The current upside momentum in Ethereum (ETH) has gained vital consideration from crypto fans. Amid this rally, in the present day, November 28, 2024, Ethereum co-founder Jeffrey Wilcke was discovered dumping a big quantity of ETH on a cryptocurrency change.

Ethereum Co-Founder Dumps $72.5 Million of ETH

In line with blockchain intelligence agency Arkham, Wilcke dumped 20,000 ETH value $72.50 million to Kraken. This vital transaction was noticed simply earlier than the opening bell of the US market. Regardless of this substantial sell-off, the co-founder nonetheless holds a large 106,000 ETH value $384 million, as reported by Arkham.

Supply: X (Beforehand Twitter)

Whales and Merchants’ Latest Exercise

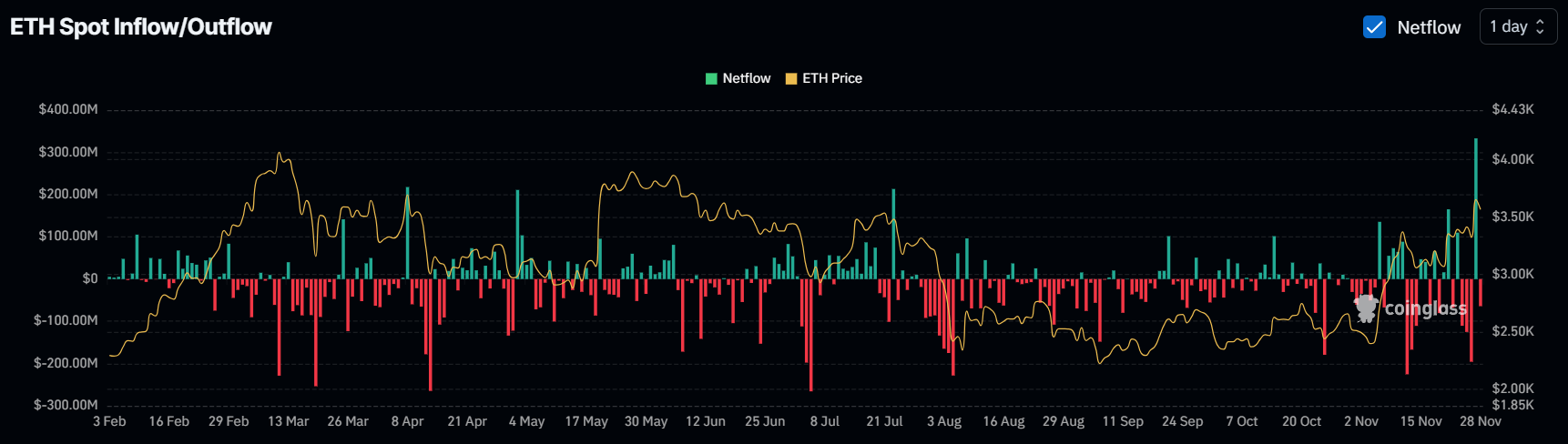

Moreover, on November 27, 2024, whales and buyers deposited $333.04 million value of ETH, in line with Coinglass’s ETH spot influx/outflow metrics. This vital optimistic internet circulation means that whales transferred ETH from wallets to cryptocurrency exchanges, a transfer that always creates promoting strain and results in a worth decline.

Supply: Coinglass

Along with long-term holders, merchants seem optimistic and have proven robust curiosity and confidence within the altcoin. Coinglass’s ETH futures open curiosity has soared by 7.9% over the previous 24 hours, indicating that merchants have been rising their positions or new merchants are coming into the market.

The mixture of on-chain metrics suggests combined sentiment amongst merchants. Lengthy-term holders seem like dumping, whereas short-term merchants are actively taking part with the token.

Ethereum (ETH) Technical Evaluation and Upcoming Ranges

In line with skilled technical evaluation, ETH seems to be retesting the breakout degree on the $3,550 mark after closing a each day candle above $3,685. Nevertheless, the altcoin stays bullish, and its each day chart doesn’t point out any bearish indicators.

Supply: Buying and selling View

With a bullish outlook, there’s a robust risk that ETH’s worth might soar by 15% to succeed in the $4,100 mark within the coming days. On a optimistic notice, Ether’s Relative Power Index (RSI) means that the altcoin nonetheless has room for progress. Presently, ETH’s RSI stands at 65, under the overbought level.

ETH’s bullish thesis will stay legitimate solely so long as it trades above the $3,300 degree, in any other case, it might fail.

Present Worth Momentum

At press time, ETH is buying and selling close to $3,570 and has registered a worth achieve of over 1.85% prior to now 24 hours. Throughout the identical interval, its buying and selling quantity surged by 9.5%, indicating elevated participation from merchants and buyers amid a bullish outlook.