Because the crypto financial system has contracted by $150 billion since Monday, the downturn has notably impacted crypto shares, with a good portion of shares experiencing double-digit declines throughout the board.

Synchronized Selloffs: The Unbreakable Bond Between Crypto and Inventory Markets

Crypto-related equities have confronted substantial stress this week, aligning with the broader market downturn that unfolded throughout the identical interval. By Friday, all 4 benchmark U.S. indices concluded the buying and selling day within the pink, shedding appreciable worth.

On March 24, the crypto financial system was assessed at $2.82 trillion, however by March 29, it had diminished to $2.67 trillion. This contraction has weighed closely on crypto shares, with many bearing the total pressure of the decline.

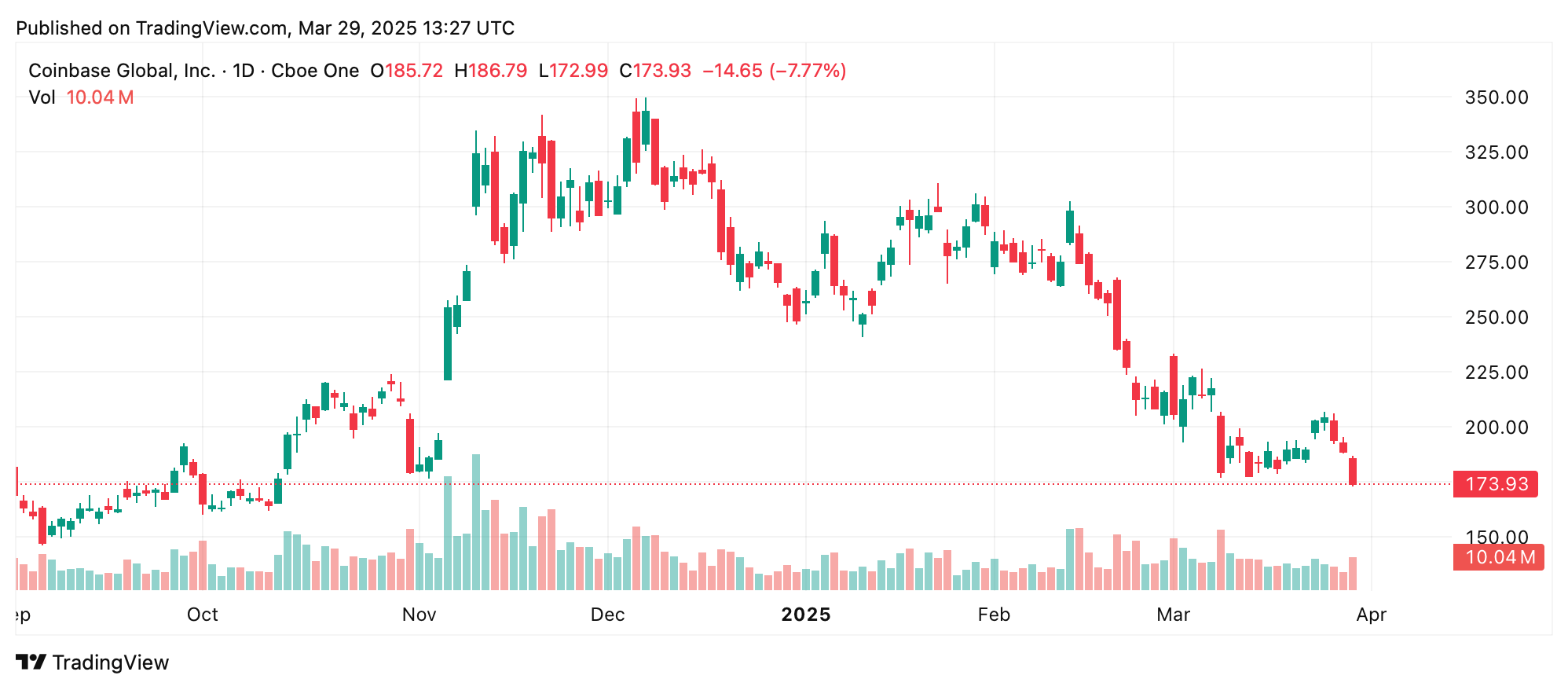

Coinbase (Nasdaq: COIN) on March 29, 2025.

Take Coinbase’s COIN, for instance, which has declined by 11.93% towards the U.S. greenback since Monday. The present market capitalization of COIN rests at $44.16 billion. In the meantime, Technique’s MSTR skilled an 8.46% drop over the span of 5 consecutive buying and selling periods. Publicly traded mining corporations have additionally borne important losses, with MARA Holdings’ shares retreating by 14.64%.

