Ethereum (ETH) has skilled a worth breakout within the weekly timeframe, comfortably buying and selling above the $3,500 resistance because the decentralized finance (DeFi) asset targets the essential $4,000 mark.

The sustainability of this newfound momentum is of key curiosity to the final cryptocurrency market, as it’s considered as a precursor to the beginning of an altcoin season heading into 2025.

Notably, as of press time, Ethereum was buying and selling at $3,569, having rallied by over 1% within the final 24 hours. On the weekly chart, ETH is up virtually 8%.

As reported by Finbold, following the current momentum, a number of analysts have provided a combined outlook for the asset.

As an illustration, after briefly breaching the $3,600 resistance, distinguished on-chain cryptocurrency analyst Ali Martinez set a short-term goal of $6,000 for ETH. This transfer would probably add extra credence to the altcoin season.

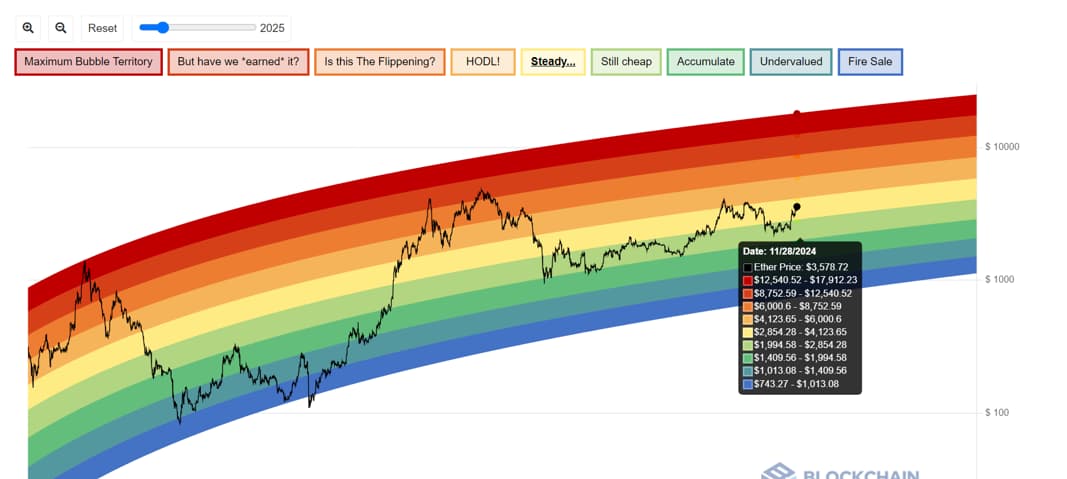

Ethereum Rainbow Chart insights

To substantiate the potential for an altcoin rally, Ethereum might want to construct on its present features all through 2024 and into the brand new 12 months. On this regard, the Ethereum Rainbow Chart, a well-liked software amongst buyers and merchants, affords insights on what to anticipate on the primary day of 2025.

The chart visually maps ETH’s historic worth knowledge on a logarithmic scale, with color-coded bands representing totally different worth zones, from “Hearth Sale” on the low finish to “Most Bubble Territory” on the excessive finish.

These representations are supposed to assist buyers assess Ethereum’s present worth in relation to its historic efficiency and recommend potential future worth targets.

The chart positioned Ethereum within the “Regular” zone at press time, ranging between $2,854 and $4,123. This implies that the DeFi asset’s worth is in a section of regular efficiency with out vital upward or downward stress in the meanwhile.

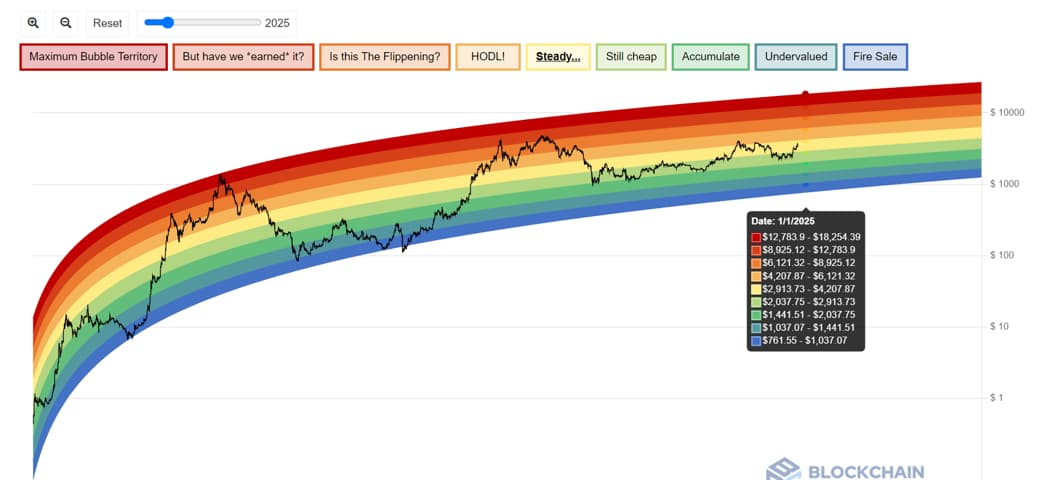

ETH worth prediction for January 1, 2025

Concerning the long run worth of the second-ranked cryptocurrency by market cap, the Rainbow Chart initiatives that Ethereum may commerce between $761.55 and $18,254.39 on the primary day of 2025.

On the prime, “Most Bubble Territory” locations Ethereum between $12,783.90 and $18,254.39, signaling excessive overvaluation and a possible market bubble. Under the “Most Bubble Territory,” the “However have we earned it?” zone from $8,925.12 to $12,783.90 factors to slight overvaluation, with costs doubtlessly exceeding basic development.

The “Is that this the Flipping?” zone, spanning $6,121.27 to $8,925.12, marks a milestone at which Ethereum might surpass previous highs with out extreme inflation.

Moreover, the market will seem wholesome and enticing to long-term holders within the “HODL!” zone, which predicts ETH will commerce between $4,207.87 and $6,121.32 on January 1st.

The “Regular” zone, starting from $2,913.73 to $4,207.87, displays stability and potential reasonable development. Under this, the “Nonetheless Low cost” zone, $2,037.75 to $2,913.73, indicators undervaluation and a shopping for alternative.

The “Accumulate” zone ($1,441.41–$2,037.75) indicators vital undervaluation, whereas the “Undervalued” zone ($1,037.07–$1,441.51) affords a powerful entry level for long-term buyers.

At present, within the “Regular” zone, Ethereum must breach the $4,000 resistance to advance towards the upper bands of the chart.

Lastly, the “Hearth Sale” zone ($761.55–$1,037.07) represents deep undervaluation with high-risk, high-reward potential as of January 1, 2025.

Featured picture by way of Shutterstock