This can be a section from the Empire publication. To learn full editions, subscribe.

You’ve most likely heard by now that ETH is a cursed asset. Doomed.

Possibly you’ve learn tweets that say Ethereum is destined to go the best way of Intel — a inventory that has collapsed in worth by two-thirds over the previous 5 years whereas rivals (Nvidia and AMD) have thrived by comparability.

It’s a take that solely works in the event you focus solely on value and ignore how a lot exercise persists on Ethereum and its surrounding internet of layer-2s and layer-3s.

Ether has solely gained 30% previously yr whereas its direct rival, SOL, has about doubled.

Even XRP has simply overwhelmed ETH over the bull market up to now. XRP is now up greater than 600% because the backside of the final bear market in November 2022.

BTC has in any other case gained about 500% and SOL nearly 1,500%. ETH does seem spookily uninteresting by comparability.

At the very least ETH has overwhelmed BNB

Right here’s another principle: The relative overperformance of cash like SOL and XRP has nothing to do with ETH.

Let’s begin with XRP. Ripple Labs’ ongoing conflict with the SEC (which began in December 2020) had sidelined XRP for virtually this complete market cycle, to not point out its underperformance via the 2021 bull run.

So, no matter beneficial properties XRP made in mild of Trump’s win in November has extra to do with catching up with the market than something notably particular concerning the asset itself.

As for SOL, it pays to look again at how the highest finish of crypto actually seemed through the years.

Typically, the highest three cash have stayed more-or-less the identical since 2016: BTC, ETH after which XRP.

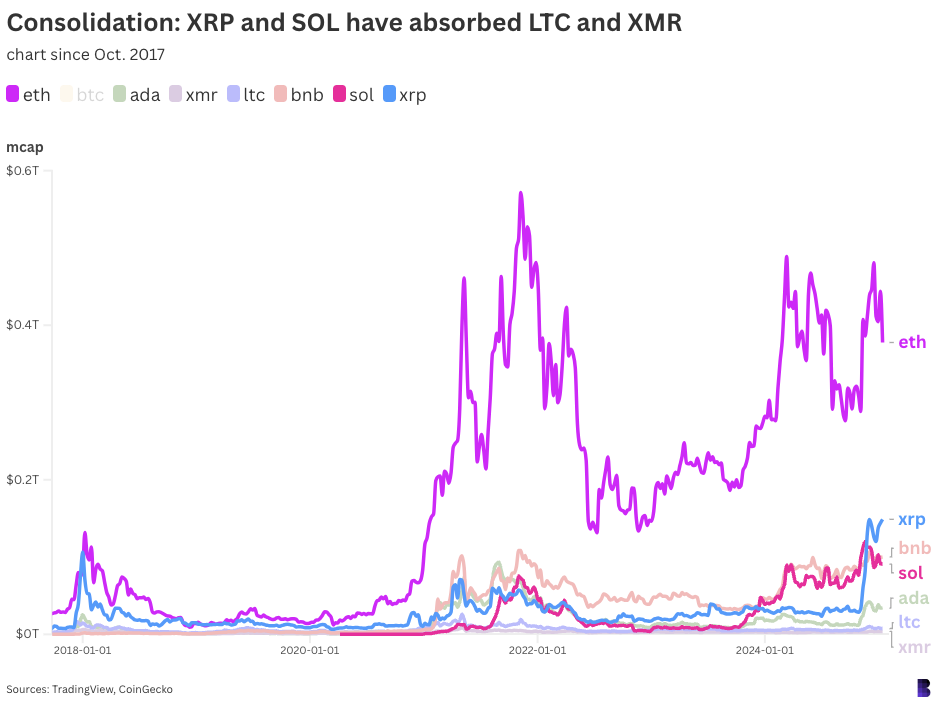

In 2017, the following Most worthy had been litecoin (LTC) and monero (XMR). It was these, plus bitcoin money (BCH) and cardano (ADA) in 2018; EOS in 2019; BNB in 2020.

LTC is now in twenty seventh place — a lot additional down available in the market — whereas monero in thirty seventh and bitcoin money twenty third.

Examine the chart above to the primary one, which solely mapped value efficiency. It tracks the market caps of the highest finish of the market — and it makes clear simply how a lot smaller all these cash are to ETH.

It’s solely pure that they’d outperform ETH at sure components of the cycle. Whereas liquidity doesn’t essentially map to market capitalization, smaller property typically want a lot much less contemporary capital to maneuver the needle that far.

It’s additionally not a coincidence that LTC, XMR and BCH, all bitcoin alternate options, have fallen off so dramatically between cycles.

Bitcoin has received the race as a retailer of worth and stablecoins emerged to raised fulfil the digital funds use case than litecoin.

No matter thoughts and market share the key cash from yesteryear — those that by no means discovered product-market-fit at scale — could have merely been transferred to Solana.

So, the Solana renaissance has little do with the anticipated demise of Ethereum, and extra to do with the shrinking significance of a lot older cash.

As for whether or not Ethereum may even turn into a type of “a lot older cash” someday down the road — handwaiving that concern requires completely totally different cope. Let me get again to you.