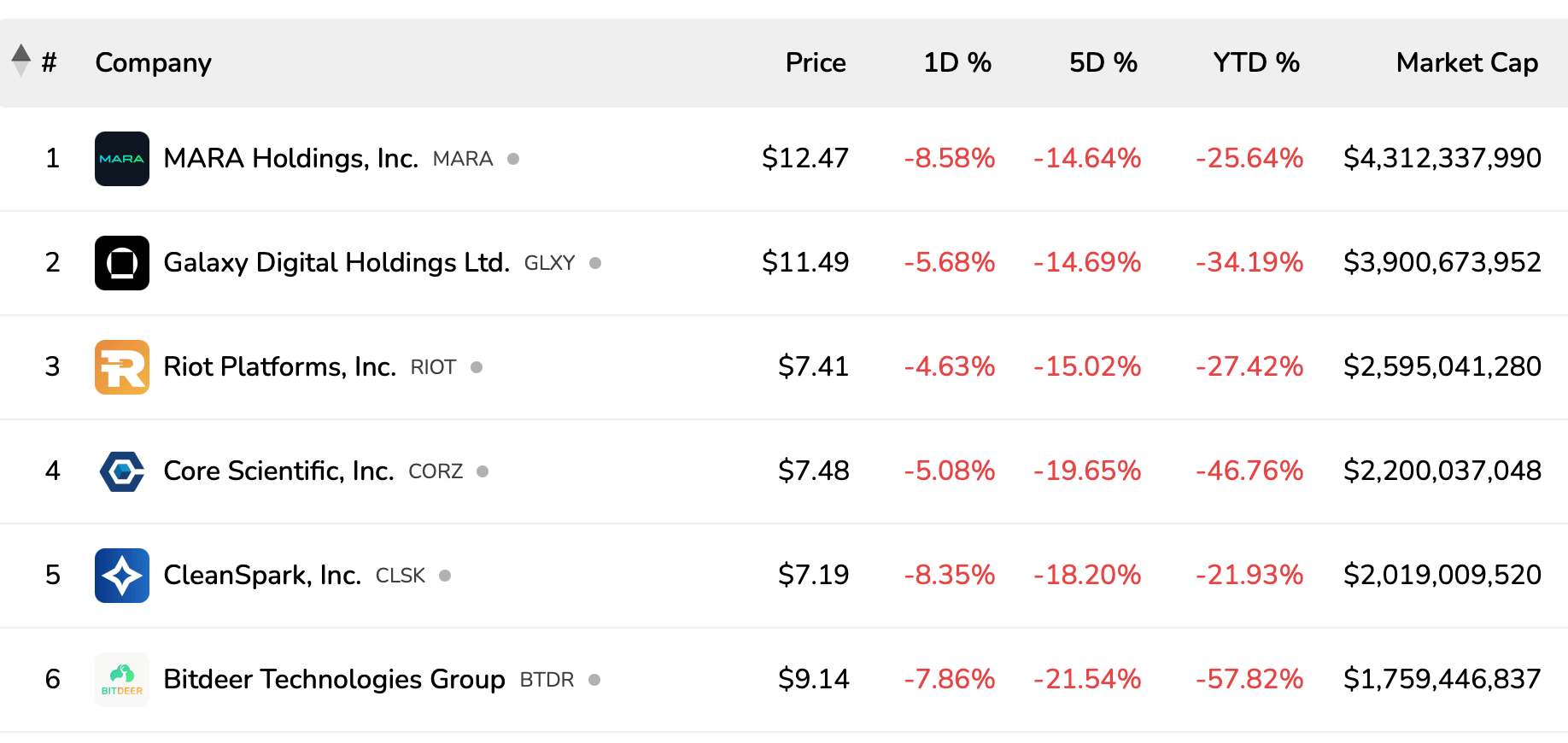

Prime six mining shares by market caps on March 29, 2025, by way of bitcoinminingstock.io.

Galaxy Digital (GLXY) relinquished 14.69%, Riot Platforms (RIOT) fell by 15.02%, and Core Scientific (CORZ) dropped 19.65% throughout the earlier week. Cleanspark (CLSK) noticed its worth diminish by 18.2% towards the U.S. greenback, whereas Bitdeer (BTDR) plummeted by 21.54% throughout the identical five-day stretch. Moreover, Iren Restricted (IREN) and Utilized Digital (APLD) witnessed declines starting from 21.06% to twenty-eight.41%, respectively.

Crypto-related shares usually mirror the spot crypto financial system on account of their intrinsic ties to digital asset efficiency. Like crypto property, these equities are closely influenced by market sentiment and macroeconomic elements affecting cryptocurrencies. When spot costs decline, investor confidence wavers, prompting sell-offs in each crypto property and related shares.

Moreover, many publicly traded corporations maintain important crypto reserves, amplifying their vulnerability to market downturns. This interconnectedness fosters synchronized losses throughout each domains.