Ethereum has slipped under the $1,600 mark, however on-chain and technical indicators trace that the market could also be coming into a key accumulation section.

In keeping with an Apr.17 evaluation by CryptoQuant contributor abramchart, Ethereum (ETH) is buying and selling close to its realized worth stage, traditionally a zone that has preceded important rebounds. The realized worth, at present round $1,585, has served as a dependable sign of deep-value accumulation.

Each main bull run in ETH’s historical past has began when the worth fell to or under this stage. Ethereum is approaching the decrease band of the realized worth mannequin, indicating market cooling and probably priming long-term holders for re-entry.

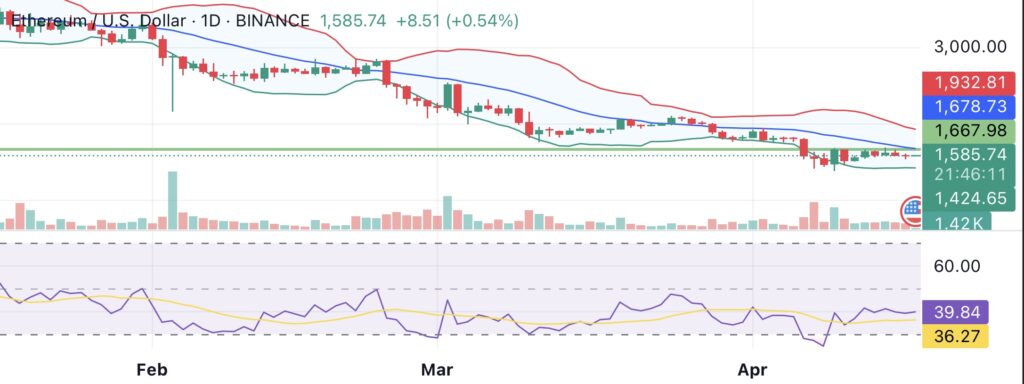

Nonetheless, technical indicators stay blended. ETH has slipped beneath its 20-day shifting common and stays nicely under the 200-day, indicating a robust downtrend. The relative energy index hovers slightly below 40, reflecting weak momentum however not but totally oversold. Day by day Bollinger Bands stay compressed, reflecting decrease volatility, however a decisive transfer in both path could also be imminent.

ETH worth evaluation. Credit score: crypto.information

Ought to the downtrend persist, ETH might discover assist within the $1,450–$1,550 vary, a zone that has traditionally served as a bottoming space. Speedy resistance lies round $1,670 and a stronger overhead stress might be skilled within the $1,930 space.

On the basics entrance, Ethereum’s worth seize on layer 1 has weakened significantly because the Dencun improve, as famous by an Apr. 16 Binance Analysis article. Whereas scalability has elevated almost 16-fold because of the introduction of blobs, the change diminished L1 charge revenues.

With customers migrating to cheaper layer 2s, ETH’s position as “ultrasound cash” has diminished, hurting its enchantment relative to sooner, lower-fee rivals like Solana (SOL) and BNB Chain (BNB).

Santiment’s Apr. 16 evaluation revealed that Ethereum charges have dropped to 5-year lows, averaging simply $0.168 per transaction. This exhibits falling utilization and congestion, however from a contrarian perspective, might trace at a possible rebound.

https://twitter.com/santimentfeed/standing/1912571781782585596?s=46&t=nznXkss3debX8JIhNzHmzw

Traditionally, low charges underneath $1 typically precede worth rebounds. As Santiment notes, “The extra the retail group leans away from an asset (particularly one with nonetheless thriving improvement), the upper the chance of an eventual shock rebound with little resistance.”

A lot of the pullback could also be tied to broader macro uncertainty. Santiment noticed that merchants are extremely delicate to tariff and financial information, typically delaying ETH exercise till higher readability returns to the worldwide image.