The Ethereum value efficiency was fairly disappointing within the ultimate weeks of 2024, struggling beneath the $3,500 stage. This end-of-the-year blues considerably flowed into the altcoin’s motion within the first month of 2025, because it did not construct any severe momentum within the first 30 days of the 12 months.

Unsurprisingly, this sluggish value motion has led to the panic of a number of Ethereum buyers, with a portion of the market pondering if to promote their tokens. A well-liked crypto analyst on the social media platform X has come ahead with an in-depth evaluation of the ETH value over the subsequent few months.

What Does The Future Maintain For ETH Value?

In a Jan. 31 submit on X, crypto pundit Ali Martinez tried to reply the “Is it time to promote Ethereum and transfer on?” query whereas breaking down its current value motion and on-chain motion. In response to the analyst, the long run appears to be like considerably bleak for the value of ETH, because it stands on the danger of a deep correction within the brief time period.

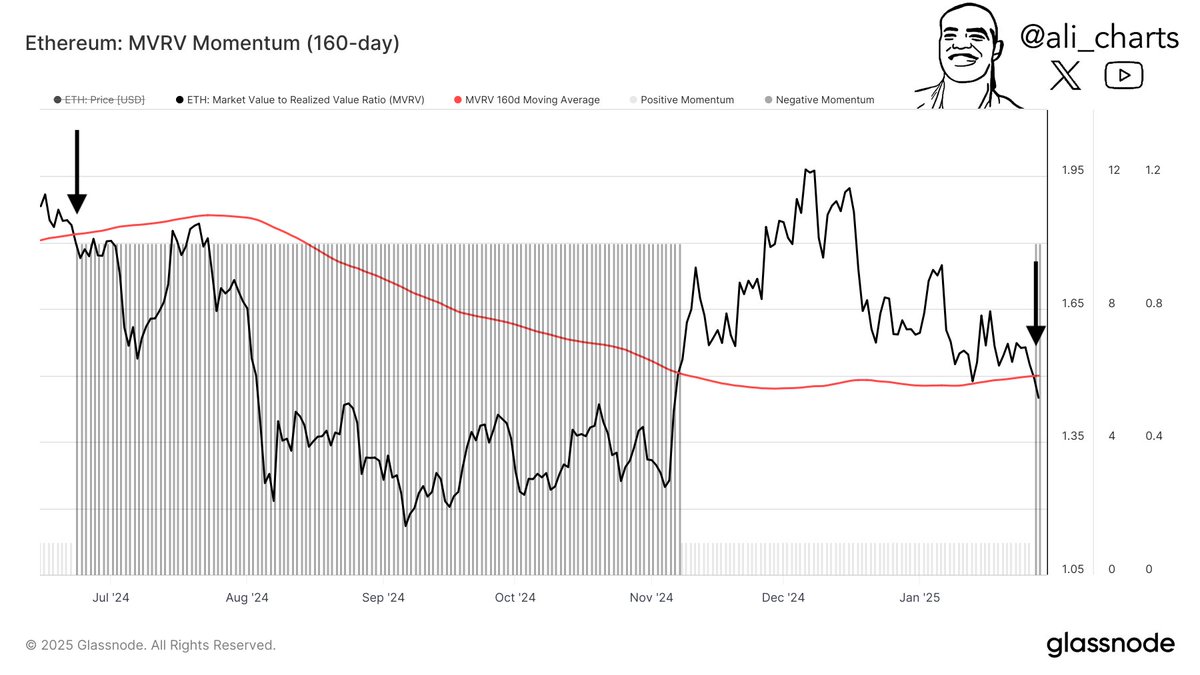

That is primarily based on the MVRV Ratio (160-day transferring common), which tracks the ratio between a coin’s market cap and the realized cap. It helps to judge whether or not a cryptocurrency (Ethereum, on this situation) is overvalued. In response to Martinez, the ETH value lately fell beneath the MVRV (160D-MA), an prevalence that led to a 40% correction the final time.

Supply: Ali_charts/X

The potential of a extreme value pullback has resulted in a shift in investor sentiment, with a specific investor cohort exhibiting some stage of tension out there. Information from Glassnode reveals that long-term Ethereum holders are starting to dump a few of their cash, strengthening the percentages of a value correction.

Within the case of a correction, sure on-chain value ranges could possibly be essential to the long-term well being of the ETH value. One such value area is between $2,230 and $2,610 (the place practically 12 million wallets purchased 62.27 million ETH), which may act as a significant assist zone in opposition to additional decline.

From a technical value evaluation standpoint, the ETH value seems to be forming an inverse head-and-shoulders sample, with a significant assist stage between $2,800 and $3,000. In response to Martinez, the Ethereum value may make a play for the sample’s neckline at $4,000 if this assist area holds.

Supply: Ali_charts/X

Whereas the $4,000 stage has acted as a significant resistance stage for 4 years, current whale accumulation will increase the Ethereum value’s probabilities of breaking this important area. The newest on-chain information reveals that whales purchased over 100,000 ETH (price over $340 million) in the previous few days.

Martinez famous that if the Ethereum value efficiently breaks above the $4,000 mark, it may journey as excessive as $6,770 primarily based on the MVRV pricing bands. This might symbolize an over 100% rally from the present value level.

Ethereum Value At A Look

As of this writing, the value of Ethereum stands at round $3,315, reflecting over 2% soar prior to now 24 hours.

The Ethereum value loses the $3,300 stage on the day by day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from iStock, chart from TradingView