Ethereum (ETH) is dealing with a pointy correction, dropping 11% over the previous week as bearish momentum continues to dominate. The Relative Energy Index (RSI) stays weak, exhibiting a scarcity of robust shopping for strain, whereas the Directional Motion Index (DMI) confirms that sellers are nonetheless in management.

Moreover, the Exponential Shifting Averages (EMA) are in a firmly bearish construction, suggesting that ETH may quickly take a look at crucial help ranges at $1,756 and probably fall under $1,700 for the primary time since October 2023.

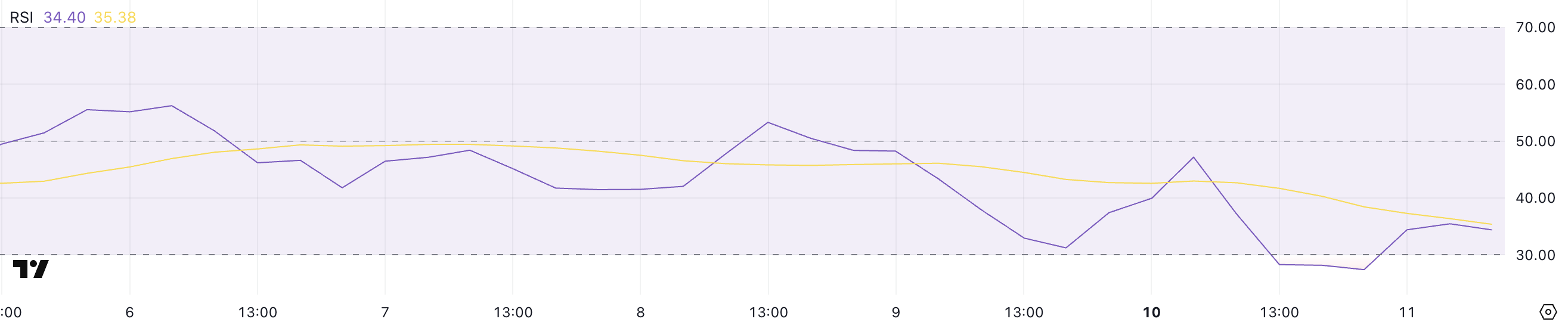

ETH RSI Reveals the Lack Of Shopping for Strain

Ethereum Relative Energy Index (RSI) is at the moment at 34.4, recovering barely after briefly dipping to 27.4 yesterday. The RSI has remained under the 50 mark for 3 consecutive days, signaling that bearish momentum continues to be dominant.

The RSI measures the pace and magnitude of latest worth adjustments to evaluate whether or not an asset is overbought or oversold.

Usually, an RSI above 70 signifies overbought circumstances, suggesting potential for a pullback, whereas an RSI under 30 alerts oversold circumstances, implying that promoting strain could also be overextended and a bounce might be imminent.

ETH RSI. Supply: TradingView.

With ETH’s RSI now at 34.4, it means that whereas the asset continues to be in bearish territory, the intense promoting strain seen yesterday has eased barely.

The transient dip under 30 signaled an oversold situation, which regularly results in short-term reduction rallies. Nonetheless, for ETH to regain bullish momentum, the RSI would want to climb again above 50, indicating a shift in market sentiment.

Till then, any upward motion may face resistance, and the broader development stays weak except sustained shopping for strain pushes ETH out of this bearish zone.

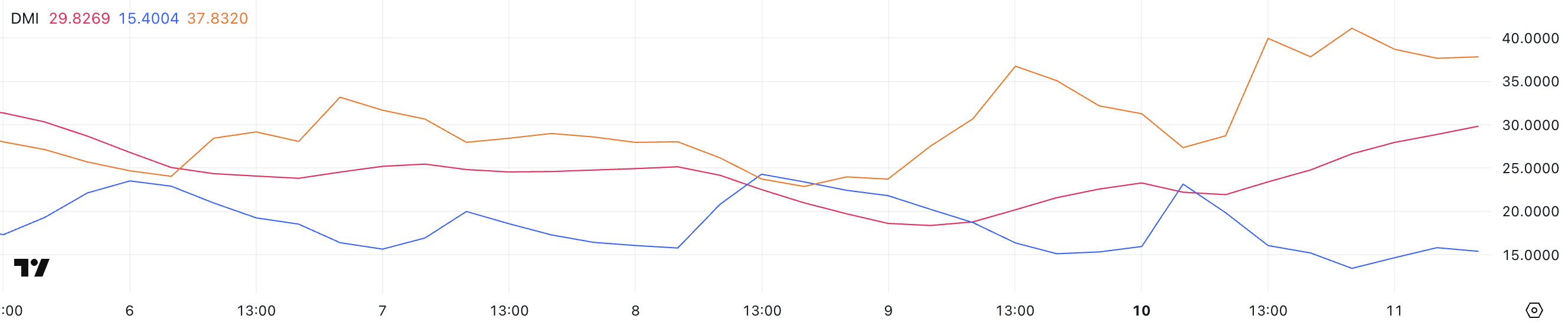

Ethereum DMI Reveals The Present Downtrend Is Sturdy

Ethereum Directional Motion Index (DMI) chart exhibits that its Common Directional Index (ADX) is at the moment at 29.82, rising from 21.9 yesterday.

The ADX measures the energy of a development, with values above 25 indicating a robust development and readings under 20 suggesting a weak or nonexistent development. Given the ADX’s sharp enhance, it confirms that ETH’s ongoing downtrend is strengthening.

The +DI (optimistic directional index) has dropped to fifteen.4 from 23.1 prior to now day, whereas the -DI (unfavorable directional index) has surged to 37.8 from 27.3, reinforcing the dominance of sellers out there.

ETH DMI. Supply: TradingView.

With the -DI considerably above the +DI, it alerts that bearish momentum is intensifying, and sellers proceed to regulate ETH’s worth motion.

The decline in +DI suggests that purchasing strain is weakening, making it tougher for ETH to stage a restoration. Until the +DI begins to rise and crosses above the -DI, ETH’s worth is more likely to stay underneath strain.

On condition that the ADX is nearing 30 and nonetheless climbing, the downtrend seems well-established, and any short-term reduction rallies might face robust resistance earlier than a significant development reversal can happen.

Ethereum Is Nonetheless Struggling Beneath $2,000

Ethereum Exponential Shifting Common (EMA) traces are displaying a strongly bearish setup, with short-term EMAs positioned under long-term ones.

This alignment confirms the continuation of downward momentum, with ETH having dropped over 11% within the final 24 hours. If the present development persists, ETH may take a look at the crucial help at $1,756, a degree that would decide whether or not additional declines are imminent.

A breakdown under this help would expose Ethereum’s worth to a possible drop under $1,700, a degree not seen since October 2023, additional reinforcing bearish sentiment out there.

ETH Value Evaluation. Supply: TradingView.

Nonetheless, if ETH manages to reverse its downtrend, the primary key resistance to reclaim could be at $1,996. A profitable breakout above this degree may set off a stronger restoration, pushing ETH towards the following resistance at $2,320.

If bullish momentum accelerates, Ethereum may prolong features towards $2,546, a degree that may mark a whole shift in development construction.

For this to occur, ETH would want sustained shopping for strain and a bullish EMA crossover, signaling a transition out of its present bearish section.