additionally separated themselves primarily based on regional visitors inflows. Binance noticed comparatively small outflows whereas taking visitors from India, Vietnam, and Korea. Coinbase, alternatively, mirrored the misplaced confidence of US merchants, erasing the impact of the US Presidential elections.

The outflow of spot merchants can also be famous on DEX markets. Presently, decentralized markets make up round 10% of CEX spot buying and selling. Regardless of this, the unstable market offered alternatives for dangerous decentralized bets. In March and early April, Hyperliquid was one of many busiest DEXs by each day volumes.

Binance retains the liveliest asset flows

Binance was one of many centralized markets with essentially the most lively asset flows. The CEX is without doubt one of the important venues for by-product buying and selling, seeing among the largest each day liquidations.

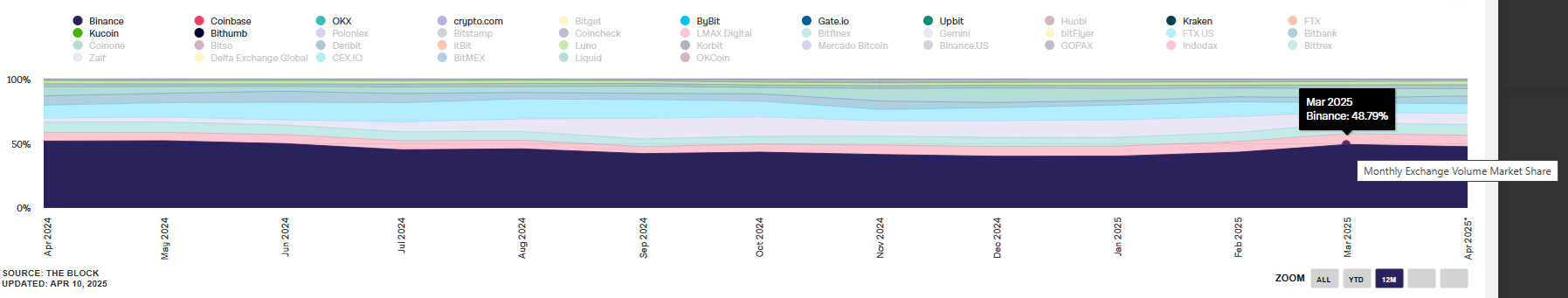

Based mostly on open positions, Binance stays a proxy for the complete by-product and futures market. The CEX can also be a benchmark for spot volumes, with over 29.5% of the complete market together with small and area of interest exchanges. For spot volumes, Binance was a pacesetter, with over 60% of all exercise in opposition to a shortlist of different giant exchanges, primarily based on information by Newshedge.

Binance remained a pacesetter amongst centralized exchanges for each spot and crypto derivatives exercise. | Supply: IntoTheBlock

The CEX additionally noticed the liveliest inflows of BTC, ETH, and stablecoins. The trade carries extra fixed balances with a strong provide of cash and tokens. In March, Binance noticed a internet outflow of BTC, however is now recovering the obtainable stability.

Regardless of the continued exercise, March was the slowest month of the yr to this point. Binance dominated all different exchanges by way of buying and selling volumes, however the total exercise adopted the weakening efficiency from January and February.