Ethereum (ETH) value has dropped over 15% within the final seven days, placing it susceptible to falling beneath the essential $3,000 degree for the primary time since November 2024. Key indicators just like the DMI and EMA traces present a bearish setup, with rising downward stress and weakening bullish momentum.

Whereas whale accumulation suggests long-term confidence in ETH, the short-term outlook stays unsure as the worth approaches important help ranges. If the present downtrend persists, ETH may face a deeper correction, however a reversal may pave the best way for a restoration towards $3,300 or greater.

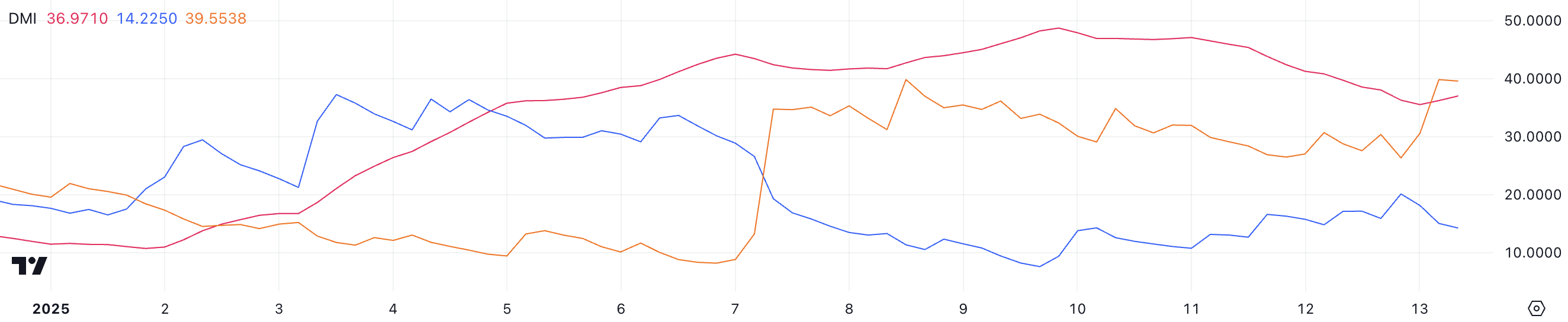

ETH DMI Reveals a Bearish Setup

Ethereum Directional Motion Index (DMI) exhibits its ADX presently at 36.9, a drop from 48 simply 4 days in the past, indicating a weakening pattern power. Regardless of that, throughout this era, ETH value has fallen roughly 6%.

The ADX, which measures pattern power with out specifying course, sometimes alerts a robust pattern above 25, with values above 40 indicating a really sturdy pattern.

ETH DMI. Supply: TradingView

The DMI additional highlights the bearish state of affairs, with the damaging directional index (D-) leaping from 26.3 to 39.5, signifying a rise in bearish stress. In the meantime, the constructive directional index (D+) has dropped sharply from 20 to 14.2, reflecting weakening bullish momentum.

This widening hole between D- and D+ reinforces ETH’s short-term downtrend. If the ADX continues to fall, it may sign a possible discount in pattern power, offering some aid for ETH value. Nonetheless, till D+ exhibits indicators of restoration or D- declines, the worth might stay below bearish stress within the close to time period.

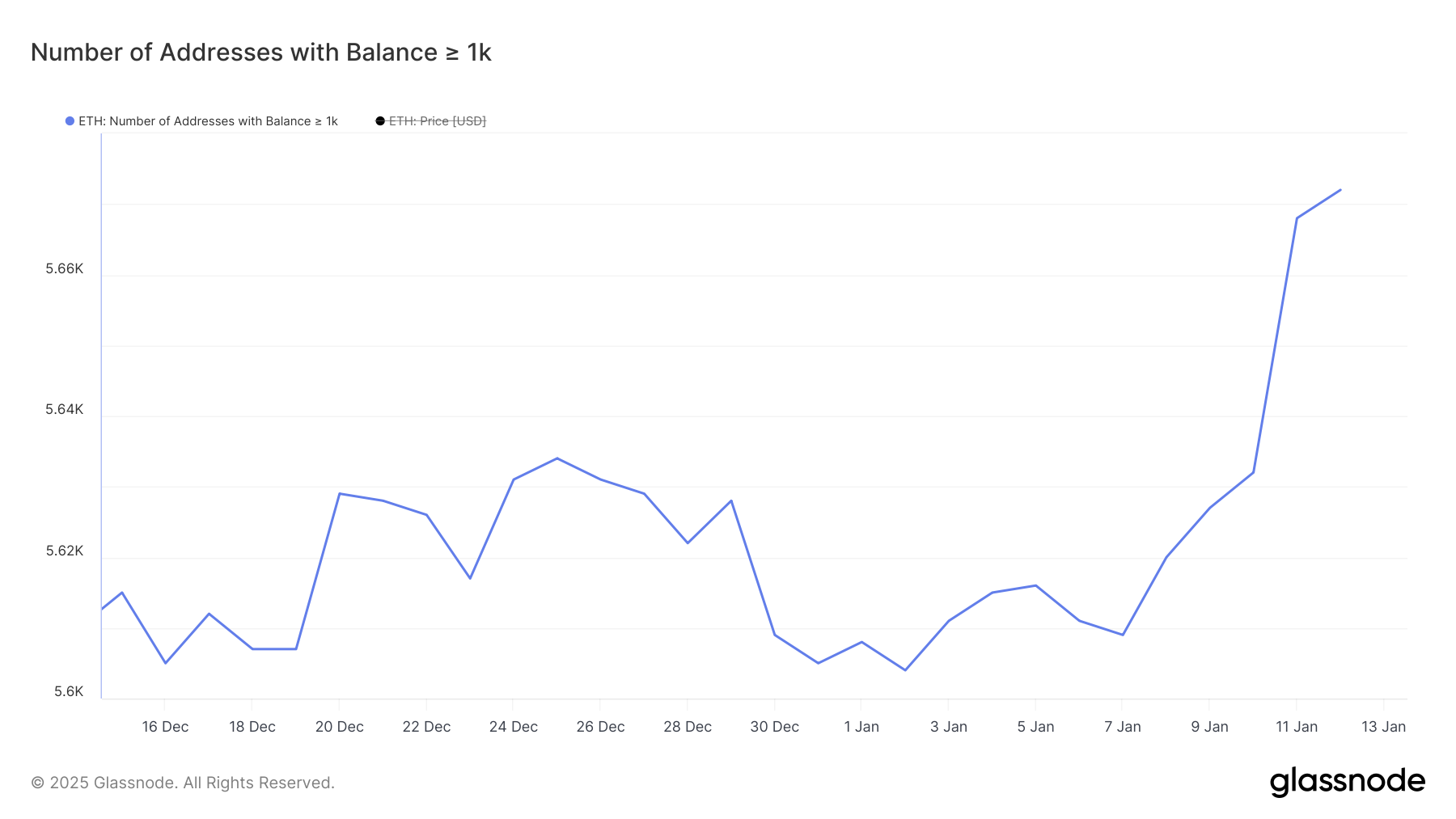

Ethereum Whales Hit the Largest Stage In 11 Months

Ethereum whales appear to be profiting from the current correction to build up extra ETH.

Between January 7 and January 12, the variety of addresses holding at the very least 1,000 ETH elevated from 5,609 to five,672, marking a notable rise in giant holders throughout this era of value weak point.

Addresses with Stability >= 1,000 ETH. Supply: Glassnode

Monitoring whale exercise is essential because it typically offers insights into market sentiment and potential value developments. Whales can affect value actions as a result of sheer quantity of their holdings, and their accumulation phases can point out confidence within the asset’s future efficiency.

The present variety of ETH whales, now at its highest since February 2024, suggests rising curiosity from giant gamers, which may sign potential upward momentum if this accumulation pattern continues.

ETH Value Prediction: A Potential 23% Correction

Ethereum EMA traces presently present a bearish setup, with all short-term traces positioned beneath long-term ones. This alignment, mixed with ETH’s sharp decline of over 15% within the final seven days, exhibits a robust downtrend, leaving the worth in a precarious place.

ETH Value Evaluation. Supply: TradingView

If the bearish momentum continues, Ethereum value may check the essential help degree at $3,014. Shedding this degree may push ETH beneath the $3,000 mark for the primary time since November 2024, with subsequent helps at $2,723 and $2,359, the latter representing a possible 23% correction.

Conversely, a reversal of this downtrend may allow ETH value to retest $3,300, with additional breakouts presumably concentrating on $3,545 and even $3,745, providing a pathway to restoration.